SJC gold bar price

As of 6:00 a.m. on November 18, the price of SJC gold bars was listed by DOJI Group at 149-151 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 149.5-151 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and unchanged for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 148-151 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

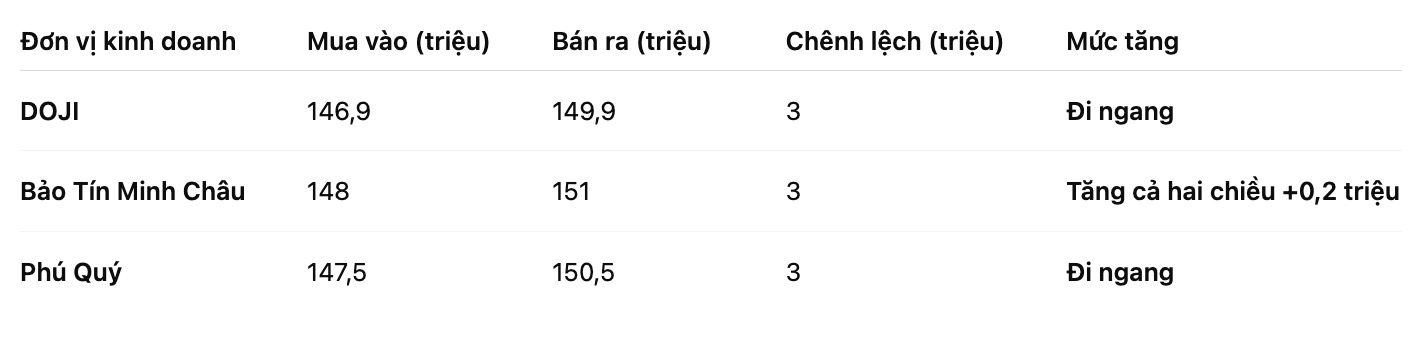

9999 gold ring price

As of 6:00 a.m. on November 18, DOJI Group listed the price of gold rings at 146.9-149.9 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 148-151 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147.5-150.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

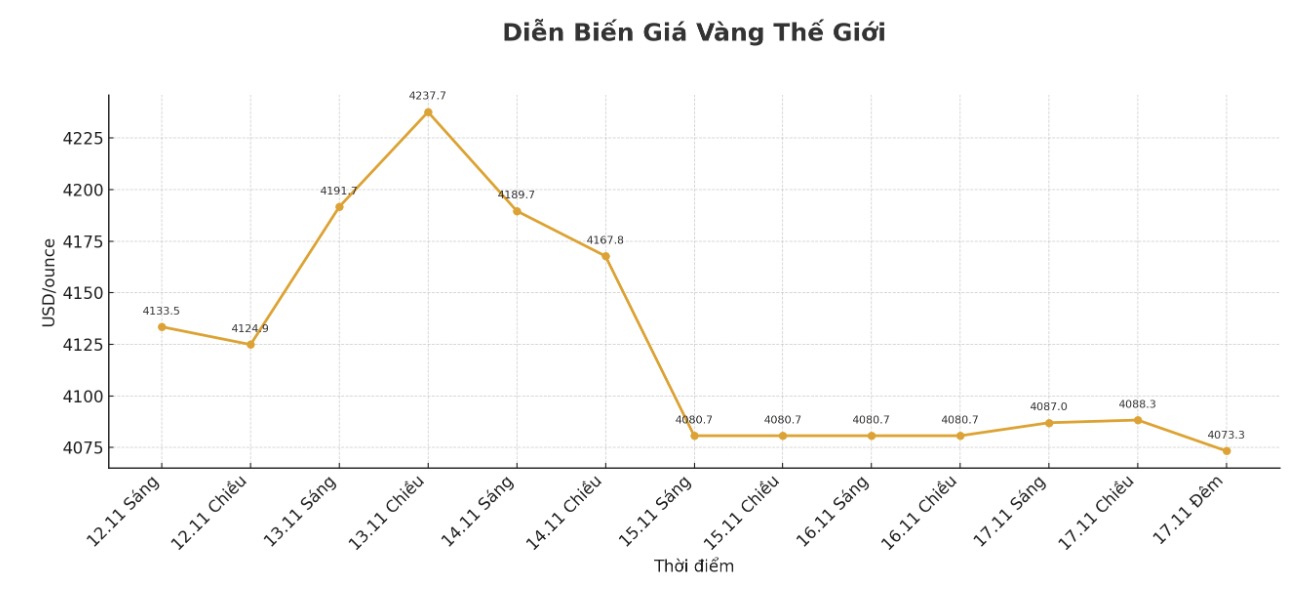

World gold price

The world gold price was listed at 9:50 p.m. on November 17 (Vietnam time) at 4,073.3 USD/ounce, down 7.4 USD.

Gold price forecast

World gold prices fell slightly last night. Precious metals traders are looking forward to a week when US government economic reports will begin to be released again.

December gold contract is currently down 8.6 USD to 4,085.90 USD. December delivery silver price increased by 0.114 USD to 50.8 USD.

The US Bureau of Labor Statistics announced that it will release its September employment report this Thursday, November 20, after being delayed due to the US government's closure. The agency will also release a September inflation-adjusted realty income report on Friday, November 21 - both reports are released at 7:30 a.m. CST.

These new data will help clarify the US economic situation, although it is later than usual.

The Asian and European stock markets last night fluctuated in opposite directions but tended to increase. US stock indexes are forecast to open in the green when the trading session in New York begins.

Technically, the next upside target for December gold futures buyers is to close above a solid resistance level at a record $4,398. The short-term bearish target for the sellers is to push prices below the strong support level of 4,000 USD.

The first resistance level was the night peak of 4,107.6 USD/ounce and then up to 4,150 USD/ounce. First support was the night low of $4,051.1 an ounce and then it hit Friday's low of $4,032.6 an ounce.

Key outside markets today showed a slight increase in the USD index. Crude oil prices are almost flat, trading around $60/barrel. The yield on the 10-year US Treasury note is at 4.125%.

Note: The world gold market operates through two main pricing mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries. Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...