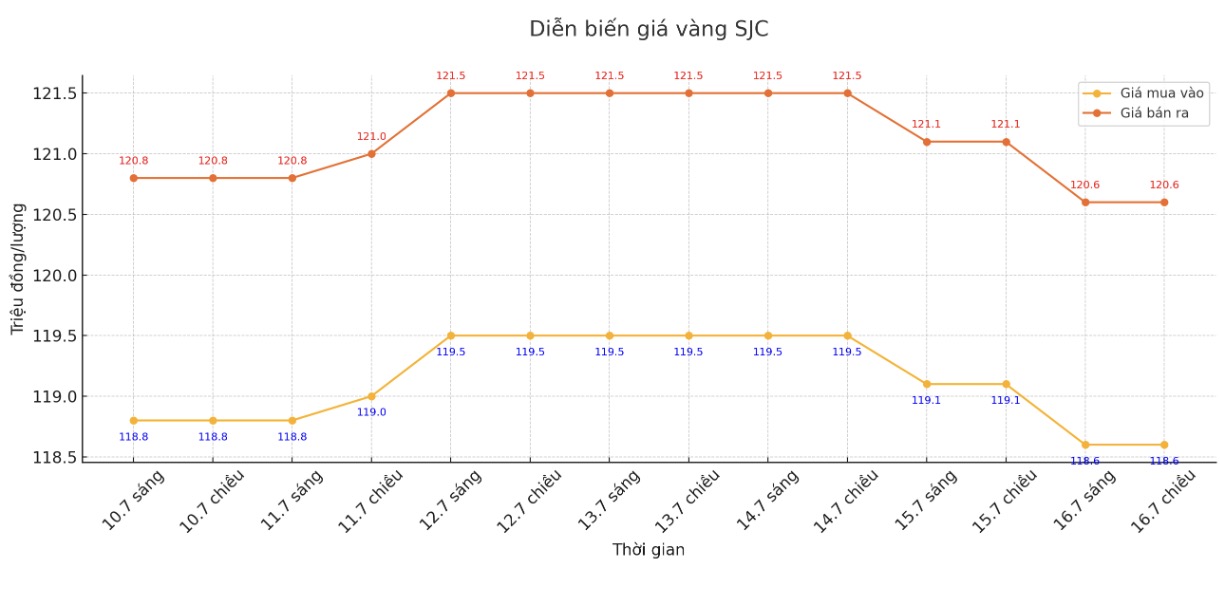

Updated SJC gold price

As of 10:00, the price of SJC gold bars was listed by Saigon Jewelry Company at 118.6-120.6 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed SJC gold bar price at 118.6-120.6 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.6-120.6 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117.9-120.6 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.7 million VND/tael.

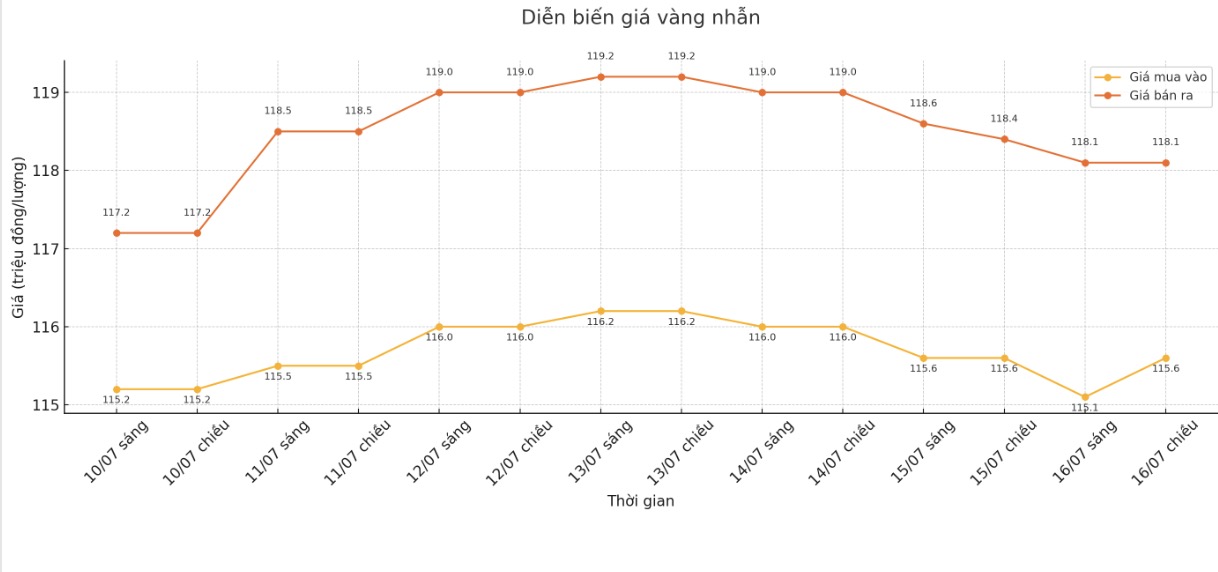

9999 round gold ring price

As of 10:00, DOJI Group listed the price of gold rings at 115.9-118.4 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 300,000 VND/tael for selling. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy in - sell out), an increase of 700,000 VND/tael. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.6-117.6 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

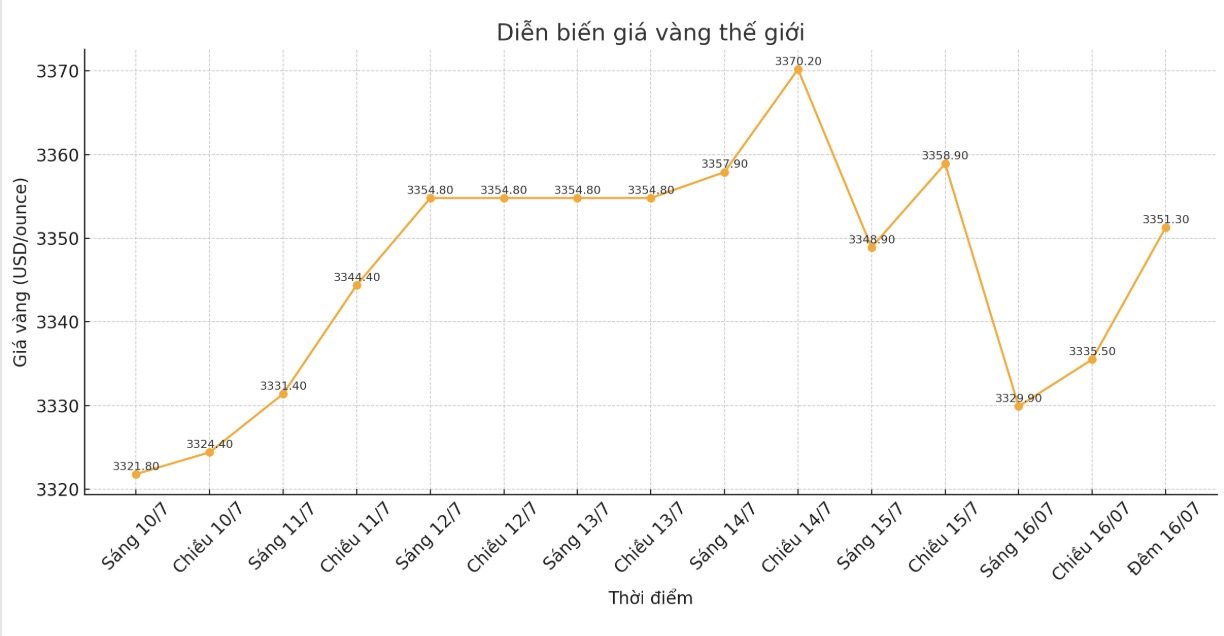

World gold price

At 10:05, the world gold price was listed around 3,340 USD/ounce, up 10.1 USD/ounce.

Gold price forecast

Gold prices remained high but could not break out significantly, even as the pressure on wholesale inflation last month did not change.

According to the US Department of Labor, the country's overall producer price index (PPI) in June did not increase, after increasing by 0.1% in May. This latest inflation data was lower than expected, as the market expected a 0.2% increase.

Over the past 12 months, overall wholesale inflation increased by 2.3%. This figure is also lower than economists' forecast of 2.5%. Last month's whole-year inflation was revised up from 2.6% to 2.7%.

The core PPI excluding volatile food and energy prices - also unchanged in June, after rising 0.1% in May. Analysts predict core PPI will increase by 0.2%.

Some experts believe that cooling inflation data could support gold prices, as this shows that inflationary pressures are under control and could create conditions for the US Federal Reserve (FED) to cut interest rates this year.

However, there are also opinions that economic instability and inflation concerns are still present due to import tariffs imposed by US President Donald Trump and the ongoing global trade war. PPI is considered an early inflation forecast, as manufacturers often shift higher input costs to consumers.

"geopolitical factors are still the factors that dominate the market. With Israeli airstrikes and a tougher US stance on tariffs, some uncertainty still exists," said Jim Wyckoff, a precious metals analyst. Mr. Jim Wyckoff predicts that gold prices will range from 3,250 to 3,476 USD/ounce in the short term.

In terms of trade, US President Donald Trump announced on Tuesday to impose a 19% tariff on goods from Indonesia. Meanwhile, the European Commission is preparing to target $84.1 billion in US goods as potential retaliatory measures if trade talks with Washington fail, after President Trump threatened to impose a 30% tariff on imports from Europe last week.

According to the World Gold Council (WGC), gold prices could increase to $4,000/ounce (equivalent to 128 million VND/tael) by the end of this year. However, there is also a possibility that the whole year's growth rate will be only a digital one, depending on the impact of geopolitical and macroeconomic risks on the main drivers of the precious metal.

Economic data to watch this week

Thursday: Retail sales, Philly Fed manufacturing survey, US weekly jobless claims.

Friday: Newly started houses, University of Michigan preliminary consumer confidence index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...