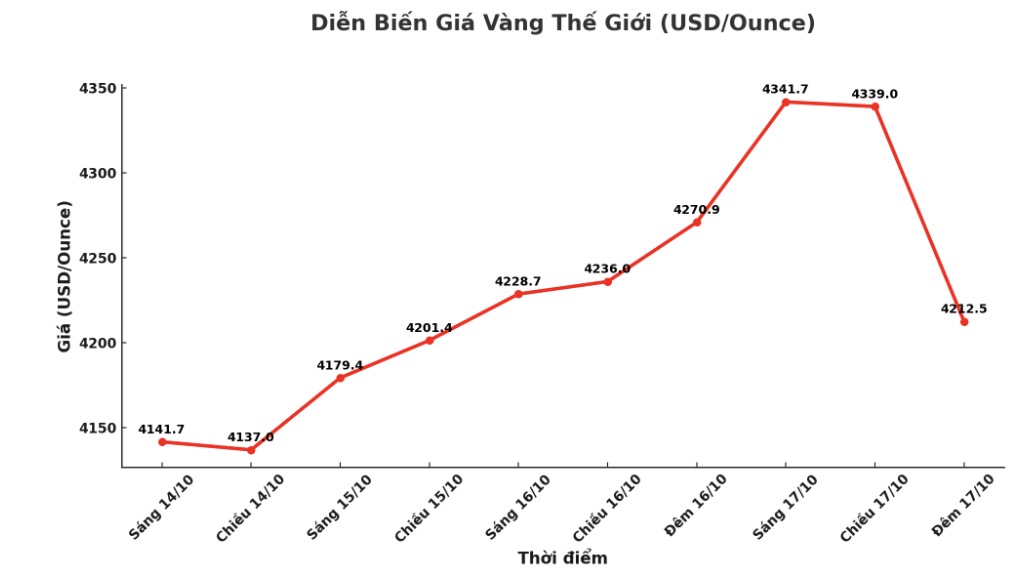

December gold futures on the Comex increased and hit a record high yesterday, reaching 4,392 USD/ounce, then decreased.

Gold prices fell sharply after hitting a record high of over $4,300/ounce, due to the rising USD and US President Donald Trump's comments that imposing a "comprehensive" tax on China is not feasible.

This past week, market risk concerns have increased, further strengthening safe-haven demand for gold. Meanwhile, the global stock market fell overnight. US stock indexes are expected to open sharply down when the trading session in New York begins.

Concerns about banks and credit have rocked the global financial market. Investors ended the trading week worried about the quality of loans at two US regional banks, raising doubts about credit risks in the economy and emphasizing the fragility of the US stock market's $28 trillion increase.

US bank stocks continued to plummet in overnight trading, after a strong sell-off on Thursday spread to both Asian and European markets.

Investors are concerned about not fully identifying the potential risks, although some experts believe that this sell-off is only short-term, and regional banks still have enough provisions for potential losses.

However, Zions Bancorp and Western Alliance Bancorp have announced damages due to credit fraud, in which Zions' subsidiary - California Bank & Trust - has lent the parties a total of 60 million USD. The defendants - two investment funds run by Andrew Stupin and Donald Marcil - " forcefully defended" their allegations through their lawyers, according to Bloomberg.

The above information caused US bank stocks to plummet. In just one week, 74 of the country's largest banks "evaporated" more than 100 billion USD in capitalization value. This development continues a series of recent financial shocks, including the substandard car lending company Tricolor Holdings filing for bankruptcy last month, and most recently the collapse of auto parts manufacturer First Brands Group - a company that owes more than 10 billion USD to many large financial institutions in Wall Street.

Before these incidents occurred, JPMorgan Chase CEO Jamie Dimon had warned investors early that there would be many other credit troubles: When you see a cockroach, there will usually be many others. He made the statement after JPMorgan released its Q3 profit report, which recorded a loss of $170 million related to Tricolor. People should be warned about this in advance, he stressed. The widespread concern caused safe-haven demand to increase sharply, pushing gold prices to a new record overnight.

The USD index is having its biggest week of decline in two months. The greenback fell for the fourth consecutive session, due to the "unmatched" signal from the Federal Reserve (FED) and new concerns about US regional banks.

The yield on the two-year US Treasury note fell to a three-year low, while the 10-year yield fell below 4%.

Traders have increased expectations that the FED will continue to cut interest rates, currently pricing a total of 53 basis points for interest rate cuts this year, compared to 46 points on Wednesday - according to Bloomberg.

FED Governor Christopher Waller said the Fed could continue to cut interest rates by 0.25 percentage points to support the weakening labor market. Meanwhile, Governor Stephen Miran reaffirmed his view that the double reduction would be more appropriate at the upcoming FOMC meeting.

The International Monetary Fund (IMF) warned that US-China trade tensions threaten global growth prospects. If this risk is realized in the form of higher tariffs and supply chain disruptions, global growth could fall by 0.3 percentage points, said Krishna Srinivasan, IMF's Asia-Pacific regions director.

Overseas markets are currently seeing the USD index continue to weaken, oil prices slightly decrease to about 57.25 USD/barrel, and 10-year bond yields at 3.94%.

In the international gold market, gold prices are formed through two main mechanisms: spot market - where prices are listed for transactions and immediate delivery; and futures market (futures) - where prices are established for future delivery contracts.

Currently, December gold delivery contracts are the most actively traded on the CME (US) exchange, due to liquidity factors that often increase sharply at the end of the year.