After recording a strong increase in the first half of 2025, many investors questioned whether gold, silver and platinum prices have peaked. However, according to Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank, the factors supporting the precious metal's increase are still intact, and many new drivers may promote prices to continue to increase in the second half of the year.

After a brilliant first half of the year, the investment metals market is entering an accumulation phase. Gold has been flat for the past 12 weeks, creating an opportunity for silver and platinum to catch up. With the increase since the beginning of the year of about 26% for gold and silver, and 54% for platinum, investors are wondering: Is the limit yet?

We believe the answer is not yet, Hansen wrote.

Hansen said the main factors that have pushed the metal price up in recent years are still in place, while new supporting factors are emerging.

Most notably, the prospect of falling US interest rates could red alert demand, especially for precious metals-backed ETFs, as the opportunity cost of holding non-interest-bearing assets like gold will fall against short-term bonds, he said.

He also emphasized the difference between gold, silver and platinum and other assets: The precious metal is politically neutral, unlike government bonds or legal currencies. They are globally recognized as assets that store value, not associated with the credit reputation of any country. That is why central banks are increasingly allocating gold to core reserves.

The weak USD factor is also a big driver for precious metal prices, especially in USD. However, in other regions, the increase was somewhat more modest: investors in Switzerland and the Eurozone recorded an increase of only about 11%, while investors in China and India had a profit closer to the USD calculation.

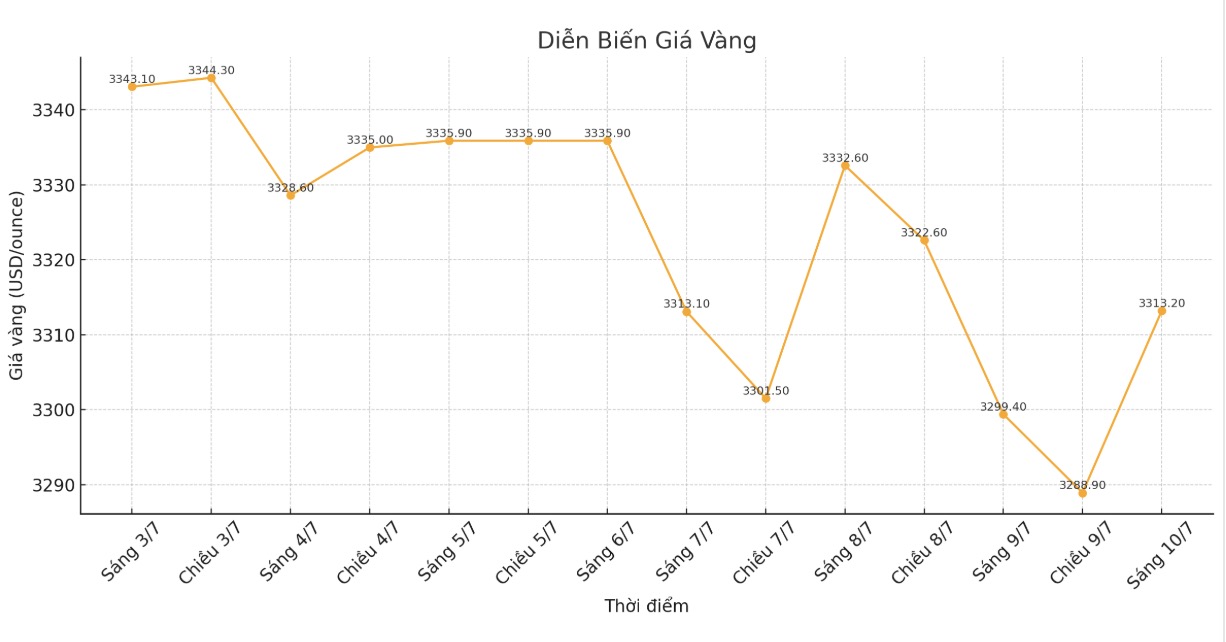

Technical charts show gold moving sideways in a narrow accumulation zone just below the record peak of $3,500/ounce in April. The lack of new supporting factors increases the risk of deeper adjustments, especially when there are signs that investors are starting to take profits. Gold has not been as strong as silver and platinum recently, nor has it been as sought as a safe haven asset in the Israel-Iran conflict, Hansen said.

However, strong US economic data has unexpectedly delayed expectations of interest rate cuts without causing gold to sell off - a sign that underlying strength still exists.

Looking to the second half of 2025, Hansen remains optimistic about gold and other precious metals. Supporting factors include: net buying demand from central banks, the risk of stagnant inflation in the US, geopolitical tensions, sanctions, trade conflicts, concerns about the US fiscal and the shift of national portfolios from US stocks and bonds to tangible assets such as precious metals. In addition, the weak USD trend is continuing.

Technically, gold is still accumulating, with the nearest support zone at $3,245/ounce and further support at $3,120/ounce. If gold breaks through the 200-day moving average of $2,945, the bullish scenario will be tested.

But since October 2023, gold has never fallen below this level, at that time the price was below 2,000 USD/ounce. Therefore, we consider this a temporary break, not an end to the uptrend - this expert said.