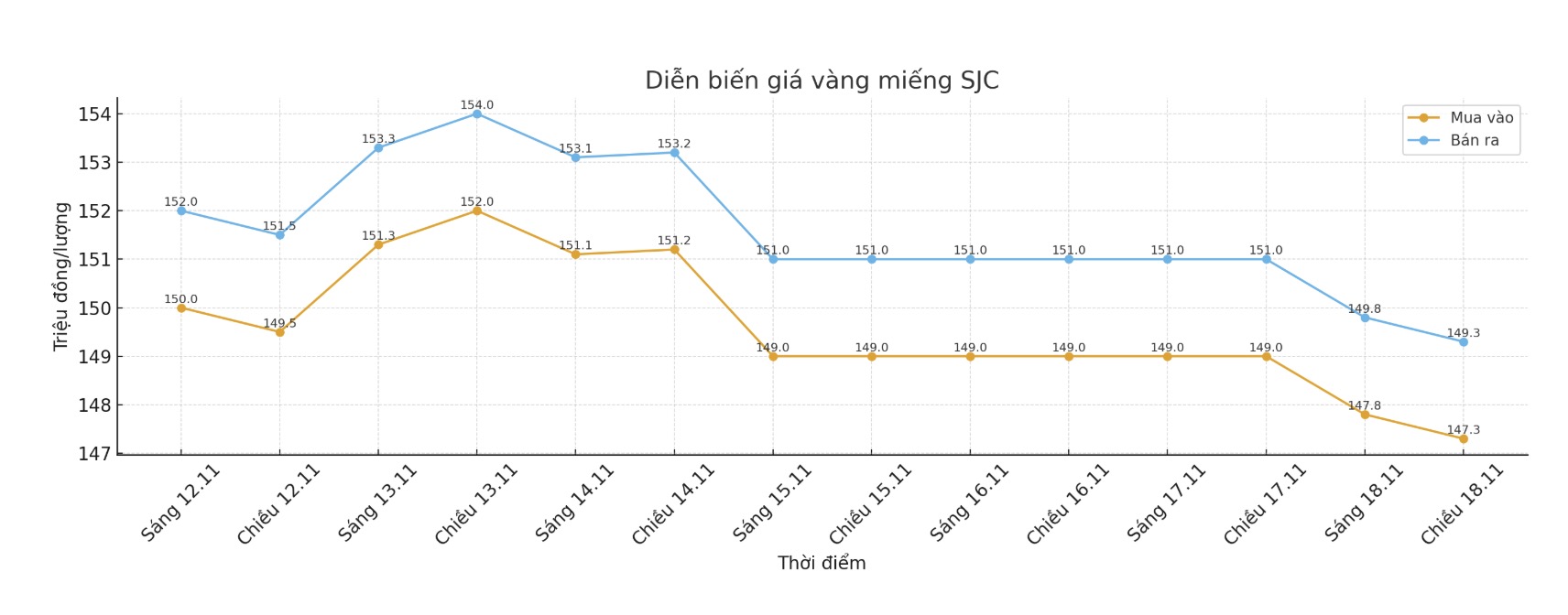

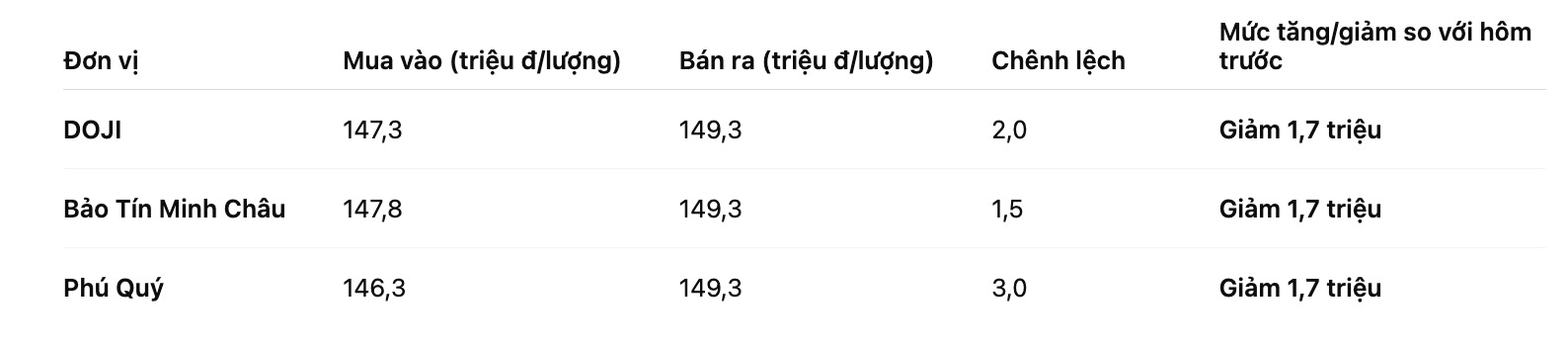

SJC gold bar price

As of 6:00 a.m. on November 19, the price of SJC gold bars was listed by DOJI Group at 147.3-149.3 million VND/tael (buy in - sell out), down 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.8-149.3 million VND/tael (buy in - sell out), down 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146.3-149.3 million VND/tael (buy in - sell out), down 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

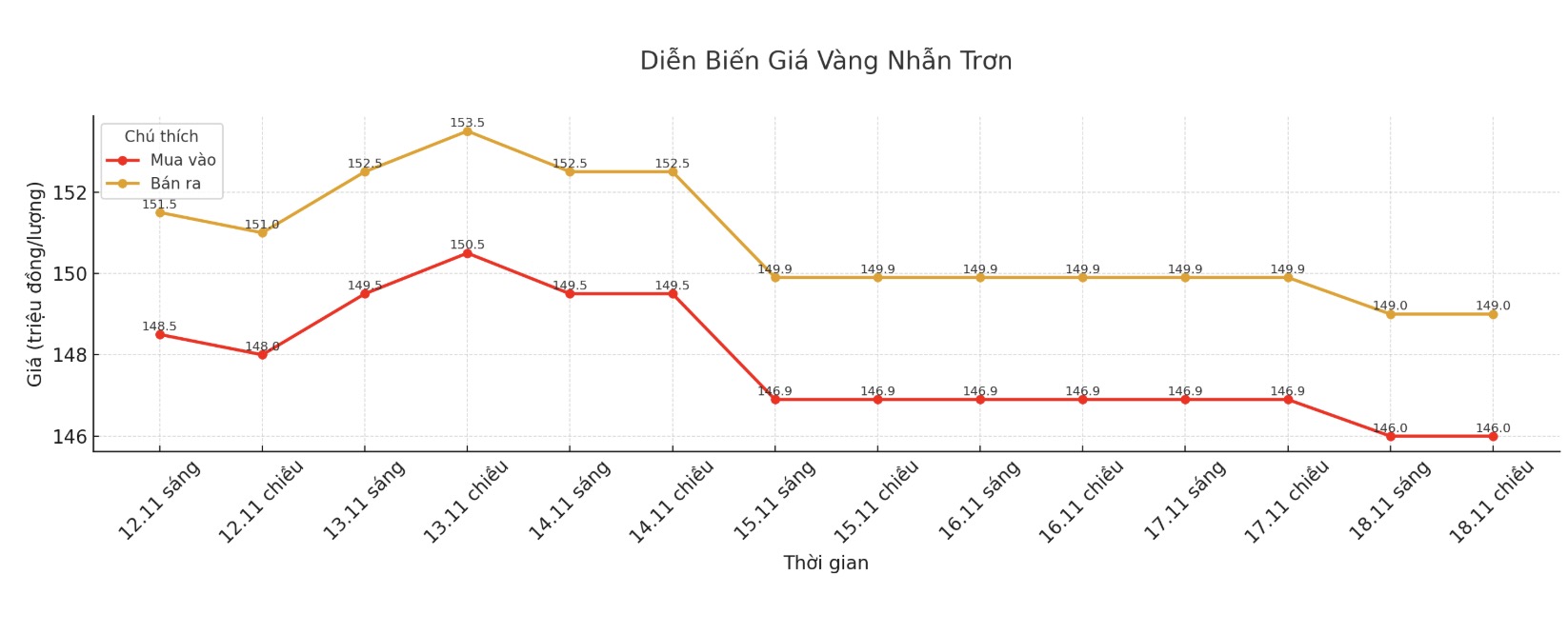

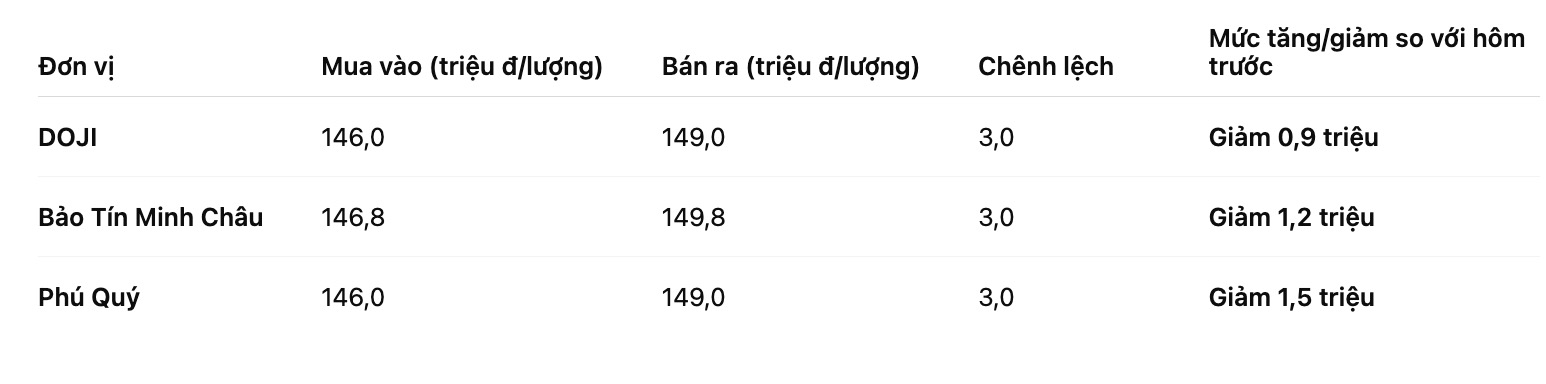

9999 gold ring price

As of 6:00 a.m. on November 19, DOJI Group listed the price of gold rings at 146-149 million VND/tael (buy - sell), down 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 146.8-149.8 million VND/tael (buy - sell), down 1.2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146-149 million VND/tael (buy - sell), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

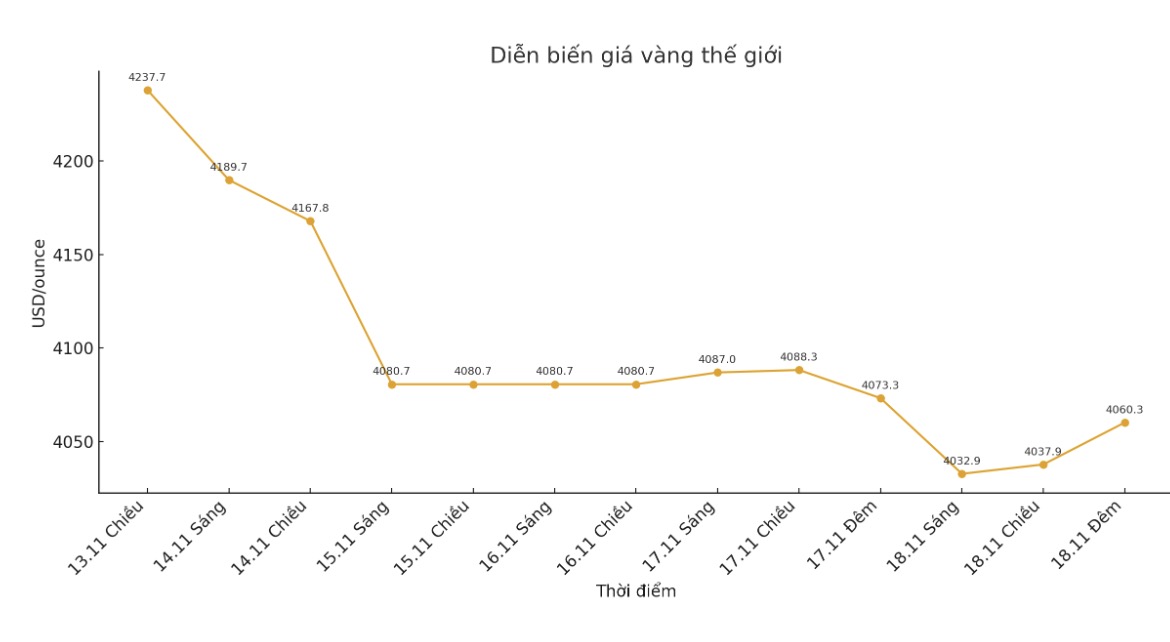

World gold price

The world gold price was listed at 23:45 on November 18 (Vietnam time) at 4,060.3 USD/ounce, down 13 USD.

Gold price forecast

The gold price trend is currently unclear. According to Dilin Wu - research strategist at Pepperstone, on the one hand, expectations of the US Federal Reserve (FED) cutting interest rates in December are decreasing, creating pressure for gold prices to weaken. On the other hand, concerns about the slowing growth rate of the US economy and internal disagreements within the FED have boosted demand for gold as a safe haven.

Buyers and sellers have been active: on the one hand, growing uncertainty about the US economic outlook and skepticism about the Feds independence have supported safe-haven demand; on the other hand, the reopening of the US government has led a segment of investors to take profits, along with repeated Hawk signals from Fed officials and expected easing down, limiting the increase, she said.

According to Dilin Wu, the focus of the market will be the US September non-farm payrolls report released on Friday morning. The data could be delayed due to government shutdowns, but it is still capable of creating strong volatility in the short term, she warned.

In a notable development, China is said to be continuing to hoard gold. Goldman Sachs quoted Bloomberg as saying that China added about 15 tons of gold to foreign exchange reserves in September, in the context of central banks' gold purchases accelerating after a period of stagnation in the summer.

Analysts estimate that global central banks bought 64 tons of gold in September, more than three times more than last month. Goldman said the buybacks are likely to continue in November.

Gold accumulation by central banks has been a key driver in golds strong rally over the past three years, taking prices to a record high of more than $4,380 an ounce in October before adjustment. Although playing an important role, the purchase by countries is quite mysterious because they often declare a shortage" - Bloomberg commented.

Technically, the next target for December gold buyers is to close above a solid resistance level at a historical peak of $4,398/ounce. The target for the sellers is to pull the price below the strong support zone of 4,000 USD/ounce.

The first resistance level was an overnight high of $4,055.4 an ounce, followed by a weekly high of $4,107.6 an ounce. First support was $4,000/ounce, followed by an overnight low of $3,997.4/ounce.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries. Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...