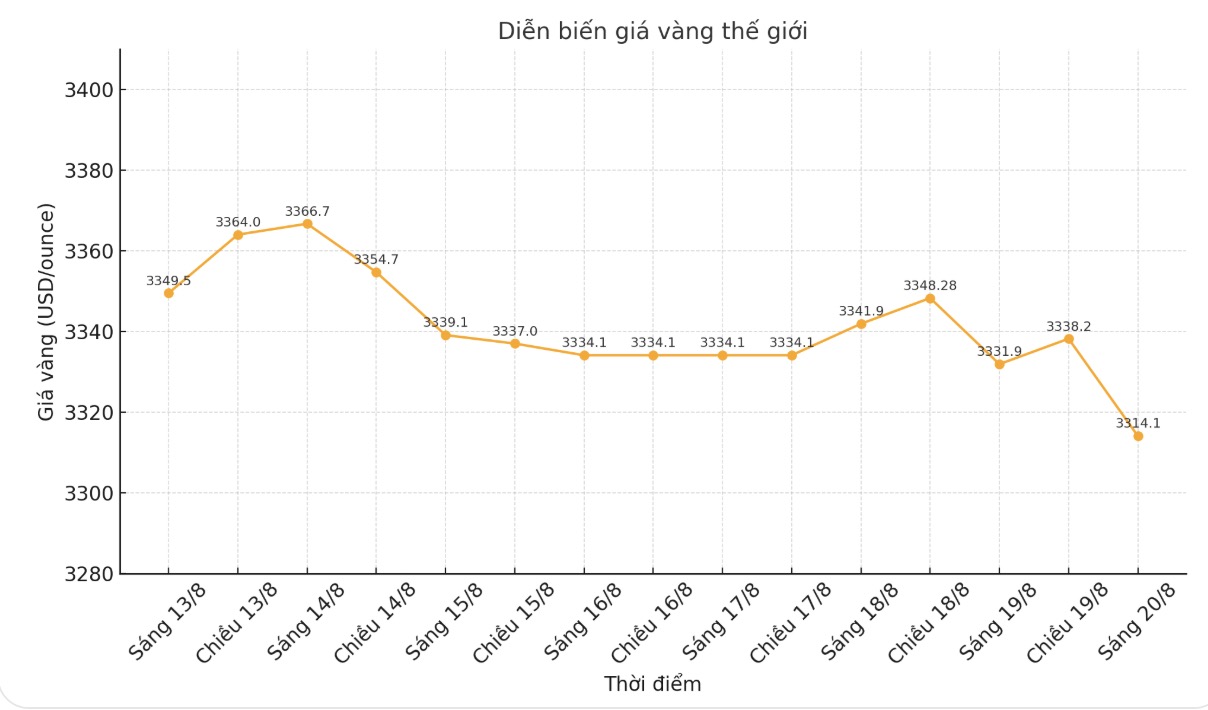

Today (8.20), the prices of precious metals and stocks both fell sharply. Gold futures fell below an important threshold, marking the biggest decline in many weeks. In the stock market, technology stocks decreased the most, dragging the whole market down.

Gold futures remained relatively stable throughout the Asia and Europe sessions, almost unchanged from Monday's closing price. However, when the New York market opened at 8:30 a.m. ( ET), the picture changed completely. Gold quickly broke through the key support level of $3,375/ounce, opening up a continuous decline that lasted for many hours afterwards.

By the end of the session, gold hit a low of $3,358.9/ounce, losing $24.6 (equivalent to 0.73%) in just a few short hours. This is also the lowest level since August 1, signaling the possibility that the recent accumulation model may have been broken.

The stock market also developed similarly, especially in the technology group. The Nasdaq composite index fell 1.32%, closing at 23,408 points after losing more than 300 points. This is the lowest level since August 7 and the day's decrease is even greater than the total decrease of the previous four consecutive sessions, showing that selling pressure has increased sharply.

Technically, gold futures have broken through the 100-day moving average (100-day SMA) - a sign that often suggests a reversal.

However, spot gold remains above the 100-day SMA - a level that has been maintained since January 6. This development needs to be closely monitored, because if gold breaks through to support $3,309, technical selling pressure could increase even more strongly.

The silver market also followed the trend, falling by 0.69 USD (1.83%) to 37.33 USD/ounce, approaching the historical support level of 37.37 USD. Notably, silver has broken the 50-day moving average for the first time since May 28.

Over the past 57 days, silver has gained an additional $3.9 11,67% on the threshold, so the loss of the important technical mark has particular concern for traders. If the decline continues, the next support levels will be around $36 and $35.5 (13-day SMA).

The parallel decline in both precious metals and technology stocks shows that risk-off sentiment is rising, as investors adjust their positions in the face of important economic data and policy orientation of the US Federal Reserve (FED).

The sell-off of gold - often seen as a safe haven asset - further highlights concerns about economic prospects and inflation. The obvious reason is cautious sentiment ahead of the Fed's Jackson Hole Annual Conference, which will open tomorrow, where investors are eagerly awaiting signals about future interest rate orientation.

See more news related to gold prices HERE...