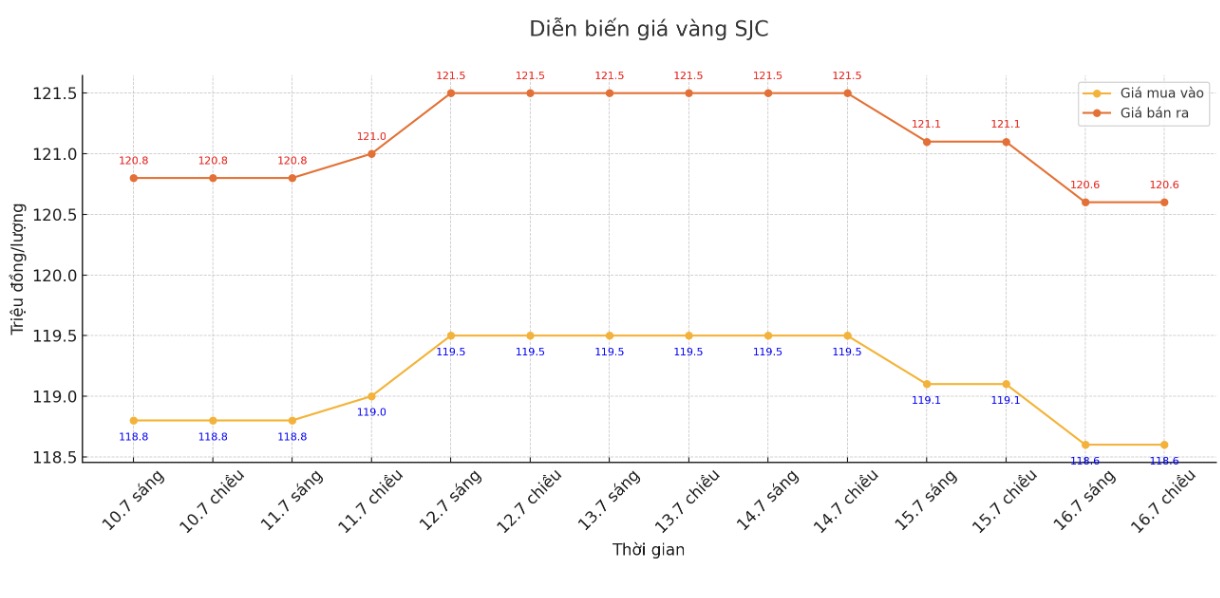

SJC gold bar price

As of 6:00 a.m. on July 17, the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.6-120.6 million/tael (buy in - sell out); down VND 500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.6-120.6 million VND/tael (buy - sell); down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.6-120.6 million VND/tael (buy in - sell out); down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.9-120.6 million VND/tael (buy in - sell out); down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

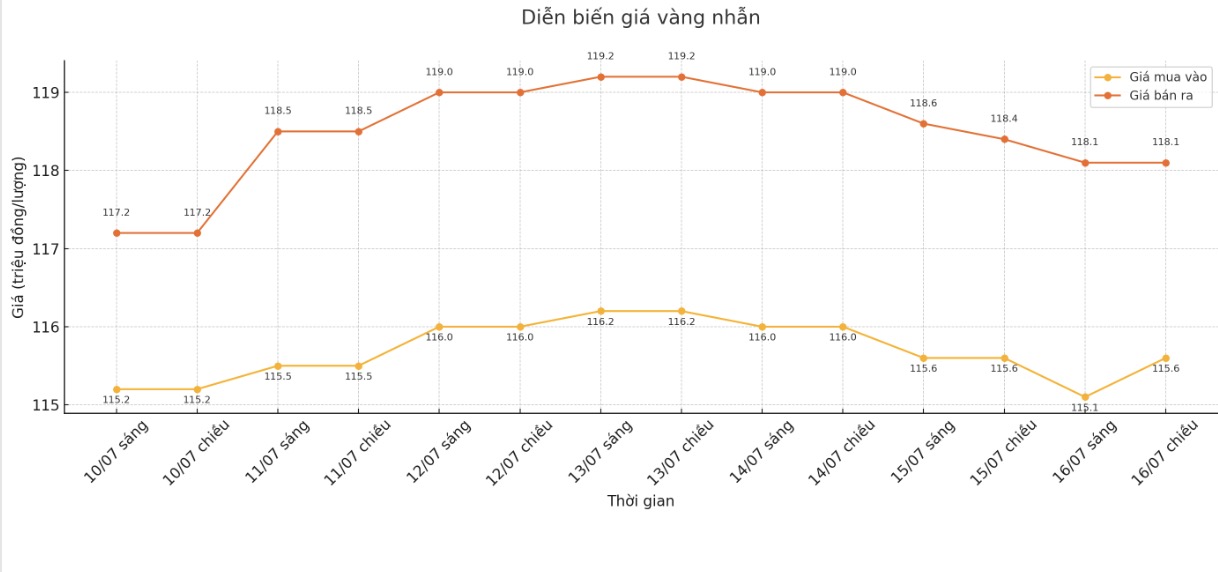

9999 gold ring price

As of 6:00 a.m. on July 17, DOJI Group listed the price of gold rings at VND 115.6-118.1 million/tael (buy in - sell out). The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.3-118.3 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.6-117.6 million VND/tael (buy - sell), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

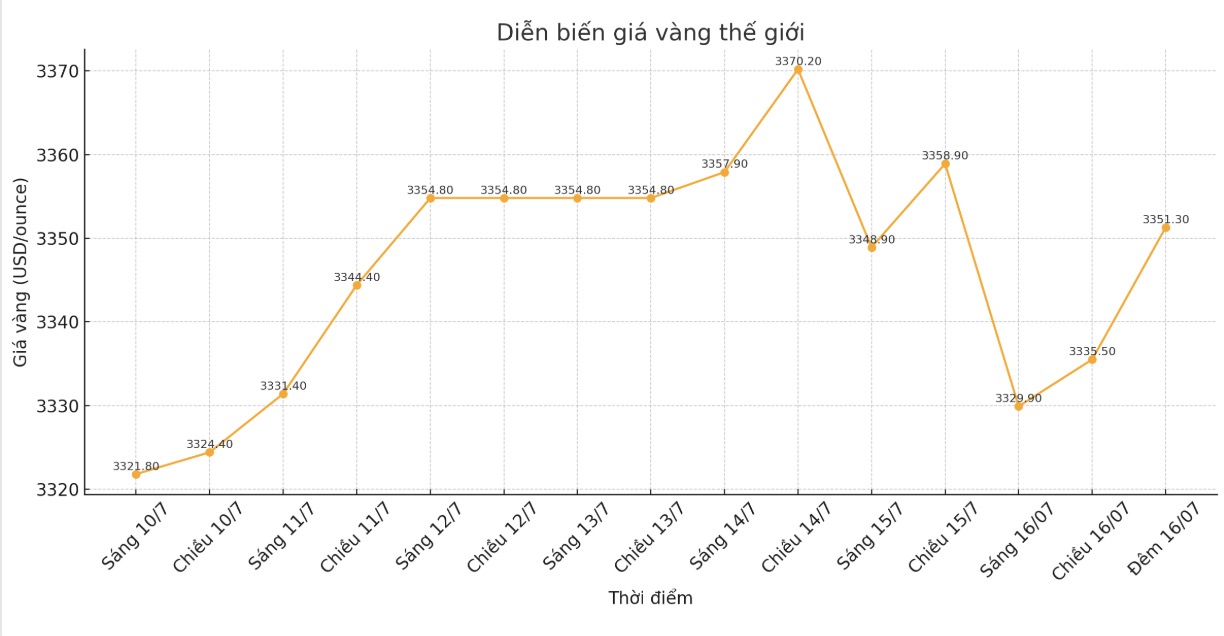

World gold price

Recorded at 10:15 on July 16, spot gold was listed at 3,351.3 USD/ounce, up slightly.

Gold price forecast

Gold and silver prices increased slightly in the trading session last night. In the middle of this week, the market did not have many fluctuations, which is not surprising in the context of a quiet summer.

August gold contract increased by 9.4 USD, to 3,346.1 USD/ounce. September delivery silver price increased by 0.165 USD, to 38.275 USD/ounce.

Asian and European stocks fluctuated in opposite directions overnight, while US stocks were forecast to open with a differentiation trend.

Technically, bulls for August gold are still holding a short-term advantage. The next upside target for buyers is to close the session above the strong resistance level at 3,400 USD/ounce. In contrast, the next bearish target for the bears is to push prices below the key technical support level at the bottom of June at $3,250.5 an ounce.

The most recent resistance was at $3,375/ounce, followed by a peak this week at $3,389.3/ounce. The most recent support is the weekly low at $3,327.30/ounce, followed by $3,300/ounce.

In outside markets, the USD index decreased slightly. Nymex crude oil futures weakened, trading around $66.00/barrel. The yield on the 10-year US Treasury note is currently at 4.477%.

Economic data to watch this week

Wednesday: US Producer Price Index (PPI).

Thursday: Retail sales, Philly Fed manufacturing survey, US weekly jobless claims.

Friday: Newly started houses, University of Michigan preliminary consumer confidence index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...