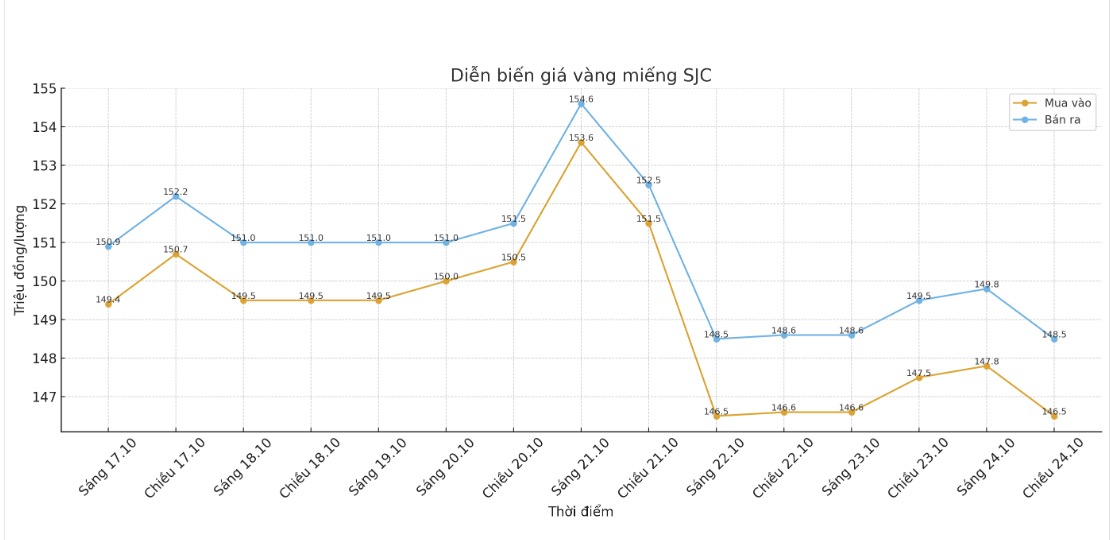

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 146.5-148.5 million VND/tael (buy in - sell out), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.8-148.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and a decrease of 700,000 VND/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146-148.5 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

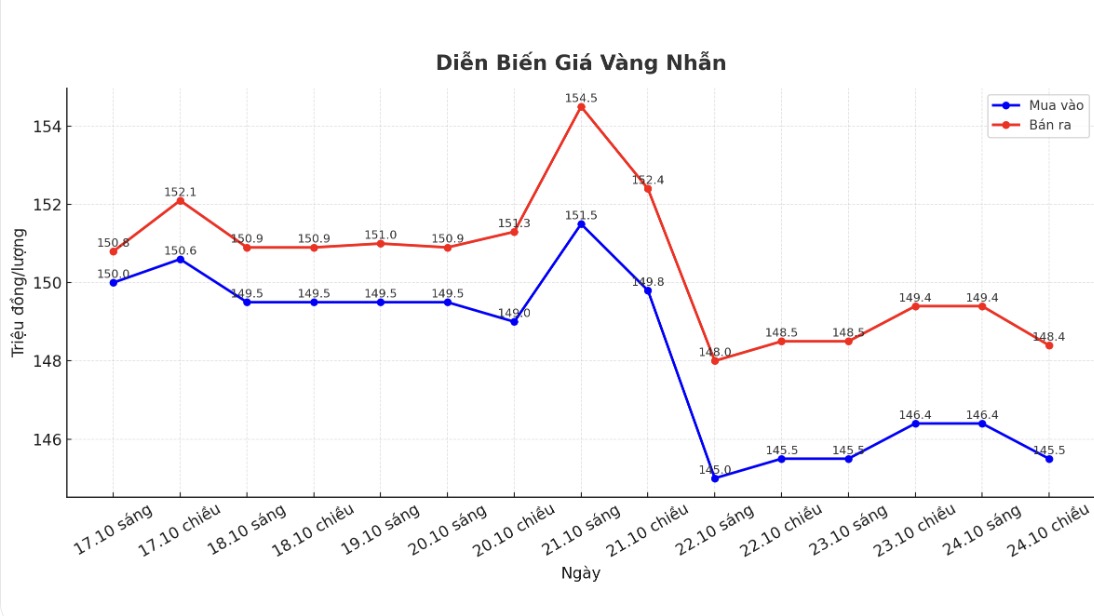

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 145.5-148.4 million VND/tael (buy - sell), down 900,000 VND/tael for buying and down 1 million VND/tael for selling. The difference between buying and selling is 2.9 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150-153 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.5-148.5 million VND/tael (buy - sell), down 1 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

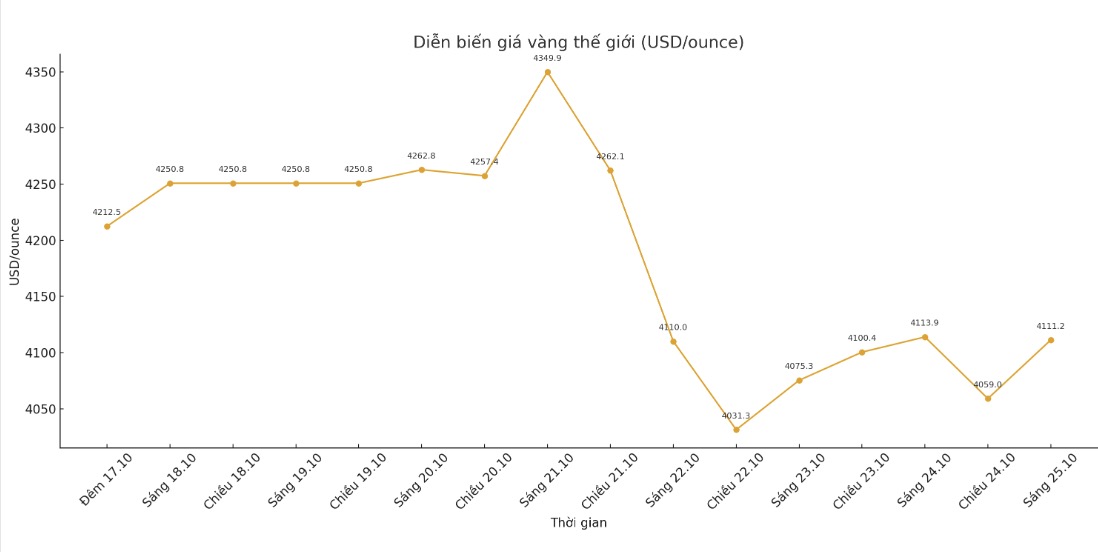

World gold price

Recorded at 5:30 a.m., the world spot gold price was listed at 4,111.2 USD/ounce.

Gold price forecast

Gold prices recovered slightly before the end of the week after the report showed weak US consumer confidence, while long-term inflation expectations continued to increase.

According to the University of Michigan, the consumer confidence index ended October with 53.6 points, down from the 55-point forecast and down from 55.1 points in September.

Slight improvement in young consumers has been offset by the decline in middle-aged and older consumers, said Joanne Hsu, director of the consumer survey. Current personal finances are inching up, while expectations for future finances are decreasing. Consumers generally do not feel much change in the economy compared to last month; inflation and high prices are still the main concerns.

Component data shows a mixed picture: short-term inflation expectations decrease but long-term expectations increase.

Year-on-year inflation expectations fell from 4.7% to 4.6%. The report said that this level is currently between the record area a year ago and the peak set in May after announcements of increased import tariffs. Meanwhile, long-term inflation expectations rose from 3.7% to 3.9%, but still below the years peak recorded in April.

The driving force for long-term inflation expectations is largely independent voters and Republicans, Hsu wrote. She added that the level of inflation uncertainty increased slightly in both short and long terms.

Mr. Eric Teal - Investment Director of Comerica Wealth Management - commented that consumers are concerned about the scenario of inflation, as high unemployment expectations and inflation show signs of accelerating again.

The asset effect helps high-income groups benefit, but low-income groups spending is still stifled by high credit card interest rates and rising prices, he said. Intrend rate cuts and tax incentives expected in the coming time could help confidence improve in the coming months.

In another development, JP Morgan maintains an optimistic view on gold, predicting that prices could average $5,055/ounce in the fourth quarter of 2026, thanks to strong investment and buying demand from central banks.

The bank said that the US Federal Reserve's (FED) interest rate cut cycle, concerns about inflation and the trend of diversifying assets away from the USD will continue to support gold prices. JP Morgan also saw the recent correction as healthy and kept its long-term target of $6,000/ounce unchanged by 2028.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...