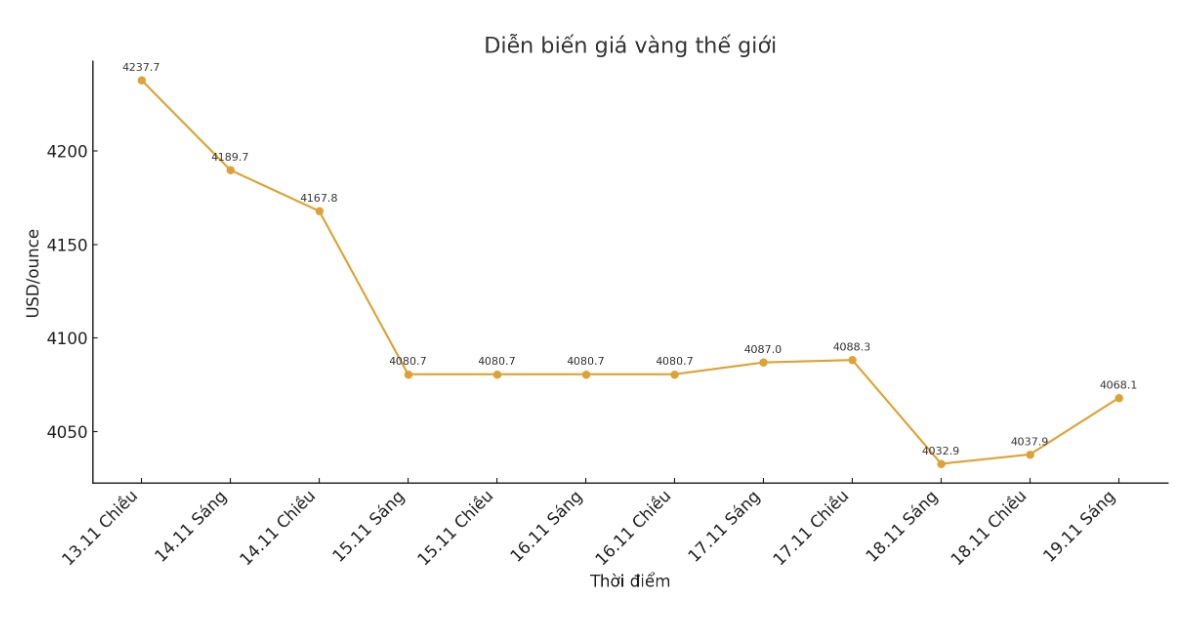

World gold prices opened on November 18 (New York time) under pressure, when prices retreated to the lowest level of the day at 3,997 USD/ounce before recovering. Thanks to this bounce, the market has avoided the fourth consecutive decline.

The key question for the current gold market continues to revolve around whether the US Federal Reserve (FED) will cut interest rates or maintain current interest rates at the upcoming FOMC meeting.

With inflation near 3% - a level often not suitable for considering interest rate cuts - the December meeting became an unusual situation. The current probability shows that the possibility of interest rate cuts is only under 50%, a significant decrease compared to the previous month, but still reflects a nearly even division among investors.

Some Fed officials have recently expressed concern about the current monetary policy stance, contributing to increased uncertainty. As a non-interest-bearing asset, gold often benefits from a lower interest rate environment, making any potential moves by the Fed especially important for the precious metals market.

The newly released labor market data is further reinforcing the case for a rate cut, although the risk of a government shutdown has delayed some reports. Unemployment claims data released today showed that the number of Americans receiving the support reached a two-month high in mid-October, with the number of extended claims increasing to 1.9 million in the week ended October 18.

Investors are now waiting for two key reports: the minutes of the FED meeting on October 28-29, which will be released tomorrow, and the Ministry of Labor's delayed September employment report, due on Thursday.

These two reports are expected to provide important information on the prospect of interest rate cuts in December, which many analysts believe has contributed to explaining the increase in gold and silver in today's session.

Going beyond the decisive factors, gold continues to be supported by structural demand, especially from central bank purchases. Major central banks around the world have recently proactively increased gold reserves instead of holding more USD, providing a fundamental foundation for the recent price increase trend.

Technically, the $4,000/ounce mark is more likely to act as a support zone than a resistance zone. If there are no major changes in the economic context, gold is expected to remain firmly above or around this important psychological level.

See more news related to gold prices HERE...