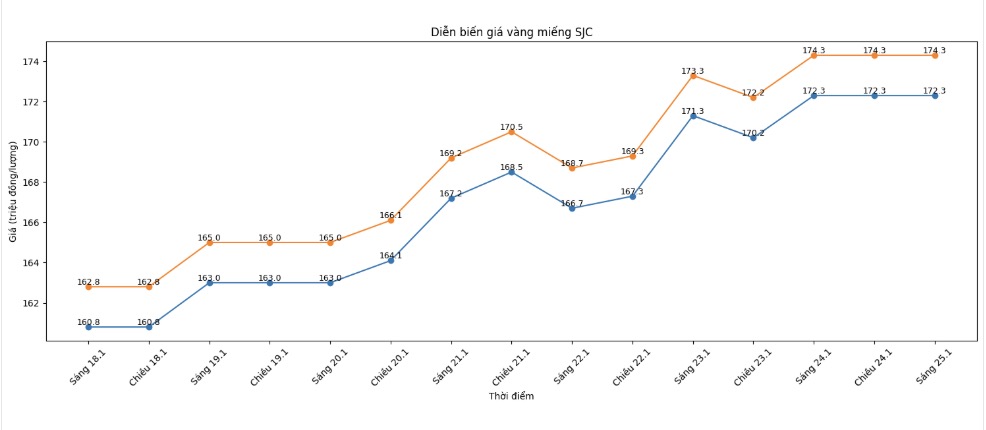

SJC gold bar price

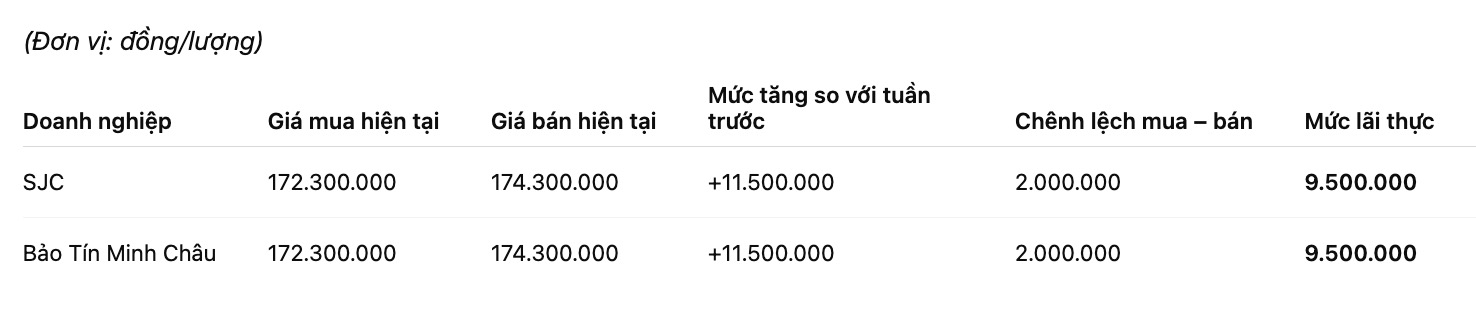

Closing the weekly trading session, Saigon SJC Jewelry Company listed SJC gold prices at 172.3-174.3 million VND/tael (buying - selling). The buying - selling difference was 2 million VND/tael.

Compared to the closing session of last week's trading (January 18), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 11.5 million VND/tael in both directions. The difference between buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at the threshold of 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 172.3-174.3 million VND/tael (buying - selling). The buying - selling difference is at 2 million VND/tael.

Compared to a week ago, the price of SJC gold bars increased by Bao Tin Minh Chau by 11.5 million VND/tael in both directions. The difference between buying and selling SJC gold at Bao Tin Minh Chau is at the threshold of 2 million VND/tael.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau on the session of January 18 and selling it on today's session (January 25), buyers will make a profit of 9.5 million VND/tael.

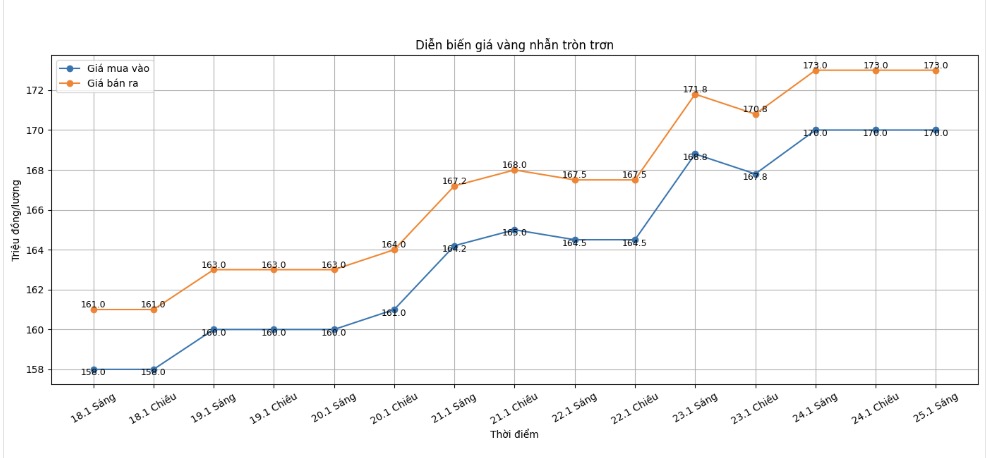

9999 gold ring price

Bao Tin Minh Chau listed the price of gold rings at 171.3-174.3 million VND/tael (buying - selling); an increase of 11.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 170.5-173.5 million VND/tael (buying - selling), an increase of 12.5 million VND/tael in both directions compared to a week ago. The buying - selling difference is at 3 million VND/tael.

If you buy gold rings in the session on January 18 and sell them in today's session (January 25), buyers at Bao Tin Minh Chau will make a profit of 8.5 million VND/tael, while the profit for gold rings buyers in Phu Quy is 9.5 million VND/tael.

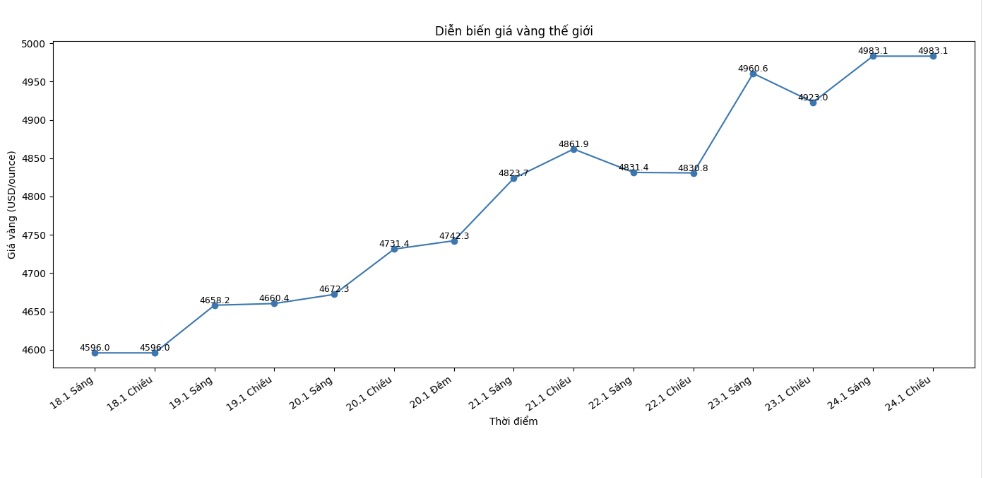

World gold price

Closing the weekly trading session, world gold prices were listed at 4,983.1 USD/ounce, a sharp increase of 387.1 USD compared to a week ago.

Gold price forecast

The strong increase in gold prices in the past week is further strengthening the positive expectations of analysts for the prospects of precious metals in the short and medium term. The fact that world gold prices closed the week close to the 5,000 USD/ounce mark - a historic high - shows that safe-haven cash flow is still dominant in the context of economic and geopolitical instability showing no clear signs of cooling down.

According to international analysts, the main driving force supporting gold prices today comes not only from speculative sentiment or the "fear of missed opportunities" (FOMO) effect, but also from fundamental long-term factors. Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that the current increase in gold reflects a combination of strong market momentum and a favorable macroeconomic environment. The demand for gold purchases from central banks remains high, while confidence in fiscal discipline and the sustainability of public debt in many major economies continues to be questioned.

From a more long-term perspective, Bank of America (BofA) makes a noteworthy forecast that gold prices may reach the 6,000 USD/ounce mark in the spring of 2026. BofA strategist Michael Hartnett believes that, compared to previous price increases, the increase range of gold in the current cycle is still not excessive. According to him, mining supply tends to decline while increasing production costs will continue to create support for gold prices in the coming years.

In the short term, the market is forecast to fluctuate strongly around important economic events, especially the monetary policy meeting of the US Federal Reserve (Fed). Although the possibility of the Fed early cutting interest rates is not expected by the market, any signal showing a change in the operating stance may create a big wave for gold prices.

In the domestic market, the dien bien of SJC gold bar and gold ring prices is forecast to continue to be directly affected by world trends. However, the high buying-selling price difference and the regulation of the domestic market may make the domestic fluctuation range different from the international one. Investors need to be cautious, avoid the psychology of chasing prices in hot rises, and consider long-term holding strategies to limit risks.

See more news related to gold prices HERE...