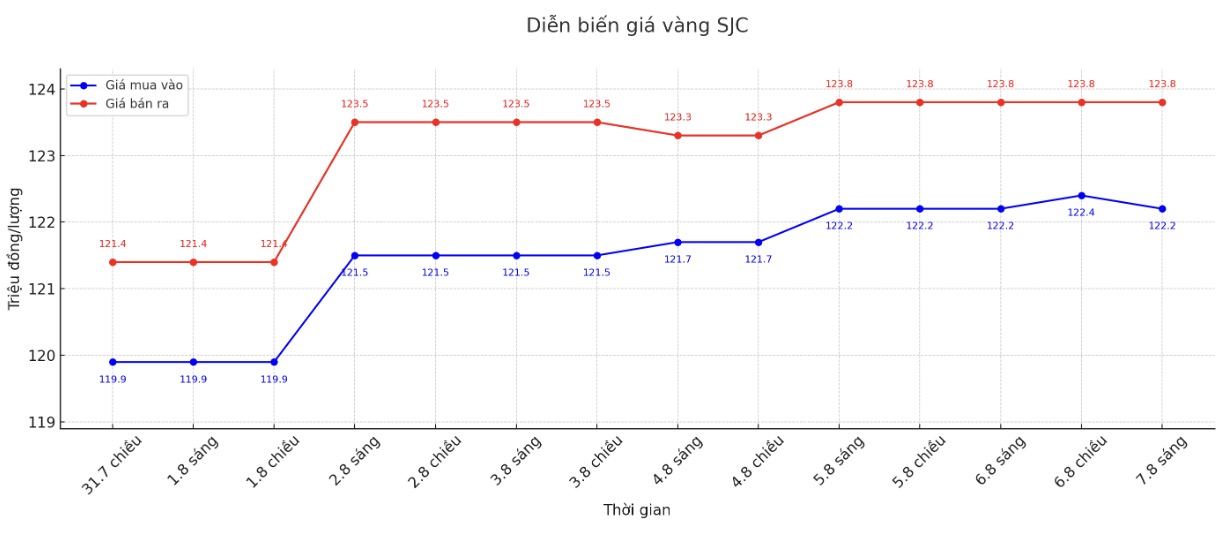

Updated SJC gold price

As of 9:50 a.m., the price of SJC gold bars was listed by DOJI Group at VND122.2-123.8 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.6 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 122.2-123.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.6 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 121.2-123.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

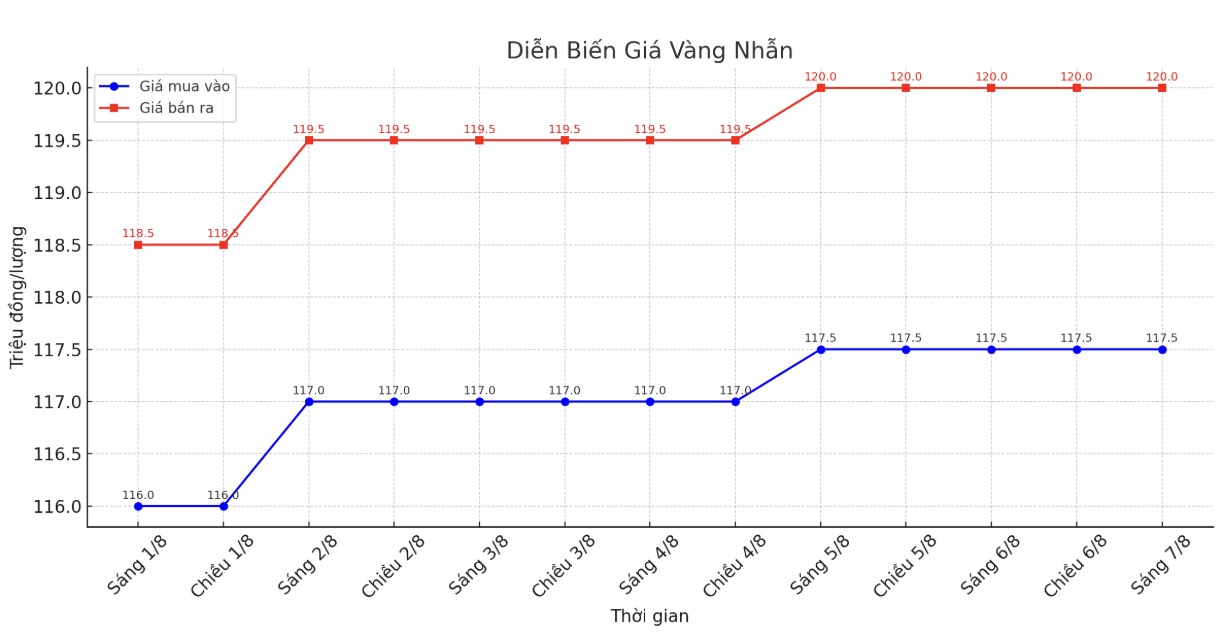

9999 round gold ring price

As of 9:50 a.m., DOJI Group listed the price of gold rings at 117.5-120 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.8-120.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.8-119 1.8 million VND/tael (buy in - sell out), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

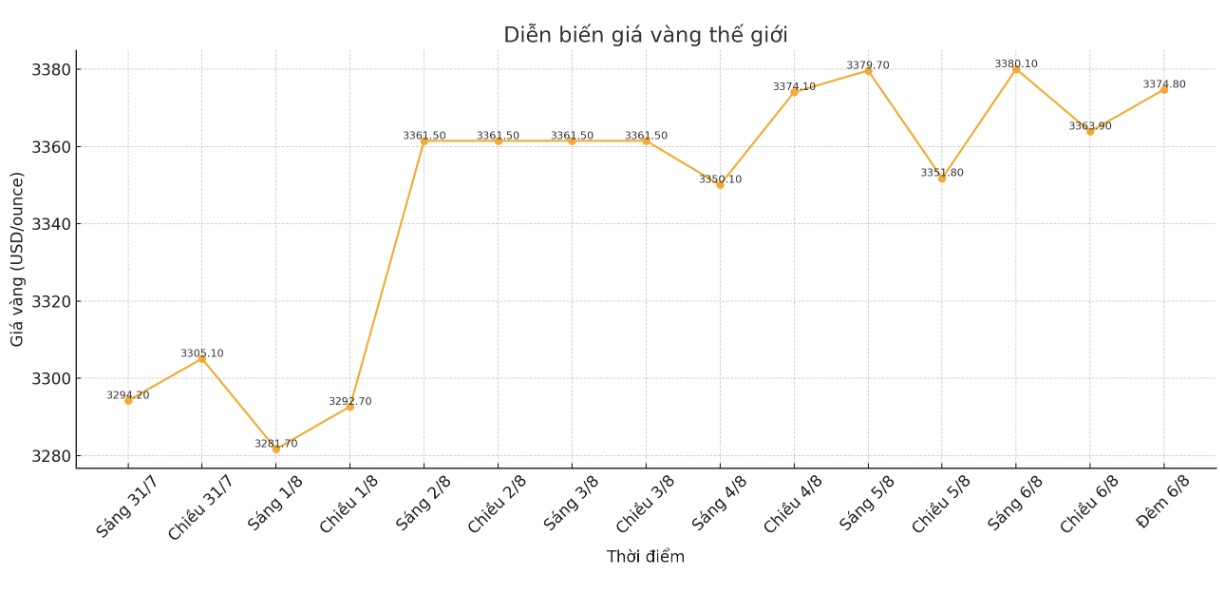

World gold price

At 9:50 a.m., the world gold price was listed around 3,380 USD/ounce, not much change compared to a day ago.

Gold price forecast

In the latest report, WisdomTree, a New York-based investment institution (USA), unexpectedly predicted that the world gold price could reach a very high level, up to 3,850 USD/ounce in the second quarter of 2026 according to the base scenario. However, if the Trump administration pursues a policy of weakening the US dollar - simulated as the " Mar-a-Lago Agreement", gold prices could soar to $5,355/ounce, or even higher.

The report points out five key macro risks that could push gold prices to new records.

One is trade instability. Preliminary trade agreements between the US, China and the UK have not satisfied the market, while negotiations with Canada, Mexico and the EU are still ongoing, leading to the risk of widespread tax increases.

The other is the increased government debt. The newly passed "One Big Beautiful Bill Act" in the US will increase the budget deficit by more than 3,000 billion USD (including interest) by 2034.

Third, institutional weakness. Increasing political pressure on the US Federal Reserve (Fed) has raised concerns about the independence of central banks.

Four is geopolitical risks. The tense situation in the Middle East and the Russia-Ukraine conflict continue to develop complicatedly, making gold popular as a safe-haven asset.

Fifth is unpredictable monetary policy. Although there has been no official statement, the moves from the Trump administration show a tendency to weaken the USD.

The term Mar-a-Lago Agreement was coined by WisdomTree analysts, inspired by the 1985 Plaza Agreement when major countries coordinated to reduce the price of the US dollar to improve trade balance.

Some news agencies said that the amount of physical gold stored at warehouses linked to the Shanghai Stock Exchange has increased to an all-time high, showing that demand for gold in China is still strong.

More than 36 tons of gold have been registered for delivery to futures contracts, as traders and banks take advantage of the price difference between gold futures and physical gold.

Mr. John Reade - senior market strategist of the World Gold Council commented: "This shows that the demand for gold trading in China is currently very strong".

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...