Gold prices increased in the trading session on Thursday, supported by a weakening USD, after the FED cut interest rates by 25 basis points and signaled a gradual easing roadmap for the rest of the year, thereby increasing the attractiveness of the precious metal.

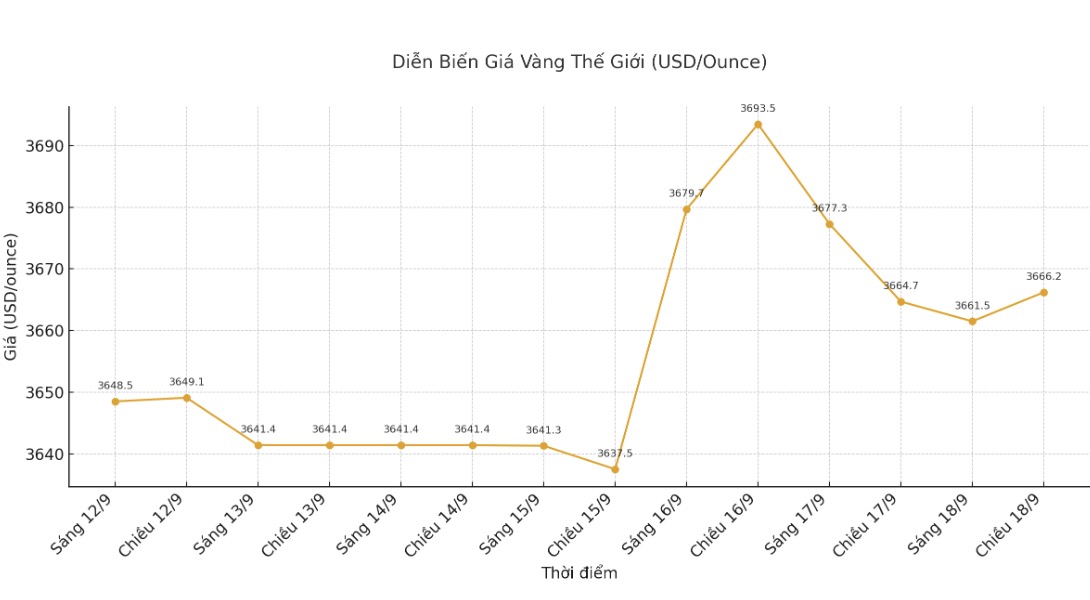

Spot gold prices increased 0.2% to $3,668.34/ounce at 10:11 GMT. Previously, prices hit a record $3,707.4 an ounce on Wednesday, before closing down 0.8%. The December US gold futures fell 0.4% to $3,703.

The USD index fell back to near a two-month low, making gold cheaper for holders of other currencies. The yield on the 10-year US Treasury note also fell.

Fawad Razaqzada - market analyst at City Index and FOREX.com said: "The USD continues to weaken, supporting gold prices. This interest rate decision is somewhat dovish, because the statement or plot dot chart shows that there will be two more cuts this year.

The Fed cut interest rates by 25 basis points on Wednesday and said it will continue to cut borrowing costs for the rest of the year. Fed Chairman Jerome Powell described the move as a risk-off against a weakening labor market and said the agency would view each meeting on the interest rate outlook.

Gold - an unyielding safe haven asset, often has the advantage of a low interest rate environment. Golds rally is still holding steady and is likely to continue to record new records, said independent analyst Ross Norman.

According to CME Group's FedWatch tool, traders are now predicting a 90% chance of another 25 basis point rate cut at the October meeting.

ANZ Bank also forecasts gold will outperform in the early stages of the easing cycle, with demand for safe-haven assets driven by a challenging geopolitical context.

For other precious metals, spot silver rose 0.4% to $41.84/ounce, platinum rose 1.5% to $1,383.60/ounce, while gold fell 0.7% to $1,146.55/ounce.

See more news related to gold prices HERE...