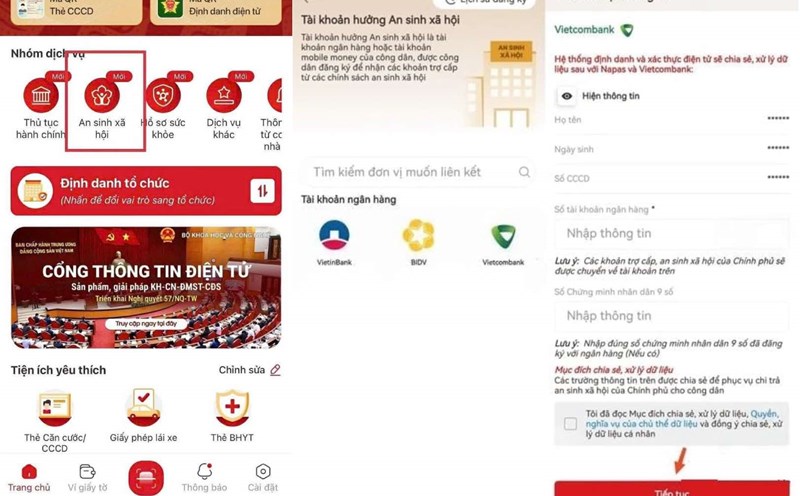

Gold prices continued to climb to a record high of over $4,100/ounce in the trading session on October 14, thanks to growing expectations that the US Federal Reserve (FED) will soon cut interest rates.

The return of US-China trade tensions also boosted safe-haven demand, leading to a strong increase in silver - this precious metal also recorded a new historical peak.

Spot gold prices increased by 1.7%, reaching a record high of 4,179.48 USD/ounce at 5:21 ( GMT, etc. 12:31 Vietnam time). December gold futures on COMEX increased 1.3% to $4,187.50/ounce. Since the beginning of the year, gold prices have increased by 57%, surpassing the important threshold of 4,100 USD/ounce for the first time.

Gold's rally was reinforced by a series of factors including geopolitical and economic instability, expectations of interest rate cuts, strong net buying from central banks and capital flows into ETFs.

Bank of America and Societe Generale both predict gold could reach $5,000 an ounce by 2026, while Standard Chartered raised its forecast for 2026 to $4,488/ounce.

Spot silver prices rose 2.2% to 53.60 USD/ounce, supported by factors that boosted gold and a shortage of supply in the market.

OANDA analyst Kelvin Wong said: Trade tensions are not the main driver for todays rally. More importantly, the market is betting heavily on the Fed continuing its interest rate cutting cycle, thereby reducing long-term capital costs and opportunity costs of holding gold.

Anna Paulson, Fed president of Philadelphia, said the increased risks to the labor market have further strengthened the basis for upcoming interest rate cuts.

Investors are now waiting for Fed Chairman Jerome Powell's speech at the NABE annual meeting on October 14 for more signals on monetary policy orientation.

According to the FedWatch tool, traders predict the probability of the Fed cutting 25 basis points in October and December will be 99% and 94%, respectively.

In other developments, US Treasury Secretary Scott Bessent said President Donald Trump is still expected to meet Chinese President Xi Jinping in South Korea at the end of October.

Trade tensions between the US and China escalated after China announced the expansion of rare earth export control measures. The US side will then consider applying a new tax rate on imported goods from China and strengthening export control of some technology products, expected to take effect from November 1.

Bessent added that the US government's shutdown has entered its 13th day and is starting to affect the economy.

In other precious metals, platinum rose 1.9% to $1,677/ounce, while palladium rose 2.1% to $1,505.75/ounce.

See more news related to gold prices HERE...