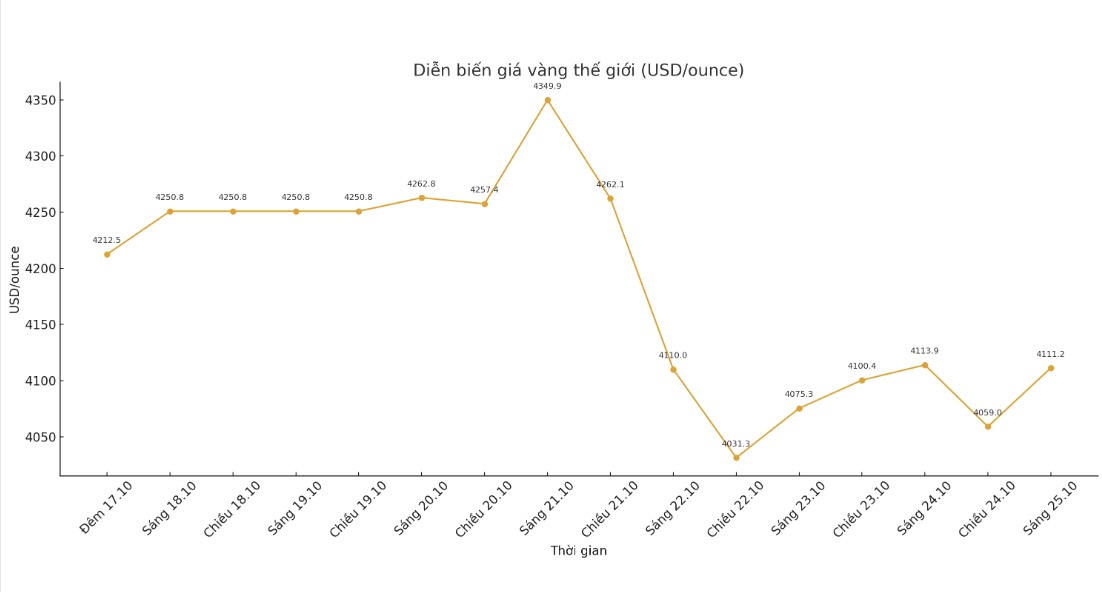

Gold prices have never had a streak of increases for 10 consecutive weeks and that record has not been broken as the market could not recover after a huge sell-off on Tuesday. Gold prices fell more than 5%, the sharpest decline in 5 years.

Despite maintaining an important support level of $4,000/ounce, gold prices are heading for a week of about 3% decline, with spot gold currently trading around $4,111.2/ounce.

In the context of great fluctuations, many experts said that it is difficult to believe that the market has hit rock bottom and needs more time to self-balance.

However, even as gold continues to make technical adjustments more deeply, the important question is: What has changed fundamentally in the market?

According to Neils Christensen - an analyst at Kitco News, in recent weeks, gold prices have increased mainly due to the "mental" mentality when many investors have been buying heavily for fear of missing out on opportunities.

The flow of money into gold ETFs continues to set records, and small-scale gold contract trading on CME exchanges also increased strongly, showing that small investors are the driving force for the recent increase of 1,000 USD. However, such a speculative rally is often unsustainable.

If we look beyond short-term fluctuations, before prices rose sharply, gold recorded its strongest annual increase since 1979. That is not a coincidence - the core value of gold is consolidating and will not change soon.

Just an example: This week, US public debt has exceeded $38 trillion. Not only setting a new record, this is also the fastest increase in the trillion-dollar period outside the COVID-19 pandemic. In August, this figure was only at 37 trillion USD. Some experts note that the debt growth rate has now doubled compared to 2000.

This situation is further aggravated by the continued US government's closure, affecting economic activity.

In fact, increased public debt will put pressure on growth and push inflation higher. Many investors realize that gold is still a rare asset that preserves purchasing power in this environment.

Not only the US, global public debt is also climbing beyond its ability to bear, and that is the reason why gold has topped all major currencies this year.

Looking ahead, the market is forecast to continue to fluctuate strongly. However, many opinions say that even at $4,000/ounce, gold is still cheap compared to US stocks when the S&P 500 continuously sets new peaks.

Analysts assess that the declines will continue to create buying opportunities, especially when the upward trend that has lasted for the past three years has not been broken. This week's correction is only in the group of 5 strongest declines since the beginning of the year and is still lower than the decline in May. The large fluctuations make it difficult for the market to trade, but gold investors still have reason to be optimistic.

See more news related to gold prices HERE...