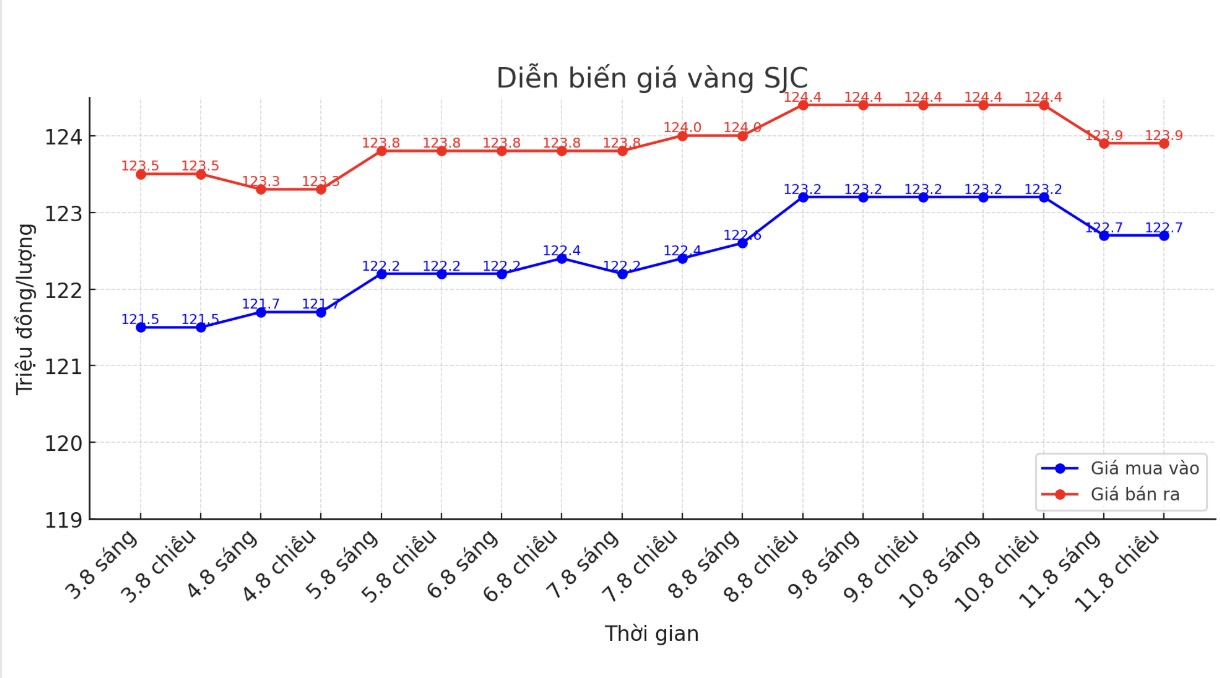

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND122.7-123.9 million/tael (buy in - sell out), down VND500,000/tael in both directions. The difference between buying and selling prices is at 1.2 million VND/tael.

DOJI Group listed at 122.7-123.9 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 122.7-123.9 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 121.9-123.9 million VND/tael (buy - sell), down 300,000 VND/tael for buying and down 500,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

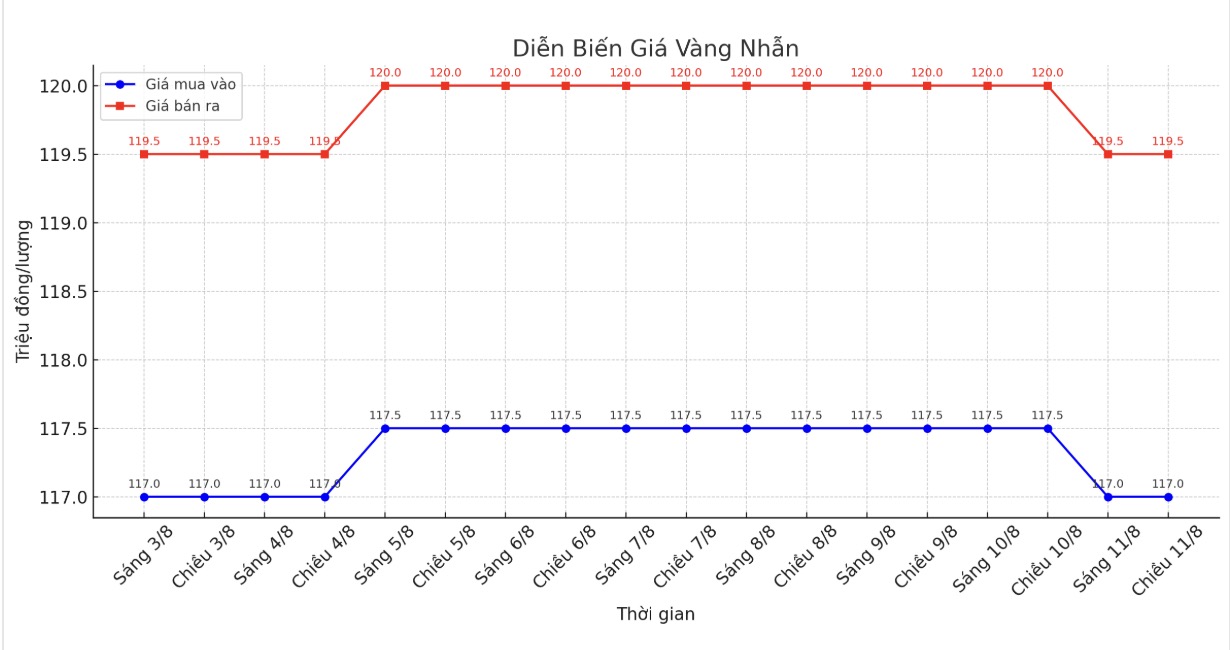

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 117-119.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.3-120.3 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

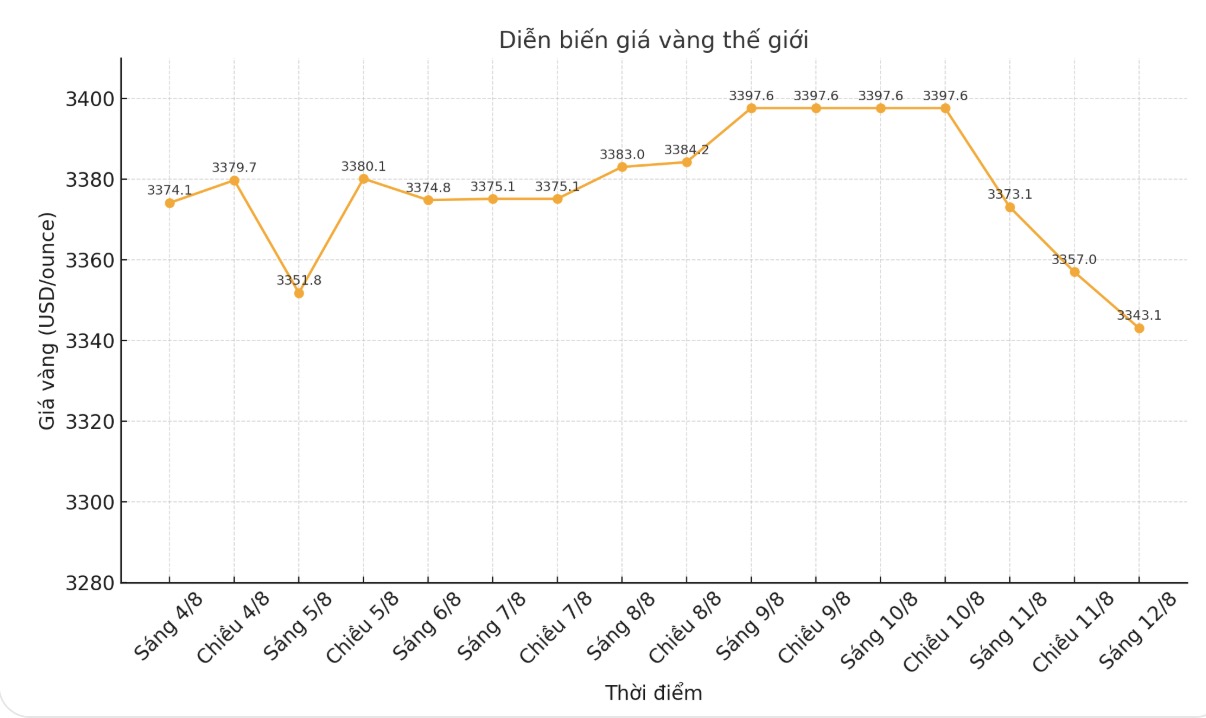

World gold price

The world gold price was listed at 0:00 at 3,343.1 USD/ounce, down 54.5 USD.

Gold price forecast

Gold prices recorded a sharp decrease due to great instability related to US gold import tax rates. Traders are waiting and considering more clarification from the US presidential administration Donald Trump on the gold import tax policy.

The government exempted the precious metal from tariffs in April, and until further clarity, the precious metal market could remain tense.

December gold contract decreased by 81.8 USD to 3,409.7 USD/ounce. September delivery silver price decreased by 0.702 USD to 37.845 USD/ounce.

Joseph Cavatoni - senior market strategist in charge of North America at the World Gold Council wrote: "We see that different segments of the gold market are operating in order while the industry awaits the possibility of clarifying this information".

No major US economic data was released on Monday. However, key inflation reports will be released this week.

Technically, December gold futures bulls are still holding a short-term technical advantage, but there are signs of slowing down.

The next target for buyers is to close above a solid resistance level of $3,500/ounce. The next short-term bearish target for the bears is to push prices below the solid technical support level at the bottom of July at $3,319.2/ounce.

The first resistance was seen at $3,450 an ounce, followed by a peak last night at $3,466.30 an ounce. First support was today's bottom of $3,397.30 an ounce, then $3,350 an ounce.

In outside markets, the US dollar index increased strongly. Nymex crude oil futures are almost flat, trading around $64/barrel. The yield on the 10-year US Treasury note is currently at 4.26%.

Economic data to watch this week

Tuesday: RBA interest rate decision, US CPI in July, speeches by Barkin and Schmid (FED).

Wednesday: Speeches by Barkin, Bostic and Goolsbee (FED).

Thursday: US PPI July, US jobless claims.

Friday: US retail sales in July, New York Empire State Production Index, Michigan Consumer Confidence Index (preliminary estimate).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...