Gold and silver prices fell sharply as market expectations of a possible Fed rate cut in December weakened this weekend. The pressure to take profits from short-term futures traders also appeared in both metals, along with the selling pressure to liquidate buying positions.

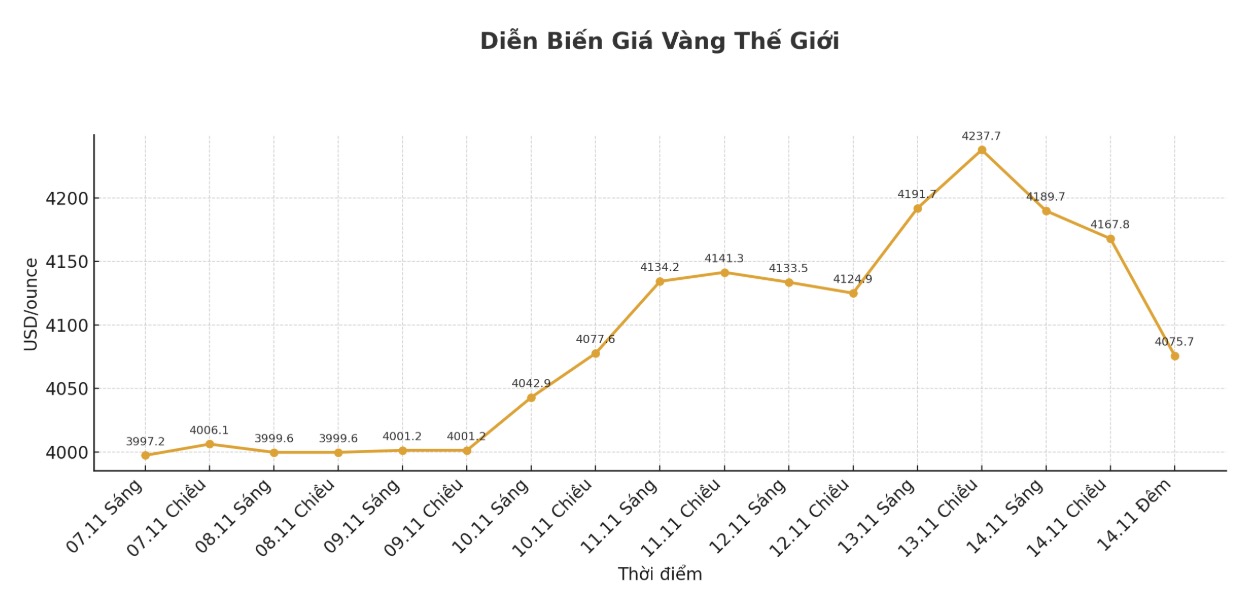

December gold contract fell 75.5 USD to 4,119 USD/ounce. December delivery silver price decreased by 1.53 USD to 51.63 USD/ounce.

US stock indexes plummeted in the session on Thursday and continued to decline overnight, ending the recovery this week, which was driven by the prospect of the US Government reopening.

Strong statements from Fed officials right before a series of important economic data have raised investors' concerns. As optimism about ending the government shutdown has been reflected in prices, concerns about stock valuations have returned, triggering a wave of sell-offs in technology groups.

Fed officials on Thursday expressed caution over the possibility of a rate cut in the coming time, causing the currency market to lower expectations for a December rate cut to below 50%, according to Bloomberg.

In separate statements, the Fed President of the St. Petersburg branch said. Louis, Alberto Musalem, said the Fed should take cautious action as inflation remains above target.

Fed Chairman Cleveland Beth Hammack stressed that monetary policy needs to maintain certain levels of tightening. Fed Fed Minneapolis Chairman Neel Kashkari said he did not support the latest cut and had not yet decided on December.

In other developments, the US and Argentina have reached an agreement to strengthen bilateral trade and investment cooperation, according to the White House's announcement on Thursday. The two countries will open markets for each other for key products, the statement said, adding that Argentina will give preferential market access to US goods, including some pharmaceuticals, chemicals, machinery, information technology products and medical equipment. The US also announced trade deal frameworks with El Salvador and Ecuador on Thursday.

China's economic activity slowed more strongly than expected in the first quarter, with an unprecedented decline in investment and slowing industrial product growth, according to Bloomberg. fixed-asset investment fell 1.7% in the first 10 months of the year, while industrial output last month rose 4.9% year-on-year, the weakest increase since the beginning of the year.

Meanwhile, government stimulus has yet to make a clear impact, as domestic demand weakens and borrowing demand does not improve, despite Beijing approving a total of 1,000 billion yuan in support since late September.

Technically, the next target for December gold futures buyers is to close above the strong resistance level at a record $4,398/ounce. The latest downside target for the bears is to push prices below the solid support level of $4,000/ounce.

The first resistance level was seen at $4,200/ounce, followed by an overnight peak of $4,215.1/ounce. First support was at 4,100 USD/ounce and then 4,050 USD/ounce.

The December silver contract still maintains a clear technical advantage in the short term. The next target for buyers is to close above the strong resistance level at the historical peak this week: 54.415 USD/ounce. The target for the sellers is to bring the price below the important support of 50 USD.

The first resistance level was at 52 USD/ounce and then 53 USD/ounce. Next support was $51 an ounce and then $50 an ounce.

In outside markets, the USD index increased slightly. Crude oil prices rose and traded around $59.50/barrel. The yield on the 10-year US Treasury note is at 4.13%.

Note: The world gold market operates through two main pricing mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.