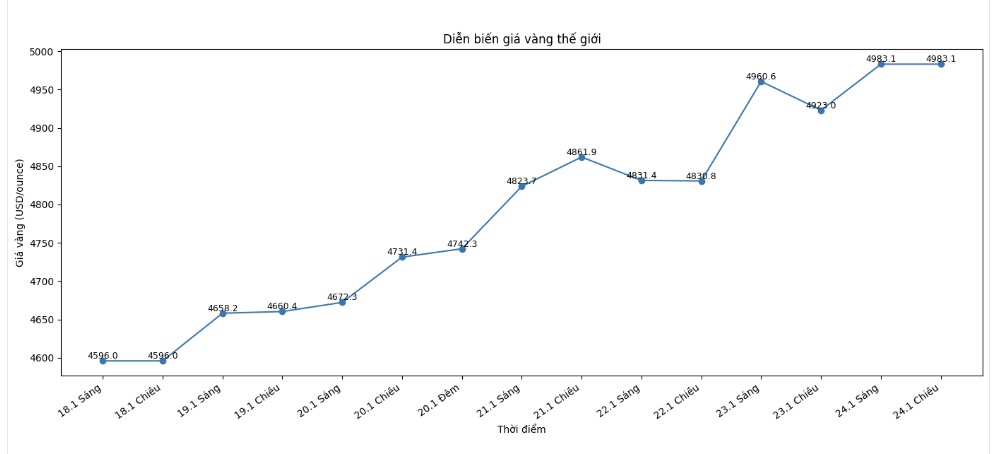

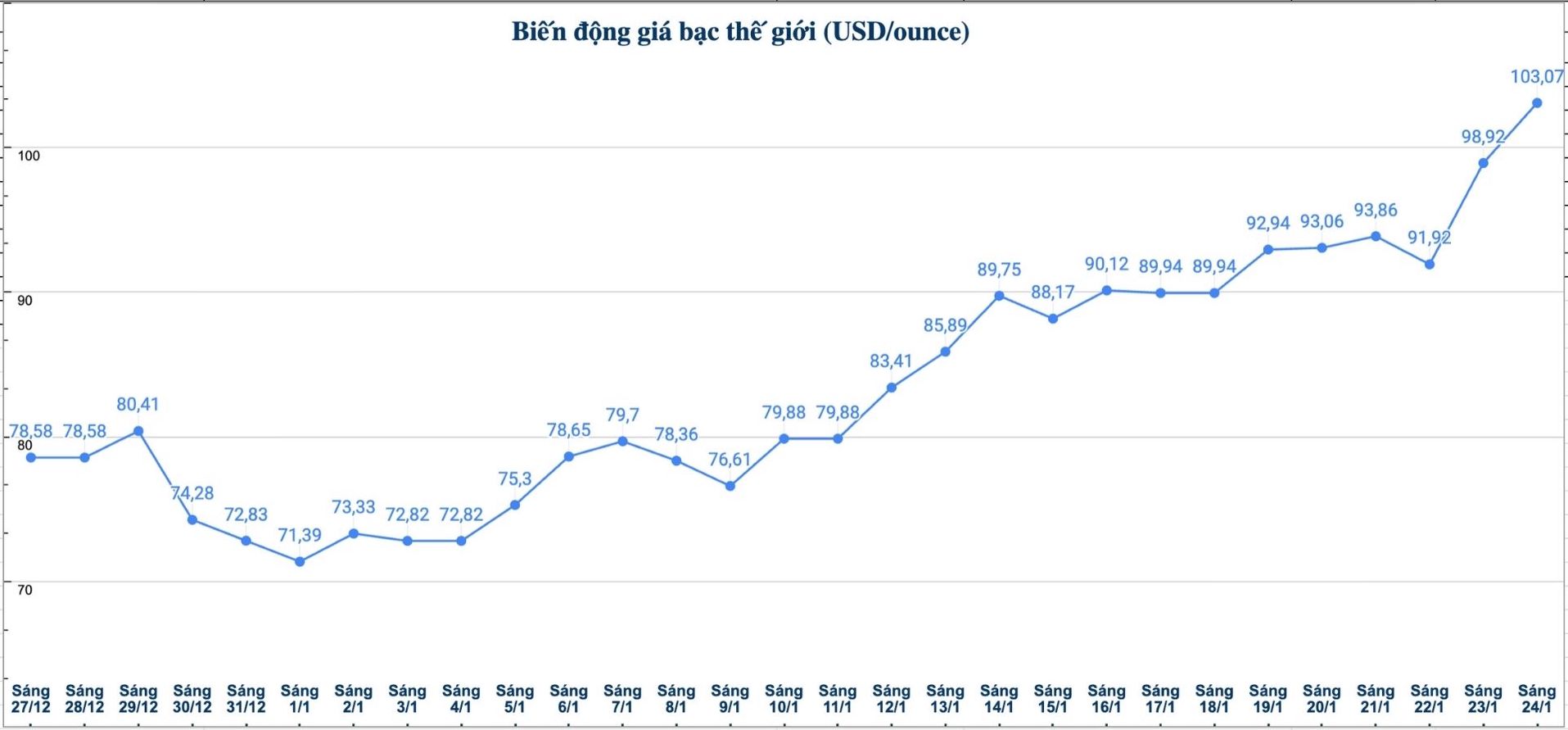

The upward momentum of the precious metal market is entering a stage that many experts describe as rare in decades. As the 5,000 USD/ounce mark for gold becomes increasingly clear in front of the eyes, silver even shows a more "excessive" state, where basic factors almost completely overwhelm technical signals.

According to Aaron Hill - Head of Market Analysis at FP Markets, gold currently brings a feeling of "nothing can stop it". Each correction is absorbed by the market almost immediately, with dense buying power always waiting in the order book.

Gold is trading as if the 5,000 USD/ounce mark is inevitable" - he commented - "With central banks still continuing to buy, despite the very high price, I would not be surprised if gold moves up to the 5,200 - 5,400 USD zone before a real correction appears.

In that picture, silver even shows more extremes. Although technical indicators show that the market is in a state of overbought, Hill believes that real cash flow is completely overwhelming the chart.

Silver at this time is even more "crazy" than gold" - he said - "Too much money chases too little metal. Each price drop is not a reversal signal, but just adding fuel to the upward momentum. The only reasonable strategy is still to buy when the price adjusts".

He said that if a quick "drawback" to the 4,850 - 4,900 USD zone appears due to unexpected positive news, it will be an opportunity to buy strongly.

Momentum, instability and huge open contracts

CPM Group experts have also just issued a buy recommendation (a suitable time to buy gold).

Gold prices have increased very strongly in the past two weeks" - they said - "The market is currently extremely volatile, reflecting the level of risk and huge political - economic uncertainty, even higher than the end of 2025 period.

For most of the recent time, CPM has recommended short-term investors to stay out, due to the too large fluctuation range. However, this view has changed as some key factors converge.

Most importantly, the global political environment is still very unstable and risks deteriorating in the short term" - experts said - "Besides that, there is a very strong upward momentum of the market.

A technical factor - but with a practical impact - is the huge number of open contracts in near-term gold contracts. Currently, there are up to 24.3 million ounces of open contracts for Comex gold contracts for February terms, which will mature in the next six trading sessions.

The contract transfer from February to April is forecast to take place rapidly, potentially creating strong price pushes, even quickly bringing gold to the 5,200 USD mark in a short time.

Long-term optimism, but the risk is not small

In the medium and long term, CPM still maintains a positive view of gold and other precious metals. According to them, the political and economic forces that are driving investors to buy gold, silver, platinum and base metals are unlikely to disappear soon.

However, accompanied by excitement is a clear warning: At these record high prices, the risk of strong adjustments is completely real.

Even if the probability of prices continuing to rise next week is very high, the market may still witness a deep drop to 4,500 USD/ounce or lower than before" - CPM warned. "This risk has caused us to continuously recommend staying out in recent weeks.

In the context of gold feeling "unstoppable" and silver becoming more "crazy" than ever, the precious metal market is entering a period where opportunities and risks go hand in hand at a maximum level - where just a pivot in geopolitics, policy or psychology can also create fierce fluctuations.