The S&P 500 index opened the week by breaking through the 50-day moving average - an important support level that has repeatedly helped buyers stay strong in previous adjustments.

Even the news that Warren Buffett through Berkshire Hathaway bought nearly 18 million Alphabet shares in the third quarter was not strong enough to attract the market.

As usual, as soon as the market weakens, there are rumors that this could be a long-awaited reversal of Wall Street and that a similar collapse in 2008 could be taking shape.

People always seem to have a need to compare any fluctuations with the financial bubble that year. And this time, there are many negative factors that contribute to strengthening that worry.

First of all, expectations of a rate cut by the US Federal Reserve (FED) have fallen sharply. Ahead of the October meeting, the possibility of the Fed cutting 25 basis points in December was almost certain by the market.

However, now, the CME FedWatch tool shows that the probability is below 50%, reflecting a more cautious sentiment. Data shortages after 43 days of government shutdowns and prolonged concerns about inflationary pressures from trade tensions are the main causes.

The Fed Chairman Cleveland even warned that much of the additional costs of tariffs on imported goods will eventually be transferred by businesses to US consumers.

The second factor comes from the cracks appearing in the private credit market. The collapse in September of First Brands - an auto parts manufacturer - and car lending company Tricolor has made investors worried.

Even in the UK, managers have begun to warn that private credit bankruptcies could spread to the traditional financial system, including banks.

The third factor is the possibility of the AI bubble starting to evaporate. Investors no longer easily believe in grand promises of potential in the future but increasingly want to see practical results.

Meanwhile, the massive issuance of debt by tech giants to finance AI projects only raises further doubts about the sustainability of this race.

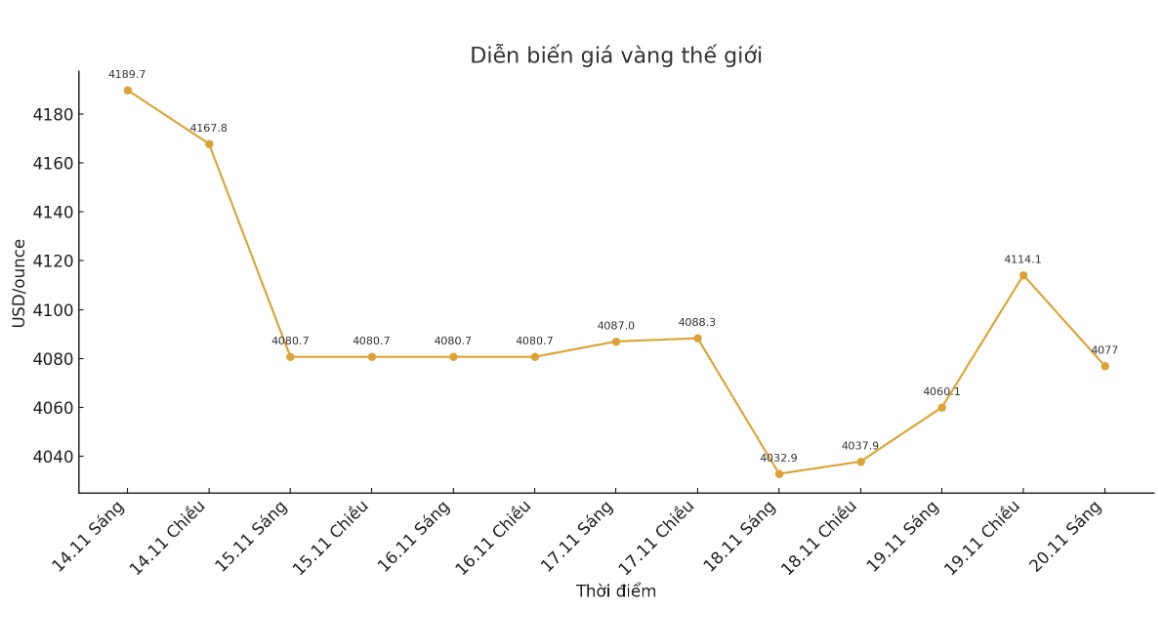

Assuming the market is truly facing a perfect storm, the question is how investors can protect themselves. Gold - which has been considered a traditional safe haven asset in recent days - has decreased in price along with Bitcoin, S&P 500, Nasdaq and Dow Jones.

What is putting pressure on gold at the moment is not investor indifference, but the fear that the FED will temporarily suspend easing in December, a scenario that could push the USD up.

In fact, during times of market panics, most assets - including gold - tend to decline sharply due to sell-off, margin calls, concerns about inability to pay and portfolio rebalancing by large organizations. Therefore, if the market plummets simultaneously, the USD and short positions are almost the few tools that can benefit.

See more news related to gold prices HERE...