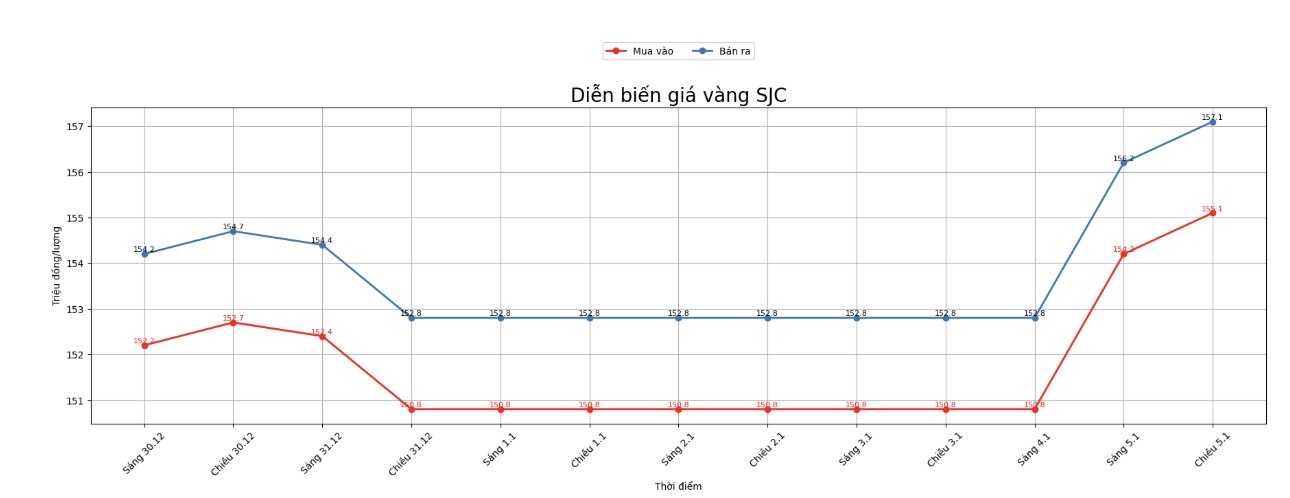

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 155.1-157.1 million VND/tael (buying - selling), an increase of 4.3 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 155.1-157.1 million VND/tael (buying - selling), an increase of 4.3 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 154.3-156.8 million VND/tael (buying - selling), an increase of 4 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

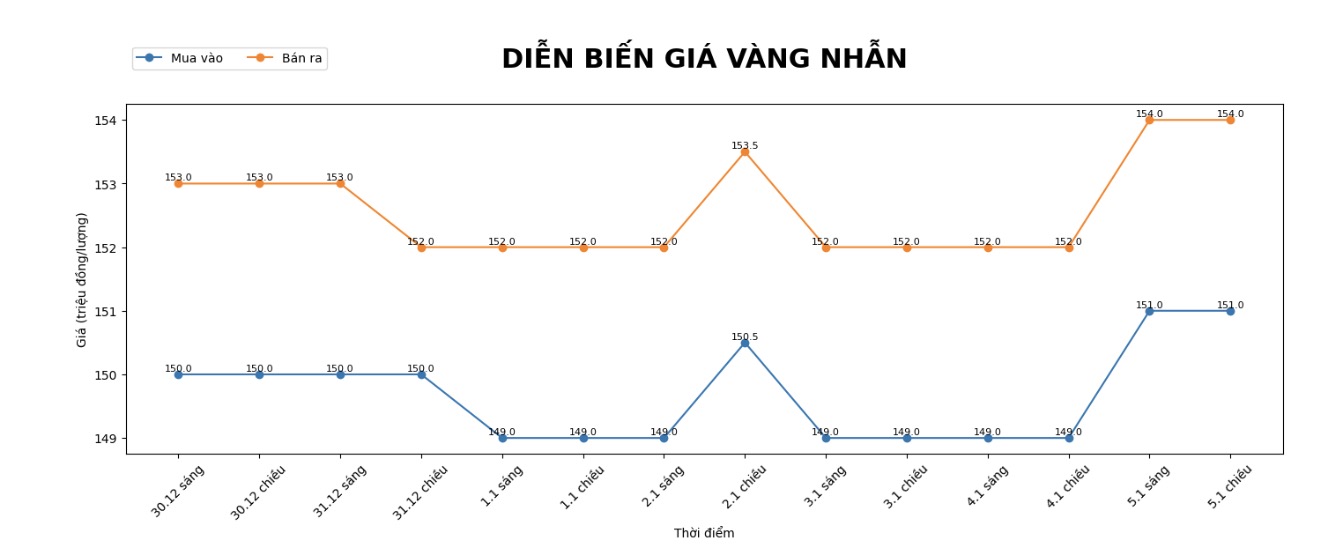

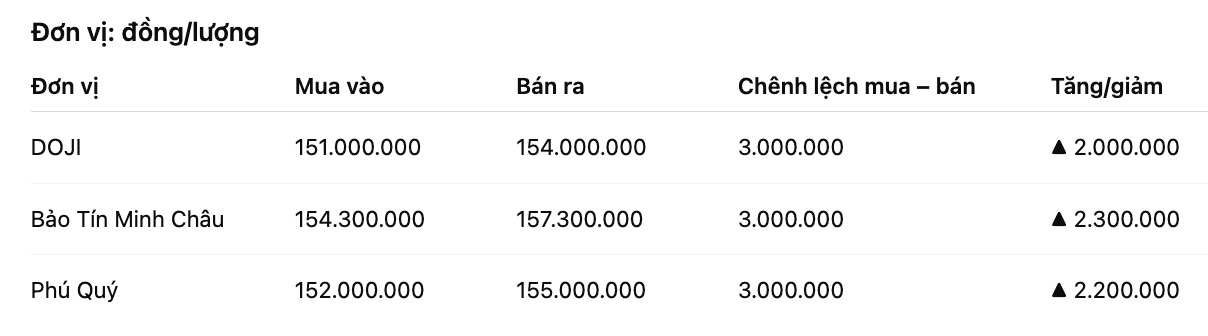

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of plain gold rings at the threshold of 151-154 million VND/tael (buying - selling), an increase of 2 million VND/tael in both buying and selling directions. The difference between buying and selling is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 154.3-157.3 million VND/tael (buying - selling), an increase of 2.3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 152-155 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

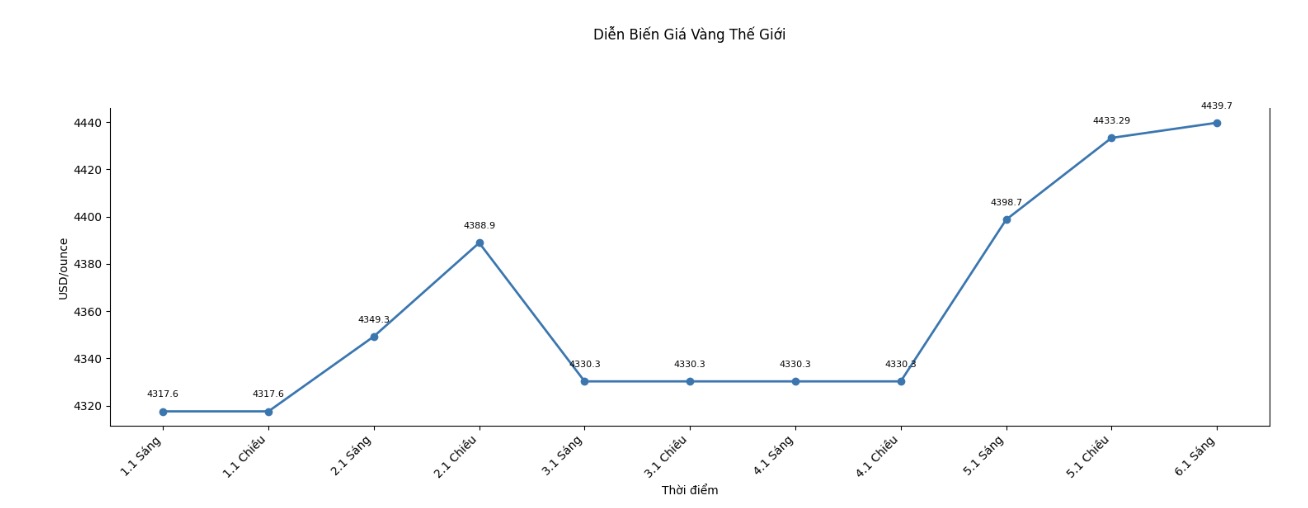

World gold price

World gold price listed at 6:00 am at 4,439.7 USD/ounce, up 109.4 USD.

Gold price forecast

Gold and silver prices rose sharply as investors' demand for safe havens increased in the face of unpredictable developments in the international market. Gold for February delivery rose 129.5 USD, to 4,459 USD/ounce. At the same time, silver for March delivery rose 5.975 USD, to 77.01 USD/ounce.

Although the global stock market and financial markets generally reacted quite stably, even some indices recorded record highs, and precious metal investors appeared more cautious.

Potential risk factors in the medium and long term, especially economic and geopolitical instability in the world, are making gold and silver continue to be prioritized as a value-preserving channel. Just part of the existing risks is enough to push cash flow to the precious metal, even if other markets still maintain positive trends.

Besides external factors, traders are focusing on following the week of announcing a series of important US economic data, information that could impact the monetary policy orientation of the US Federal Reserve (FED).

The focus is the US December jobs report, expected to be released later this week, along with data on labor markets, manufacturing activities and consumer confidence.

Technically, the upward trend of February gold futures is still dominant as buyers are heading towards the possibility that the closing price will surpass the strong resistance level at a record peak of 4,584 USD/ounce. In the opposite direction, if selling pressure increases, the price may retreat to check the important support zone around 4,200 USD/ounce.

In the short term, the price levels to be monitored are the area around 4,467.6 USD/ounce and 4,500 USD/ounce above, while the near support zone is around 4,400 USD/ounce and the low overnight level is 4,354.6 USD/ounce.

For silver for March delivery, the upward trend is also dominant as the market is heading towards the possibility that the price will surpass the strong resistance zone at a record high of 82.67 USD/ounce. In case of correction, the noteworthy support zone is around the bottom of the previous week at 69.225 USD/ounce.

In the immediate future, the market will monitor price levels around 77.205 USD and 78 USD/ounce above, while the nearest support is around 72.05 USD and 71 USD/ounce.

On related markets, the USD index decreased slightly, while crude oil prices increased and traded around 58.25 USD/barrel. The yield of US 10-year government bonds is currently at 4.17%.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...