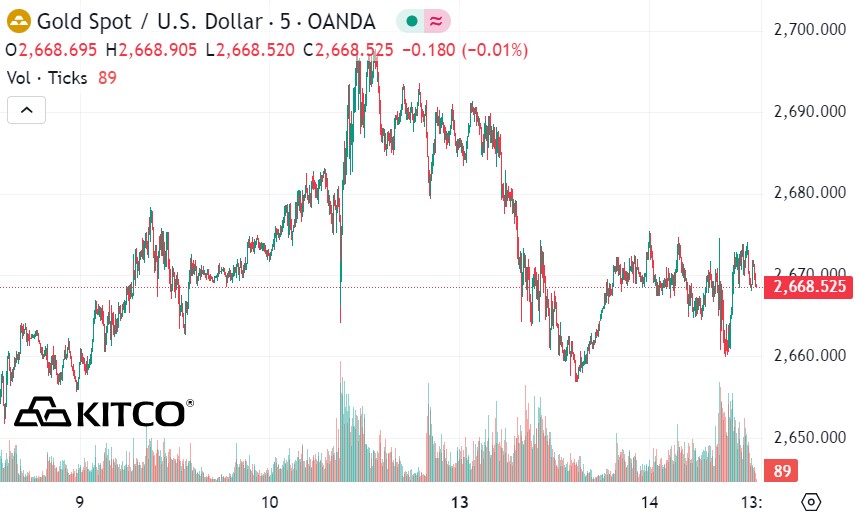

Gold prices under pressure on Middle East peace prospects

The possibility of a ceasefire in the Israel-Hamas conflict could send gold and silver prices lower, according to David Scutt, a market analyst at City Index. The two precious metals have already been weakened by the strength of the US dollar and high bond yields.

“Gold prices have been falling since the start of the week. A strong US dollar, rising bond yields, and renewed hopes for a Middle East peace deal may have contributed to the sharp decline. Short-term positioning imbalances after a strong start to the year may have amplified the reversal,” he said.

In another development, Neils Christensen - analyst at Kitco News, said the gold market is having difficulty determining a clear trend ahead of US inflation data.

The headline producer price index (PPI) rose 0.2% in December, following a 0.4% increase in November, the U.S. Labor Department said on Tuesday. The latest inflation data was slightly below expectations, with economists forecasting a 0.4% increase.

Over the past 12 months, headline wholesale inflation rose 3.3%, below the forecast of 3.4%. However, the report also pointed out that this increase was much more significant than the 1.1% increase in 2023.

"Some economists believe that the weaker PPI data in December was not enough to reinforce expectations for additional monetary easing from the US Federal Reserve (FED). Therefore, this data could put pressure on gold prices in the short term, especially as the market adjusts to the Fed's changing monetary policy stance," said Neils Christensen.

Gold is still in an uptrend

While gold has been hit by a stronger US dollar and rising Treasury yields, Scutt said the precious metal is off to a strong start in 2025: “History shows that these conditions are typically unfavorable for non-yielding assets like gold and silver.

However, concerns about US inflation may explain gold's resilience, with a correlation between gold, US 10-year inflation expectations and the nearest month WTI crude oil futures contract over the past two weeks."

Although Monday’s sell-off ended gold’s rally, Scutt said the technical outlook for gold remains positive. “Gold remains in an established uptrend and continues to trade above its 50-day moving average – a key level that has been respected in recent years.

“The RSI (14) and MACD indicators (two popular technical indicators used in financial analysis and trading to assess price trends and momentum - PV) are both sending bullish signals, making it more reasonable to buy when prices fall than sell when prices rise,” he said.

The $2,676.50 level last Friday failed to hold but remains a key level, while $2,698 and $2,725 are potential next targets if prices rebound. If gold falls below the 50-day moving average, investors will need to monitor the price reaction to the uptrend since November to assess trading opportunities.

See more news related to gold prices HERE...