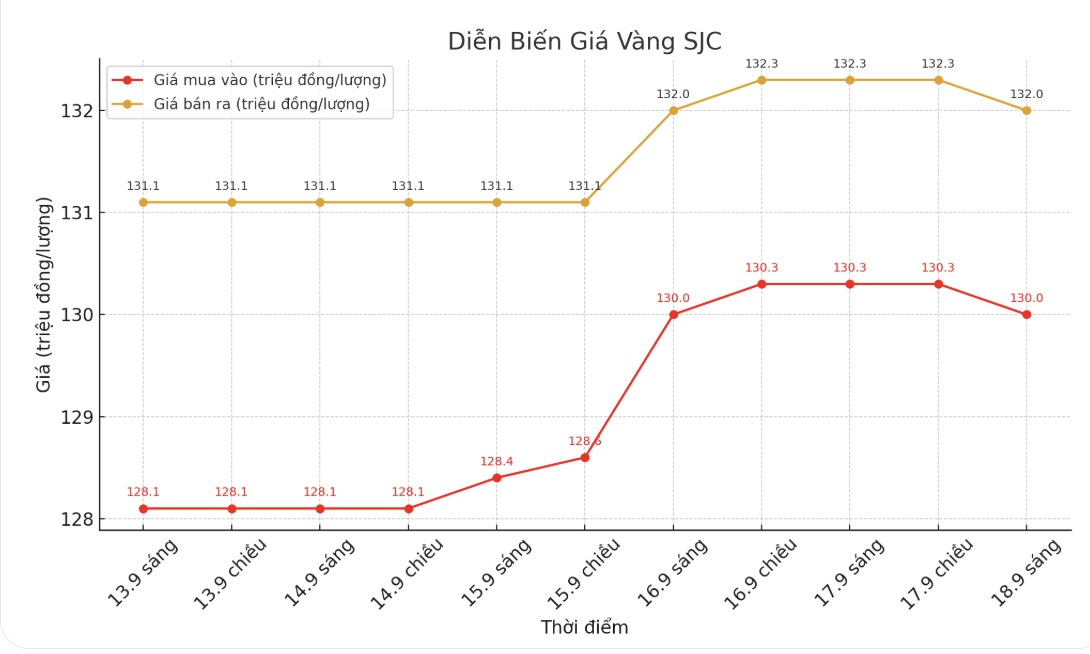

Updated SJC gold price

As of 9:50 a.m., DOJI Group listed the price of SJC gold bars at VND130-132 million/tael (buy in - sell out), down VND300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 130-132 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 129.5-132 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

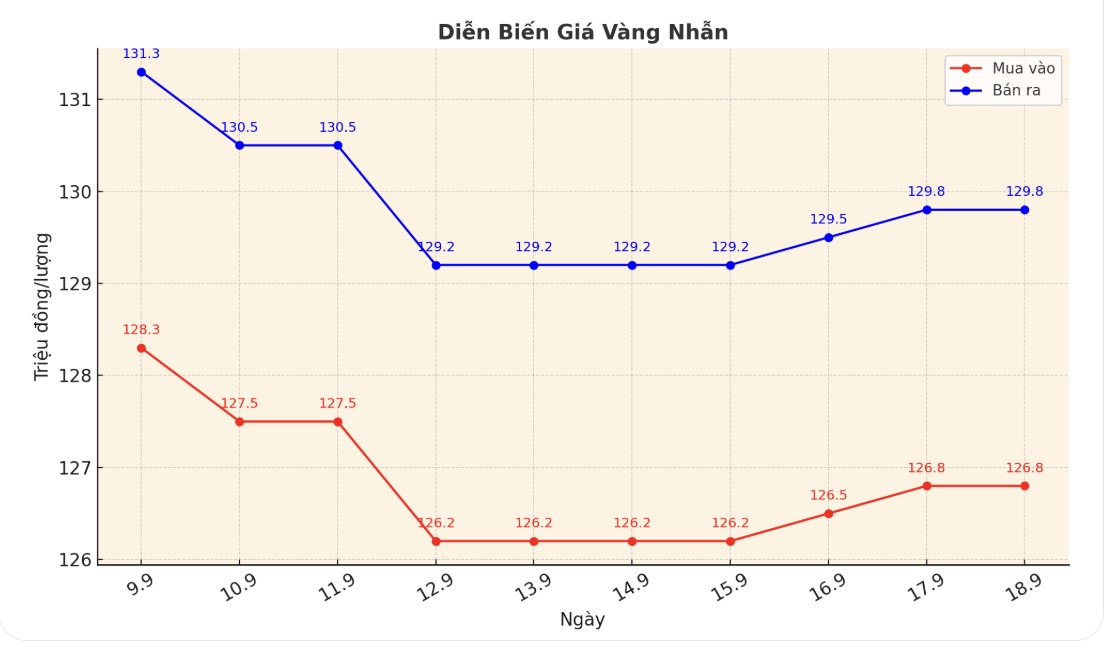

9999 round gold ring price

As of 9:50 a.m., DOJI Group listed the price of gold rings at 126.8-129.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127.2-130.2 million VND/tael (buy - sell), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 126.6-129.6 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

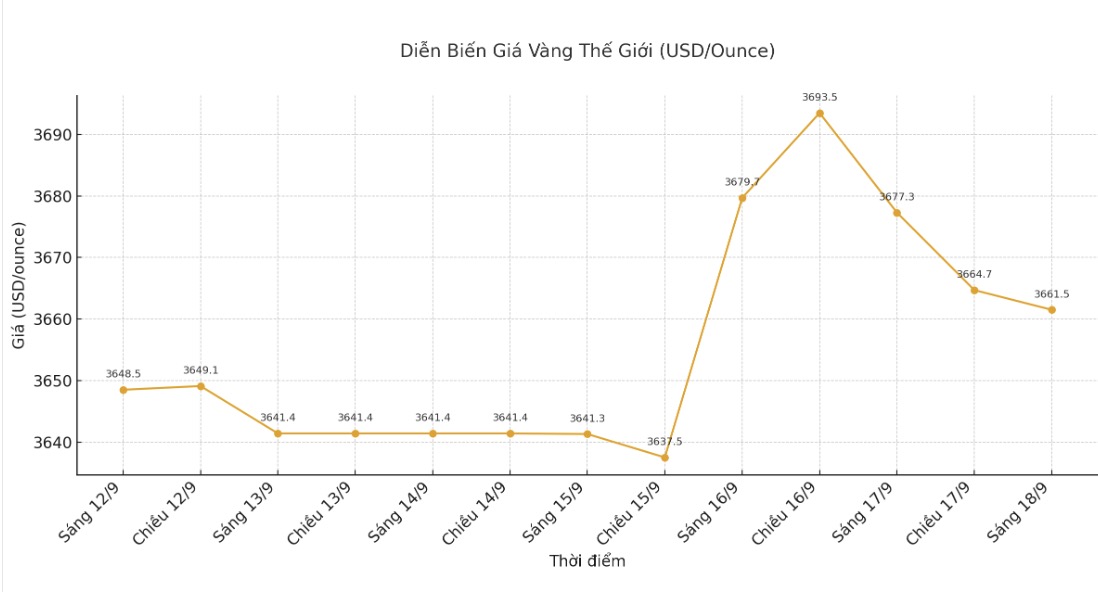

World gold price

At 9:55 a.m., the world gold price was listed around 3,661.5 USD/ounce, down 15.8 USD.

Gold price forecast

World gold prices skyrocketed last night, but quickly plummeted after the US Federal Reserve (FED) cut interest rates. This decline came after the FED announced an additional interest rate cut of 0.25 percentage points - a decision that investors and monetary policy observers had predicted in advance.

The Fed's move was in line with market expectations and was largely reflected in the surge in gold prices before the announcement time.

However, after Fed Chairman Jerome Powell's speech, investors have adjusted their positions, causing gold prices to reverse direction, even though the precious metal had previously hit a record high of $3,705/ounce.

In addition to the interest rate decision, the FED will also release updated economic forecasts. Chairman Powell's press conference is expected to be very tense, because reporters will question not only the orientation of the US economy and interest rates but also the independence of the Fed.

In addition to the Fed meeting, a number of other important US economic data will also be released, including the MBA's weekly mortgage application survey and the US Energy Department's weekly oil reserve report. These data will provide an overview of the health of the US economy, thereby affecting market sentiment and investor decisions.

Jesse Colombo, an independent precious metals analyst and founder of BubbleBubble Report, has given an optimistic view on the future of gold. He predicted that gold prices could reach the mark of 4,000 USD/ounce.

Meanwhile, Bank of America (BoA) believes that gold is still on track to reach $4,000/ounce in the second quarter of 2026. Although gold appears to be being stretched too much in the short term, the BoA believes the market will still be well supported as the Fed looks to cut interest rates amid rising inflationary pressures.

The BoA noted that gold prices have increased by an average of 13% over the past 12 months after the Fed cut interest rates amid persistent inflation. However, this reaction seems quite reserved, because gold prices have increased by nearly 40% since the beginning of the year.

This precious metal is correlated with the 30-year term interest rate, which hit an all-time high as the Feds benchmark rate rose nearly 5%, the banks analysts said.

Technically, December gold delivered the short-term bullish advantage. The next upside target for buyers is to close the session above the strong resistance level of 3,800 USD/ounce.

On the contrary, the target for the sellers is to pull the price below the support zone of 3,600 USD/ounce. The nearest resistance zone was at an all-night high of $3,732.8 and then the peak of the week at $3,739.9.9. First support was at an all-night low of $3,695.4, followed by $3,675 an ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...