Analyst James Hyerczyk at FX Empire commented that gold prices increased last night as concerns about trade tensions boosted safe-haven demand.

The USD index fell to a four-month low, making gold more attractive to foreign buyers. Currently, traders are focusing on upcoming US inflation data, which could influence US Federal Reserve (FED) policy expectations and gold price prospects.

Hyerczyk said market sentiment remains cautious amid constantly changing US trade policy. US President Donald Trump has changed his stance on tariffs, imposing and then delaying tariffs on Canada and Mexico, and increasing tariffs on Chinese goods, disrupting the global market.

China and Canada have paid back with their own tariffs, increasing economic uncertainty, he said.

The US president also mentioned the possibility of the economy falling into recession, making investors even more worried. Financial Secretary Scott Bessent described the current period as the detoxification process due to public spending cuts, while some analysts questioned the risk of recession.

This mixed outlook has helped gold maintain its position as investors seek shelter in volatile market conditions, Hyerczyk said.

All of these factors add to the importance of this week's inflation data, in which the CPI report released on Wednesday is expected to show cooling inflation.

If the CPI is lower than expected, expectations of a Fed easing policy will increase, thereby supporting gold demand. Conversely, higher-than-expected figures could create downward pressure on prices. PPI data released on Thursday will also provide more information on inflation trends, he said.

Hyerczyk said the market is pricing in the possibility of a Fed rate cut in June, which would support gold prices. However, if inflation remains high, the Fed could be forced to keep interest rates high, which would limit golds rally as the metal is not making a profit, he stressed.

Regarding the bond market, Hyerczyk noted that US Treasury yields did not fluctuate much on Tuesday, reflecting economic instability. Certain concerns about slowing growth and recent statements from Donald Trump have fueled speculation about the risk of an economic recession.

Despite concerns about recession, some analysts said that important economic indicators such as salary tables and consumer spending data were not enough to cause panic. However, any signs of economic weakness in upcoming data could increase demand for gold as a defensive asset, he added.

Forecasting gold prices, Hyerczyk said the precious metal is still well supported, but the short-term developments will depend on upcoming inflation data.

If the CPI shows cooling inflation, gold could continue to rise as the market bet on the possibility of a rate cut. Conversely, higher-than-expected inflation could push up bond yields, putting pressure on gold, he said.

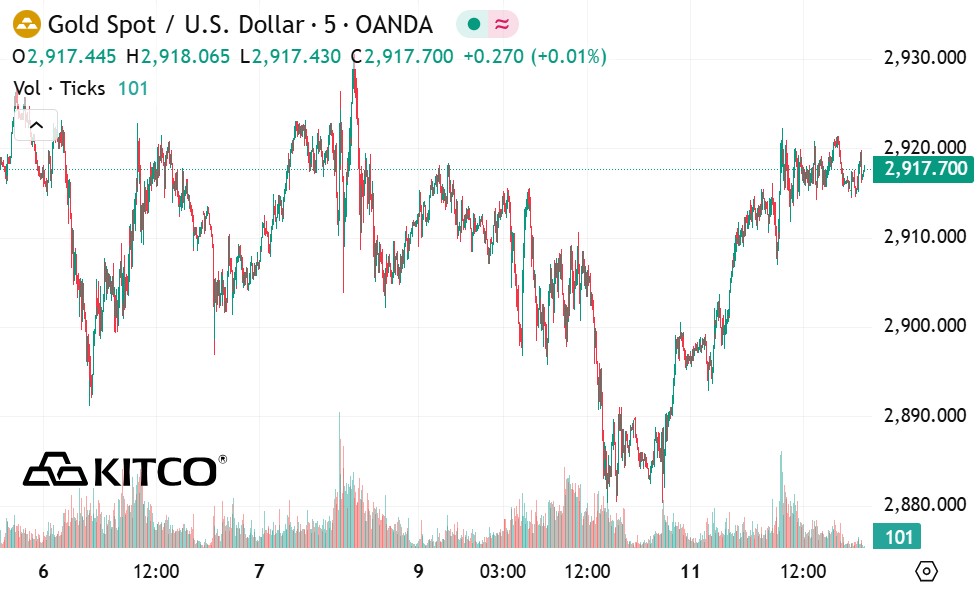

Technical analyst Hyerczyk noted: If prices successfully break out above $2,930.54/ounce, it will show a return of buying power, which could help gold reach a record high of $2,956.31/ounce. Conversely, if there is a lack of buying momentum or profit-taking pressure, gold prices may fall to support levels of 2,864.26 USD/ounce and 2,841.43 USD/ounce.

The most important support level at the moment is the 50-day moving average at $2,811.04/ounce, he wrote.

Hyerczyk also said that the outlook is still leaning towards an uptrend. Gold is likely to be supported unless inflation forces the Fed to maintain a tight monetary policy. Traders need to closely monitor CPI and PPI data, as well as any changes in interest rate expectations, to determine the next step for gold prices, Hyerczyk concluded.