Updated SJC gold price

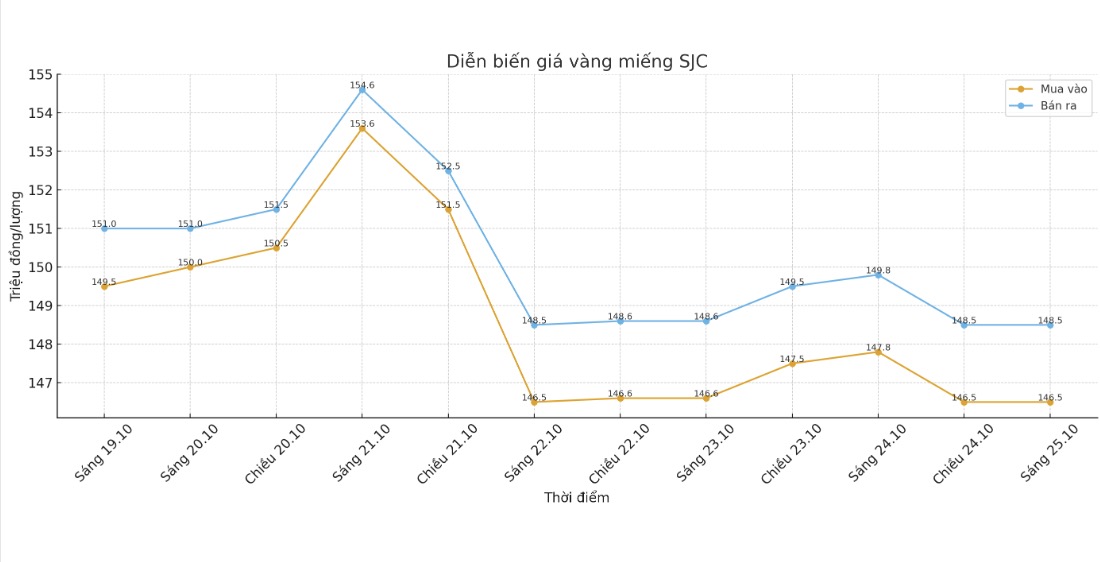

As of 2025, the price of SJC gold bars was listed by DOJI Group at 146.5-148.5 million VND/tael (buy in - sell out), down 1.3 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.8-148.8 million VND/tael (buy in - sell out), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 146.79.2 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

9999 round gold ring price

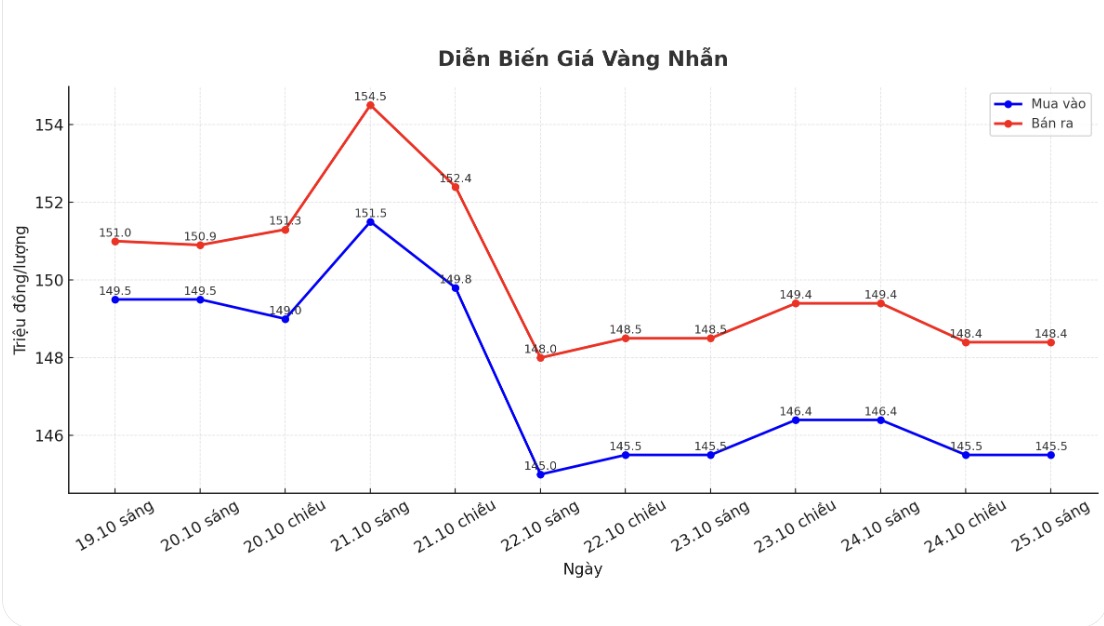

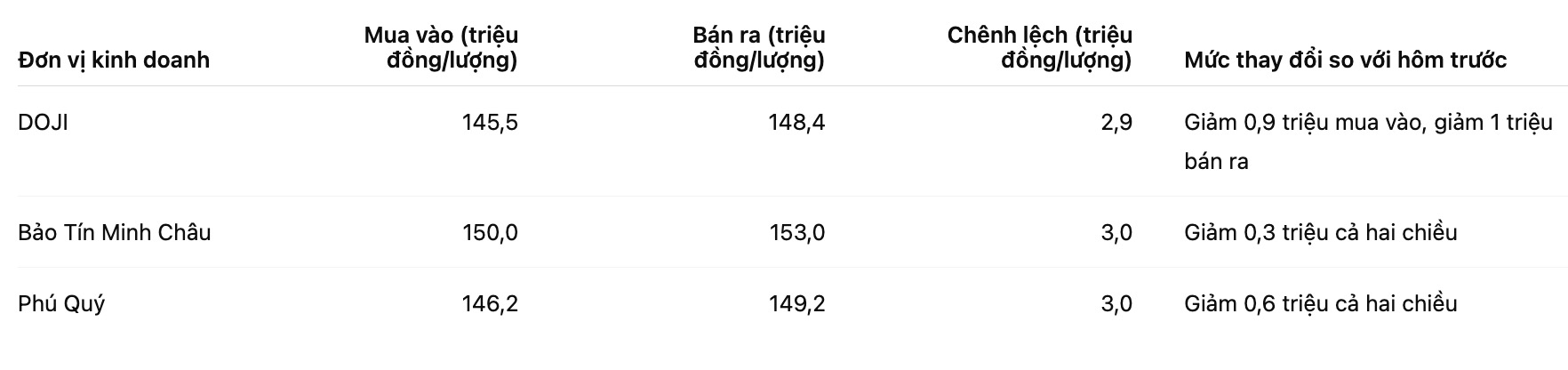

As of 2025, DOJI Group listed the price of gold rings at 145.5-148.4 million VND/tael (buy - sell), down 900,000 VND/tael for buying and down 1 million VND/tael for selling. The difference between buying and selling is 2.9 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150-153 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146.2-149.2 million VND/tael (buy in - sell out), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

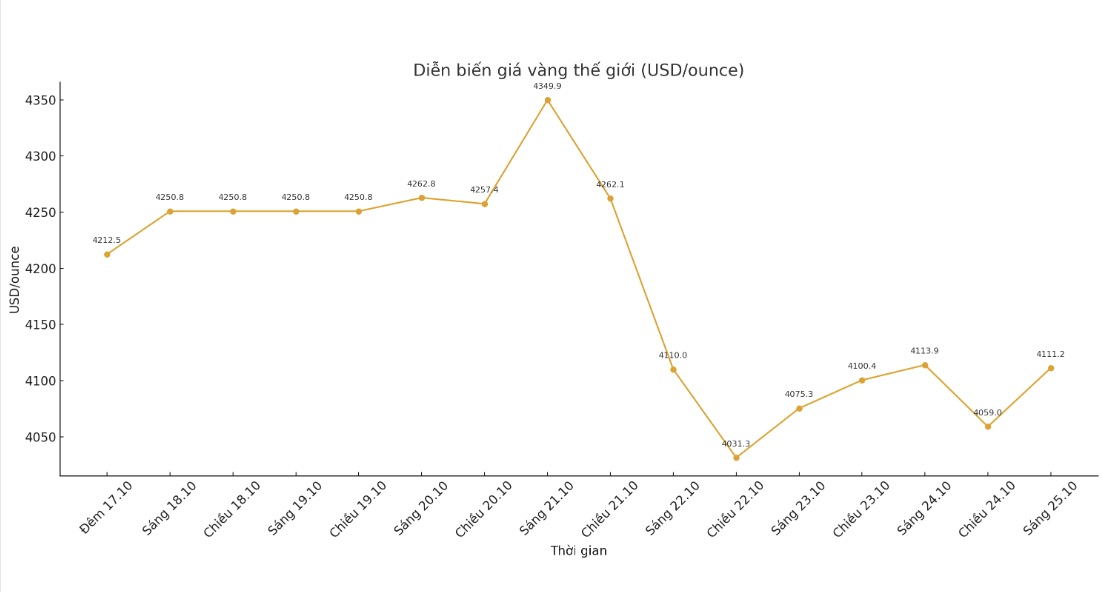

At 9:00 a.m., the world gold price was listed around 4,111.2 USD/ounce, down 2.7 USD.

Gold price forecast

World gold prices have not been able to maintain a 10-week consecutive increase streak. According to Neils Christensen - an analyst at Kitco News, in recent weeks, gold prices have increased mainly due to the "mental" mentality when many investors have been buying heavily for fear of missing out on opportunities.

The flow of money into gold ETFs continues to set records, and small-scale gold contract trading on CME exchanges also increased strongly, showing that small investors are the driving force for the recent increase of 1,000 USD. However, such a speculative rally is often unsustainable.

"Looking ahead, the market is forecast to continue to fluctuate strongly. However, many opinions say that even at $4,000/ounce, gold is still cheap compared to US stocks when the S&P 500 continuously sets new peaks.

Analysts assess that the declines will continue to create buying opportunities, especially when the upward trend that has lasted for the past three years has not been broken. This week's correction is only in the group of 5 strongest declines since the beginning of the year and is still lower than the decline in May. The large volatility makes it difficult for the market to trade, but gold investors still have reason to be optimistic," said Neils Christensen.

Morgan Stanley (an American multinational investment bank and financial services company) commented that the gold market is preparing to enter a new "fingerboard", in which the decisive factor will be the interest rate cut by the Federal Reserve (FED).

When the USD weakens and interest rates fall, gold often benefits - however, Morgan Stanley warns that there are currently many uncertainties such as geopolitical risks, monetary policy and supply that can disrupt the path of gold.

In a favorable scenario, the bank expects gold prices to reach around $3,800/ounce by the end of the year. Conversely, if the USD is not weak or the FED cuts interest rates less than expected, gold could face a strong correction.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...