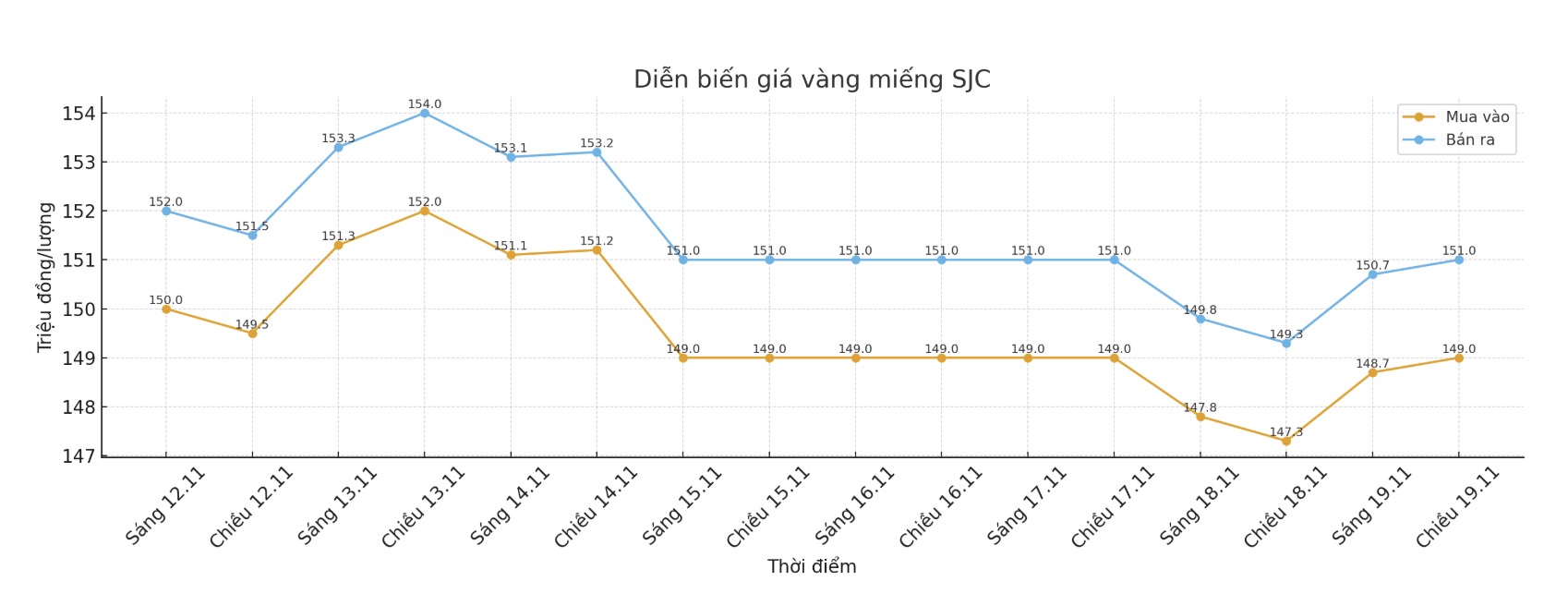

SJC gold bar price

As of 5:15 p.m., DOJI Group listed the price of SJC gold bars at 149-151 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 149.5-151 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 148-151 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

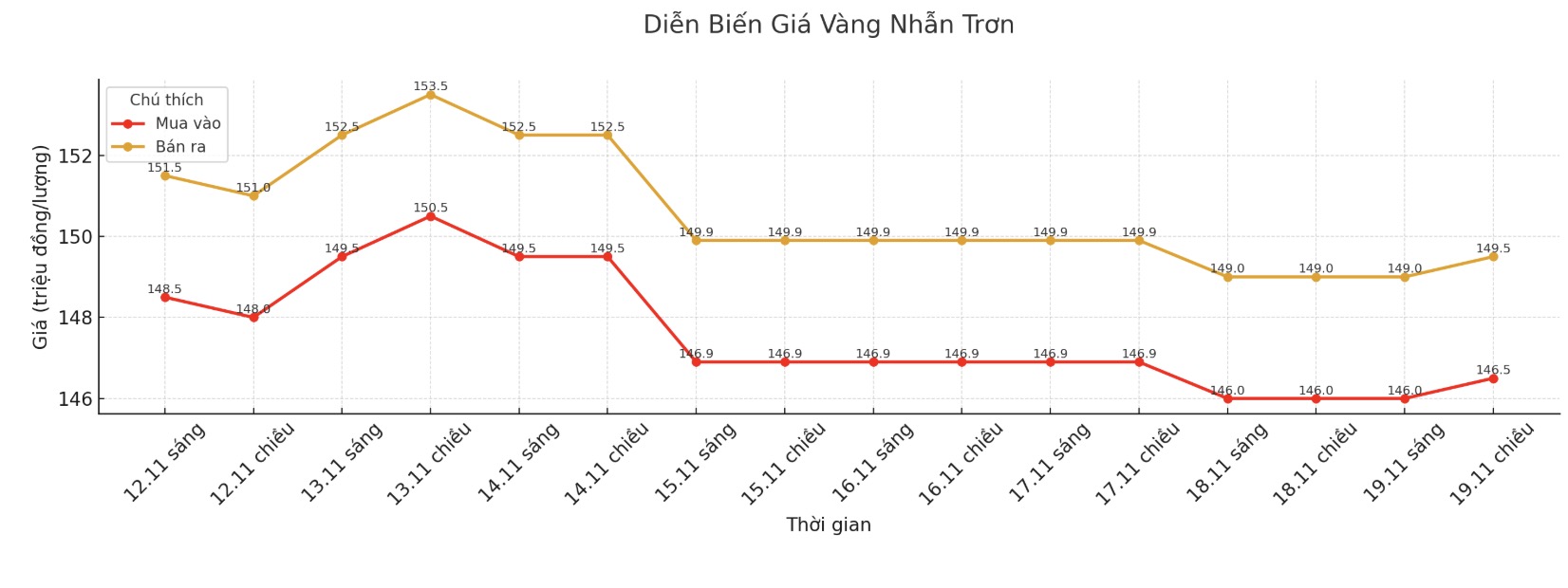

9999 gold ring price

As of 5:15 p.m., DOJI Group listed the price of gold rings at 146.5-149.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 148.3-151.3 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147.3-150.3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

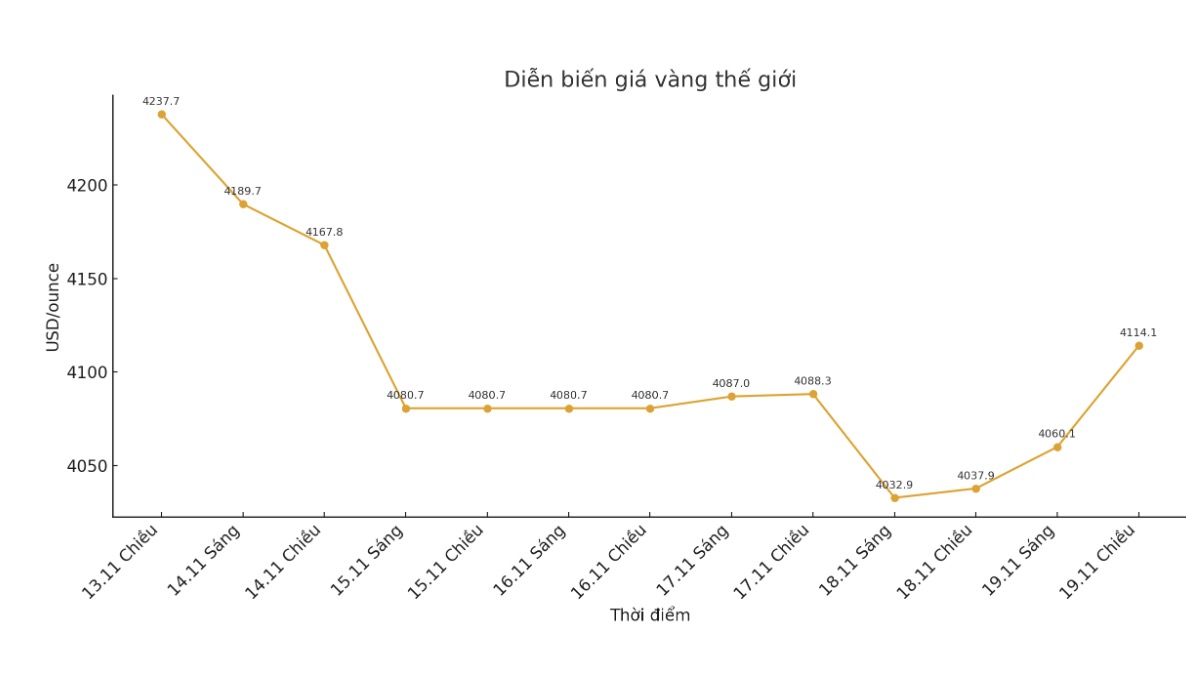

World gold price

The world gold price was listed at 5:18 p.m., at 4,114.1 USD/ounce, up 76.2 USD compared to a day ago.

Gold price forecast

The precious metal recovered as investors awaited the minutes of the latest meeting of the US Federal Reserve (FED) and the US employment delay report to find clues on the interest rate roadmap.

Investors are now waiting for the minutes of the latest FED meeting, due to be released on the same day, along with the September non-farm payrolls report due to delays due to the US government's temporary closure.

According to CME Group's FedWatch tool, traders are now assessing the possibility of the Fed cutting interest rates at its December 9-10 meeting at nearly 49%.

The gold rally has been partly held back by a stronger US dollar and doubts about when the Fed could cut rates further, said Tim Waterer, chief market analyst at Ho Chi Minh City Trade.

In the latest report, commodity analysts from Societe Generale said they are closely monitoring central bank demand for gold, as they believe that the current buying momentum could lead to a short squeeze similar to what happened with silver and platinum.

society Generale issued an early warning that this material demand for gold could put additional pressure on a market dominated by paper gold. Analysts say that just 1% of reserve assets are converted to gold, which is enough to create a "gold fever".

They also said that China will continue to play a leading role in the gold market.

Instead of previously assuming that central banks sell US assets and shift a small part to gold, we should giafy that they reallocate an additional 1% of their total reserves to gold and not sell foreign assets, then China alone will need 276 tons. In addition to the total demand of relevant countries, the figure will reach 762 tons.

If we divide these 762 tons equally over three years, it will be 64 tons per quarter, which is close to what we expect when giafying that foreign investors reduce their holdings of US assets, which are the core element of our gold forecast model."

Notable US economic data for the week

Wednesday: Minutes of the Federal Open Market Committee (FOMC) meeting.

Thursday: Philly FED Production Survey, Weekly Unemployment claims, existing home sales.

Friday: S&P's preliminary PMI, University of Michigan Consumer Confidence Index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...