Cash flow has not left the gold market

Commenting in a positive direction, Mr. Darin Newsom - senior market analyst at Barchart.com, said that the correction of gold prices is a normal development in a prolonged upward trend.

My number one market rule is not to go against trend, and the trend of the metal group, including gold, is still upward" - Mr. Newsom emphasized.

According to this expert, according to the logic of market movements, the trend only really changes when cash flow reverses. However, up to now, he has not observed any signs that capital is withdrawing from gold.

There will certainly be sell-offs, gaps formed when buying momentum temporarily runs out. But only after one or two sessions, these corrections activate buying momentum to return," he said. According to Mr. Newsom, this is a typical characteristic of a market that is in a strong upward trend and shows no signs of structural weakening.

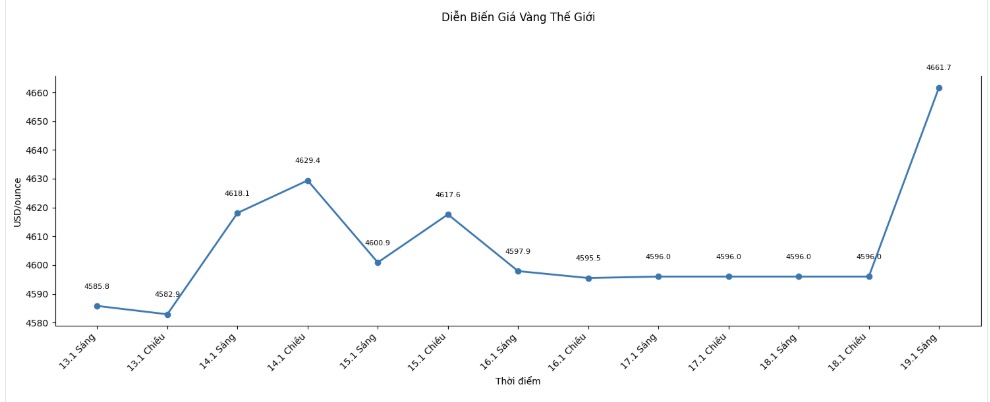

Last week's correction was only technical

Sharing the same view, Mr. James Stanley - senior market strategist at Forex.com - said that the strong fluctuations at the end of last week did not change the overall picture of gold prices.

We are witnessing a fairly clear correction before the market closes the week, but I have no reason to go against the current trend" - Mr. Stanley said.

According to him, in the context that gold has increased sharply for a long time, the appearance of profit-taking waves is inevitable. However, instead of considering it a negative signal, Mr. Stanley believes that retreats create opportunities for buyers to participate at a more reasonable price.

This expert assessed that if selling pressure can pull prices down further, potential demand will soon appear, thereby helping the market quickly stabilize and continue the upward trend.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...