Central exchange rate of VND/USD

This morning (October 17), the State Bank of Vietnam announced that the central exchange rate decreased by 5 VND, currently at 25,109 VND/USD.

With an margin of plus/ minus 5%, commercial banks today are allowed to trade USD in the range of VND 23,904 - VND 26,314/USD.

At the State Bank of Vietnam Transaction Office, the reference exchange rate today is as follows:

Buying: VND23,909/USD (down VND5/USD).

Selling: VND26,319/USD (down VND5/USD).

Domestic bank USD and black market prices move in the opposite direction

At commercial banks, USD prices today increased and decreased alternately. On the other hand, the black market USD price is moving in an upward trend, ranging from 27,145 - 27,265 VND/USD (buy - sell), increasing by 37 VND/USD in both directions.

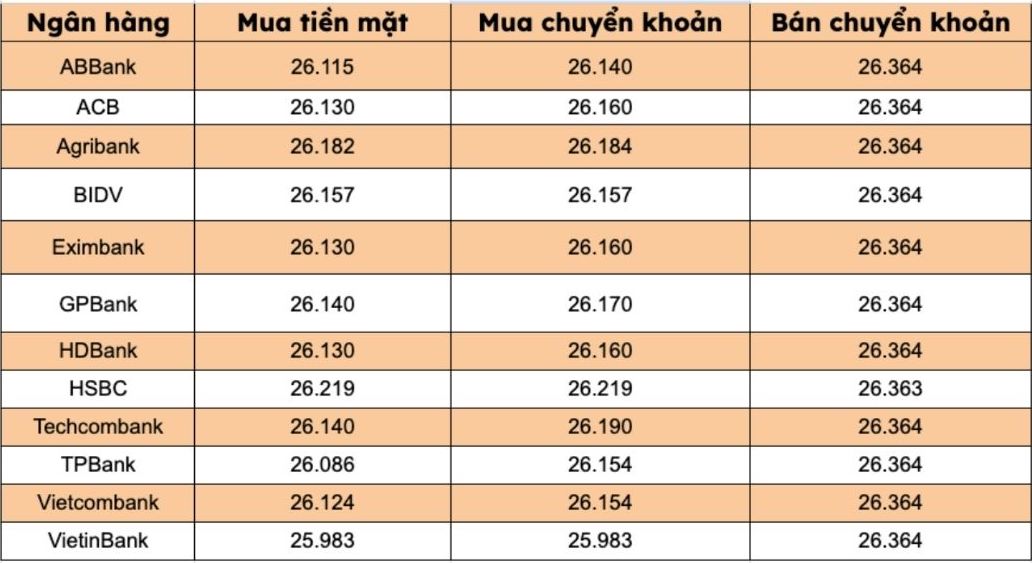

Banks simultaneously listed USD selling prices at VND26,364/USD, down VND5/USD.

The bank with the highest cash and transfer price of USD: HSBC (26,219 VND/USD).

The difference between buying and selling prices at banks ranges from 145-394 VND/USD.

Yen exchange rate against USD

At the time of the survey, the Yen exchange rate against the USD was currently trading at 150.64 USD/JPY, extending a series of days of depreciation. Meanwhile, in the free market, this pair of exchanges is trading between 176.69 - 177.89 USD/JPY (buy - sell), increasing in both directions.

Market analysis

The USD fluctuated after French Prime Minister Lecornu announced his resignation, weakening the Euro. The Japanese Yen also fell sharply after Sanae Takaichi, who supports loose fiscal and monetary policies, won the election to become Japan's new Prime Minister. In addition, rising US Treasury yields have also helped the USD benefit from increased interest rate differential.

However, the US government's continued closure into the second week is a factor that puts downward pressure on the USD. The longer it continues, the more it hurts the US economy, increasing the risk of GDP growth decline, thereby negatively affecting the currency.

The market is currently pricing in a 95% chance that the Federal Reserve will cut by 25 basis points at its FOMC meeting on October 28-29.

Weaker-than-expected US economic data has led the market to believe the Fed will continue to cut interest rates. This is a positive factor for gold and silver.