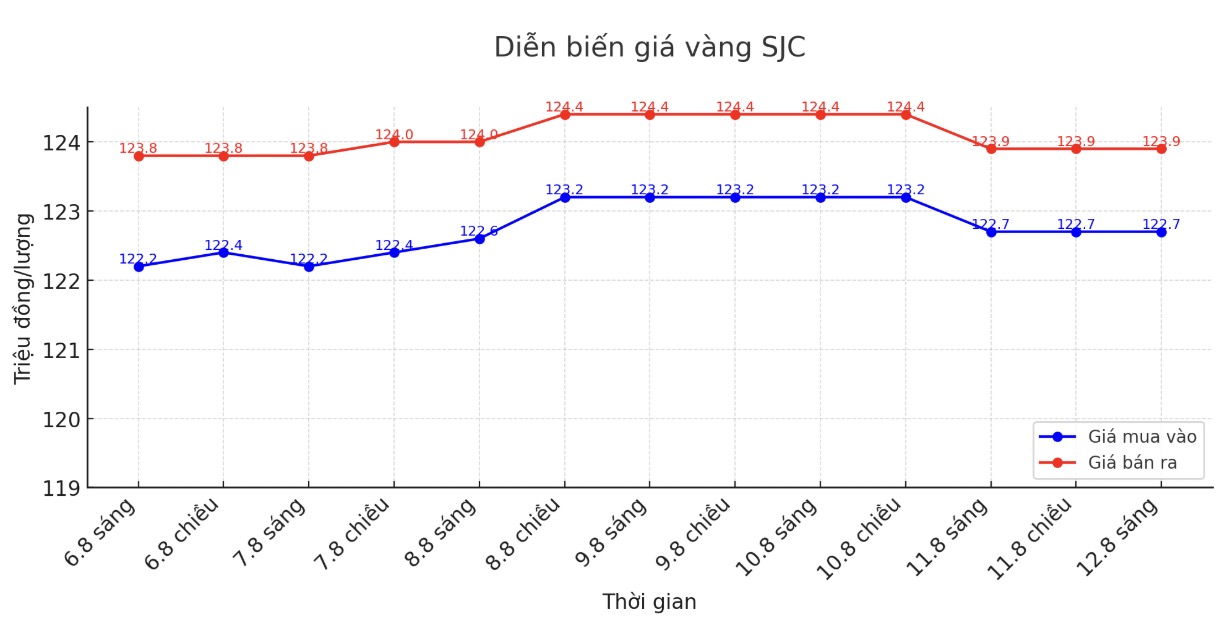

Updated SJC gold price

As of 9:10 a.m., DOJI Group listed the price of SJC gold bars at VND122.7-123.9 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 122.7-123.9 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 121.9-123.9 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

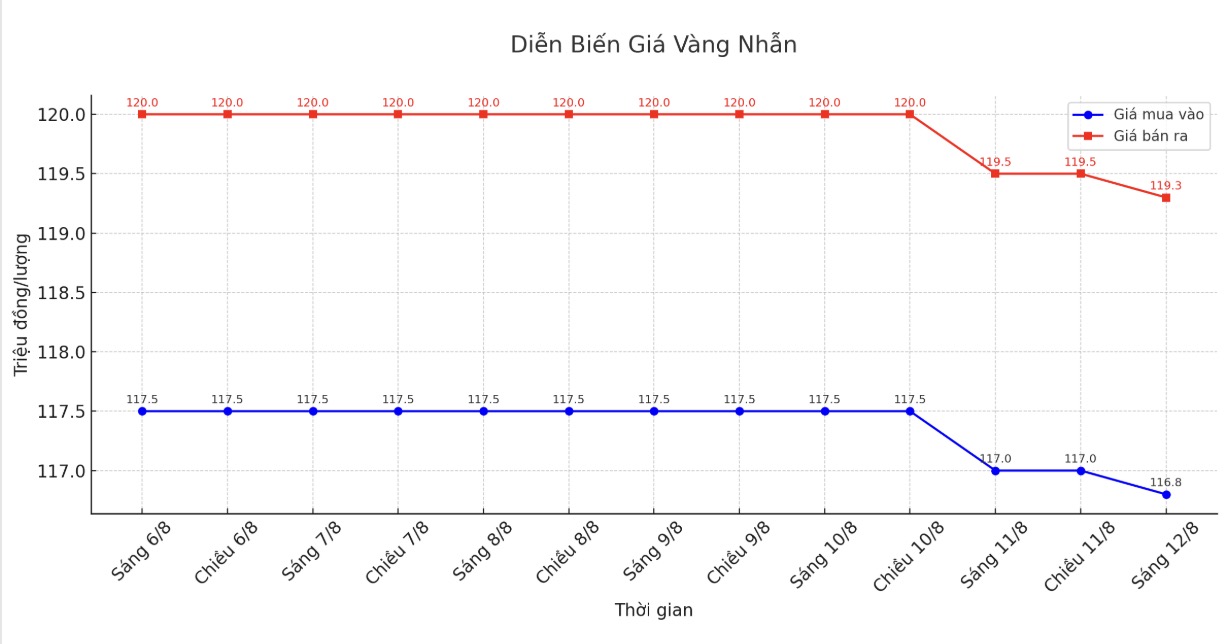

9999 round gold ring price

As of 9:10 a.m., DOJI Group listed the price of gold rings at 116.8-119,3 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

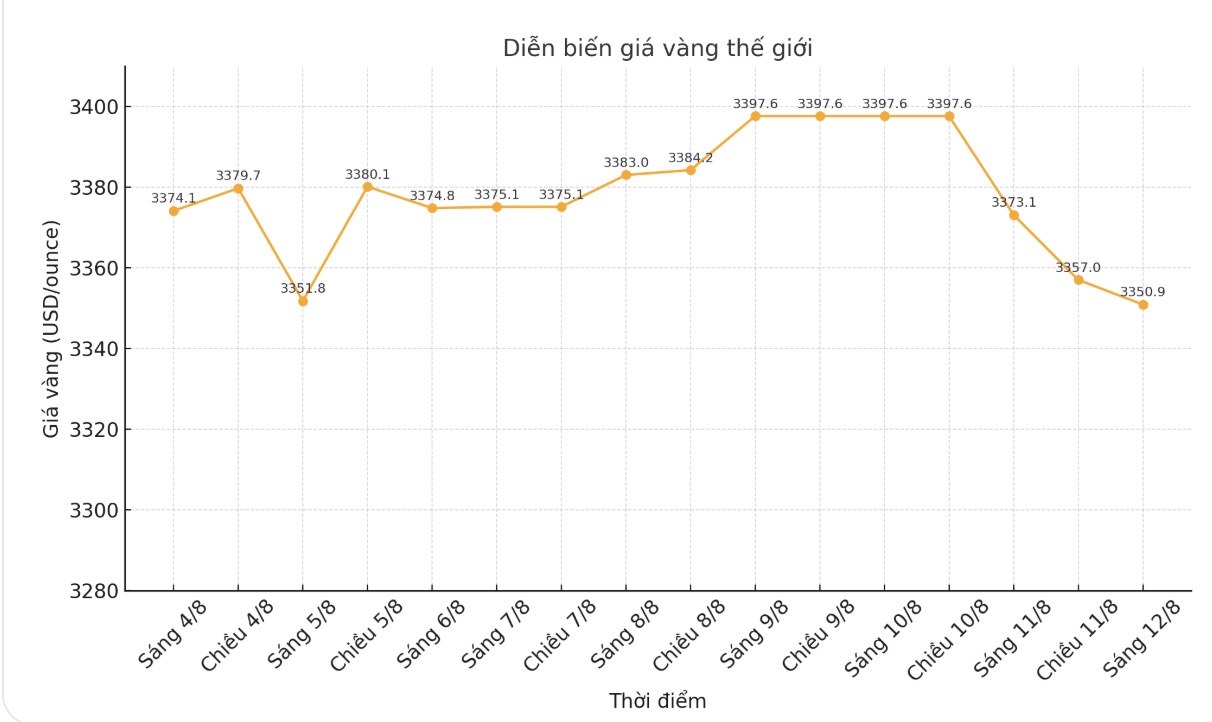

World gold price

At 9:00 a.m., the world gold price was listed around 3,373.1 USD/ounce, down 24.5 USD compared to a day ago.

Gold price forecast

Gold prices fell sharply as US President Donald Trump clarified his tax policy on precious metals.

The gold market is still waiting for the official announcement from the White House on the possibility of applying a tax on imported gold of 100 ounce and 1kg types of gold bars. However, on social media, US President Donald Trump said that the precious metal will not be subject to import tariffs.

Although the world gold price is under strong selling pressure, a market strategist still predicts a peak of 4,000 USD/ounce by the end of the year.

Mike McGlone - Senior commodity strategist at Bloomberg Intelligence said that looking at the bigger picture, gold still maintains an important support level of over 3,300 USD/ounce and technical developments could signal an upcoming breakthrough.

He said the key to gold's breakout could come from the stock market, as the S&P 500 shows signs of slowing near its historical peak above 6,400 points.

A catalyst for gold to reach $4,000 an ounce could come from a slight correction in US stocks, which will also highlight the risks of gold. Golds foundation has been consolidated around $3,300 an ounce since April and will need a fresh force to push prices below this threshold.

ETFs have shifted to strong inflows after 4 years of net withdrawal. A slight correction in US stocks could be a catalyst for gold to approach $4,000/ounce, he wrote in the latest report.

Economic data to watch this week

Economic news will be bustling again next week, with key indicators of inflation and consumer health on the watch list.

Early Tuesday morning, the Reserve Bank of Australia will have an interest rate decision, with the market predicting a 25 basis point cut, from 3.85% to 3.60%. Traders will then turn their attention to the US CPI report for July, which is expected to show core inflation rising slightly to 0.3% from 0.2% in June.

Wednesday is expected to be quite quiet, highlighted by the statements of FED Governors Goolsbee and Bostic. However, data will be bustling again on Thursday with the US PPI report on core inflation expected to increase by 0.2% after June's zero level along with weekly jobless claims.

The week will end with a deeper look at US consumers, as July retail sales are expected to decline slightly from 0.6% to 0.5%, while core retail sales are expected to decrease from 0.6% to 0.3% compared to June.

Then in the morning, the University of Michigan's preliminary consumer confidence index for August will let the market know what consumers expect in the coming time.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...