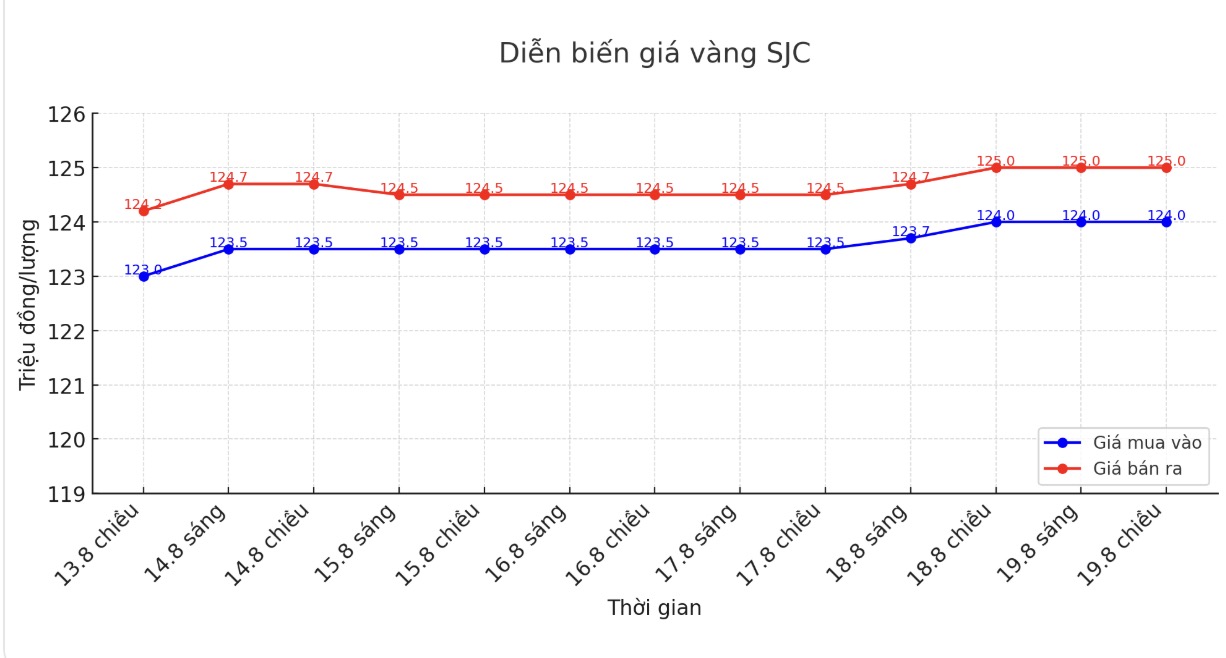

SJC gold bar price

As of 5:00 p.m., the price of SJC gold bars was listed by DOJI Group at 124-125 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 124-125 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 123-125 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

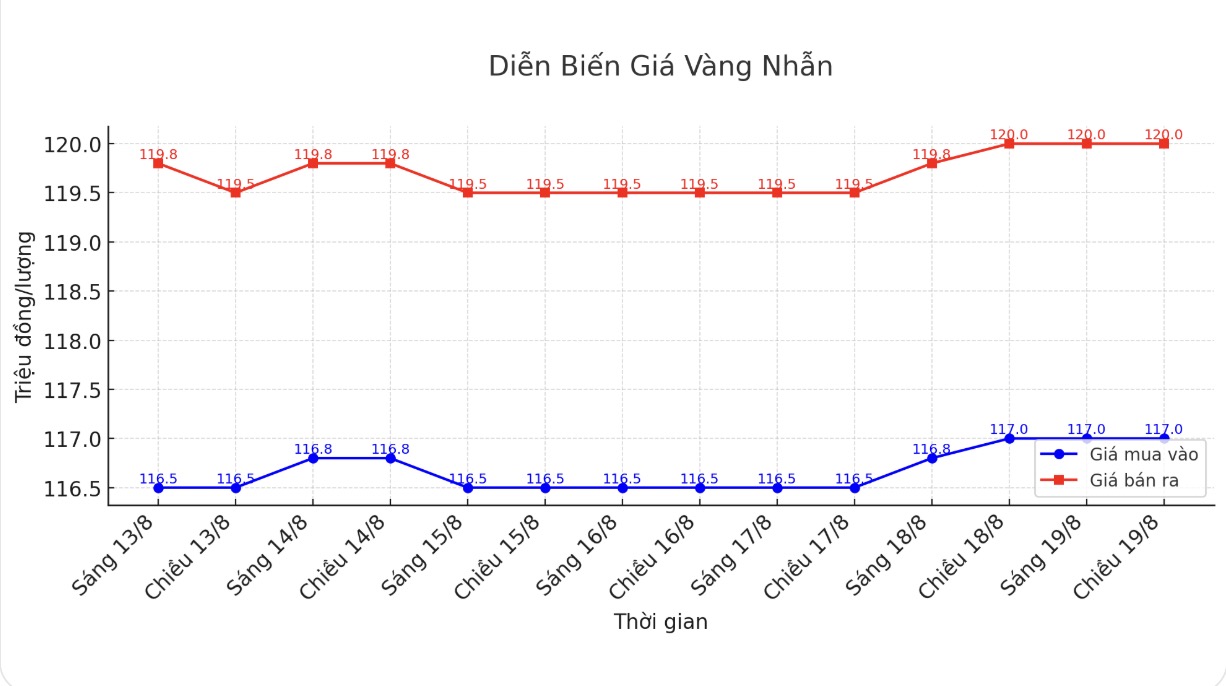

9999 gold ring price

As of 5:00 p.m., DOJI Group listed the price of gold rings at 117-120 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-119 7.7 million VND/tael (buy - sell), down 100,000 VND/tael in both directions compared to a day ago. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

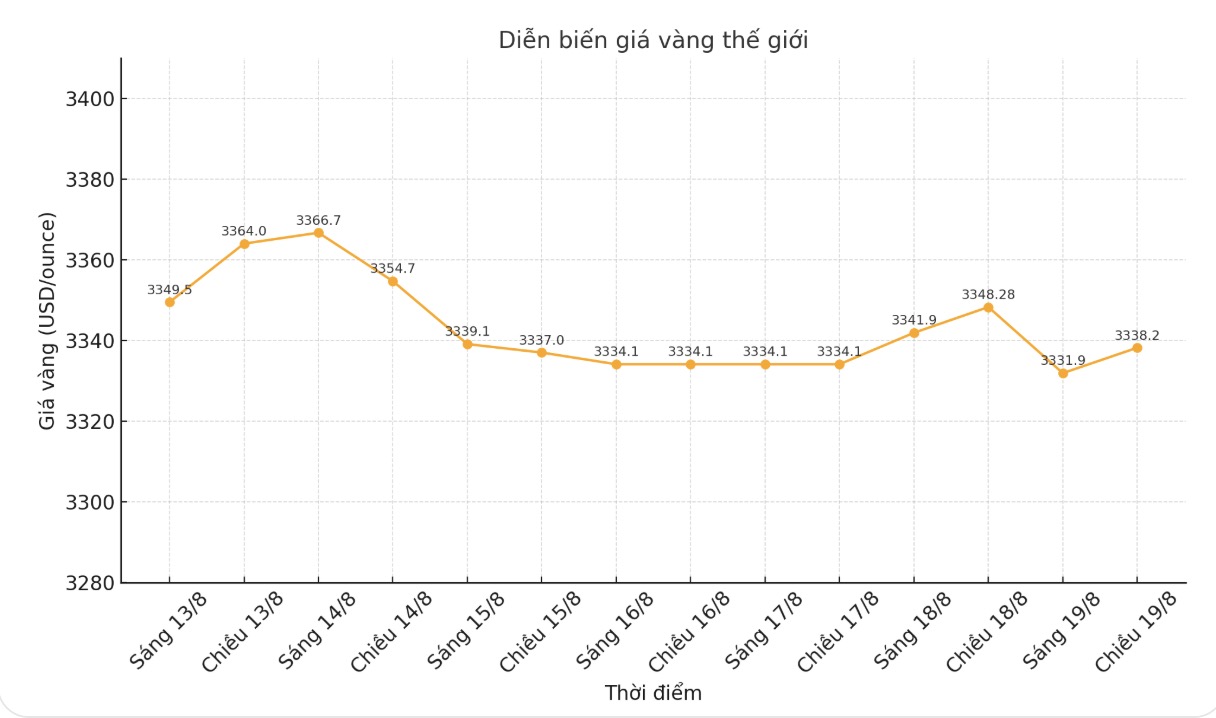

World gold price

The world gold price was listed at 5:18 p.m. at 3,338.2 USD/ounce, down 10.5 USD compared to a day ago.

Gold price forecast

World gold prices are struggling in the third session as investors await the FED's Jackson Hole conference taking place this weekend to find clues about the possibility of interest rate cuts, while considering Washington's efforts to end the war in Ukraine.

Fed Chairman Jerome Powell's speech at the Jackson Hole conference on August 21 to 23 could provide more clarity on the central bank's economic outlook and policy orientation.

Gold is still in the accumulation phase and is really waiting for a new driver to break out. I think the big event to watch is Jackson Hole and whether the Fed will give a signal of easing or not, said Kyle Rodda, a financial market analyst at Capital.com.

According to the CME FedWatch tool, the market currently rates an 84% chance that the FED will cut interest rates by 25 basis points at the next meeting. Gold often benefits in a low interest rate environment and when uncertainty increases.

The minutes of the Fed's July meeting, due out on Wednesday, will also provide further policy clues.

Rhona OConnell - Head of EMEA & Asia Market Analysis at StoneX has just raised the annual gold price forecast to $3,115/ounce, up 1% from the previous estimate of $3,078/ounce.

OConnell noted that gold prices have only fluctuated within a 2% range over the past week and around 8% over the past three months.

In the third quarter, she forecasts gold will average around $3,320/ounce. However, in the last three months of the year, the average could be around $3,000/ounce.

Ms. O'Connell said that gold prices are unlikely to hit a new peak. She explained: unless there is a serious surprise event (such as "Black Rift" or a humanitarian crisis), the highest price ever reached 3,500.1 USD/ounce on the morning of April 22 in London is at its peak.

She added the reason: the level of gold price's reaction to the FED's decisions is getting weaker, which shows that the market is saturated and unlikely to have a strong breakthrough.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...