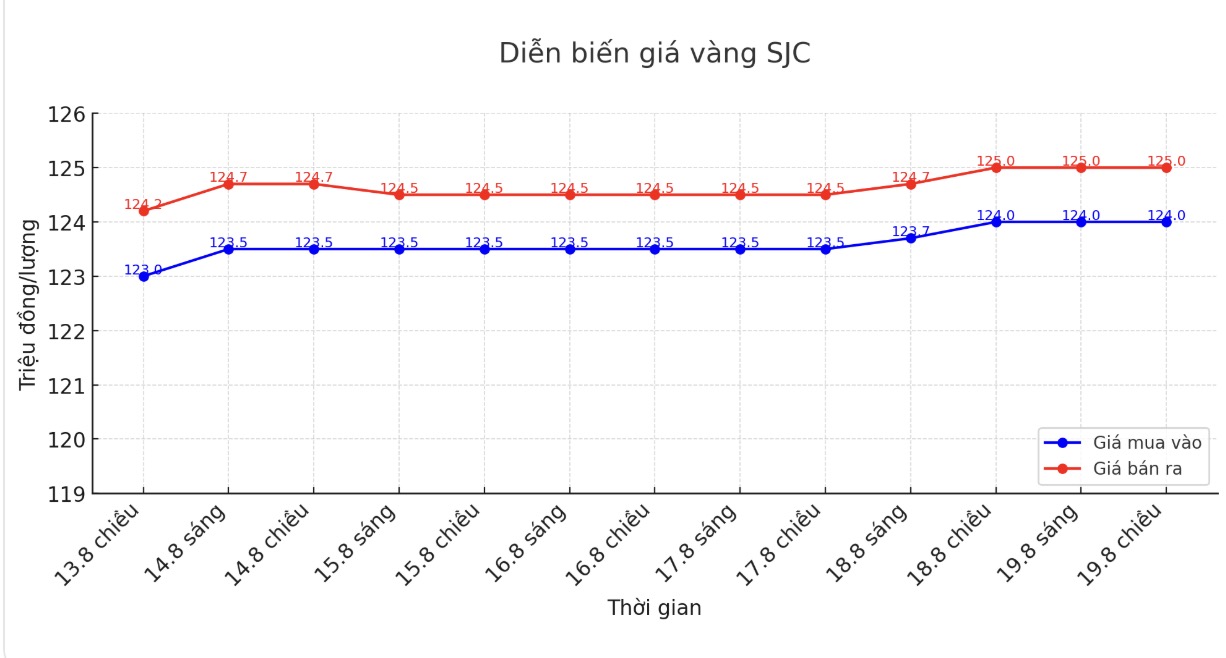

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 124-125 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 124-125 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 123-125 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

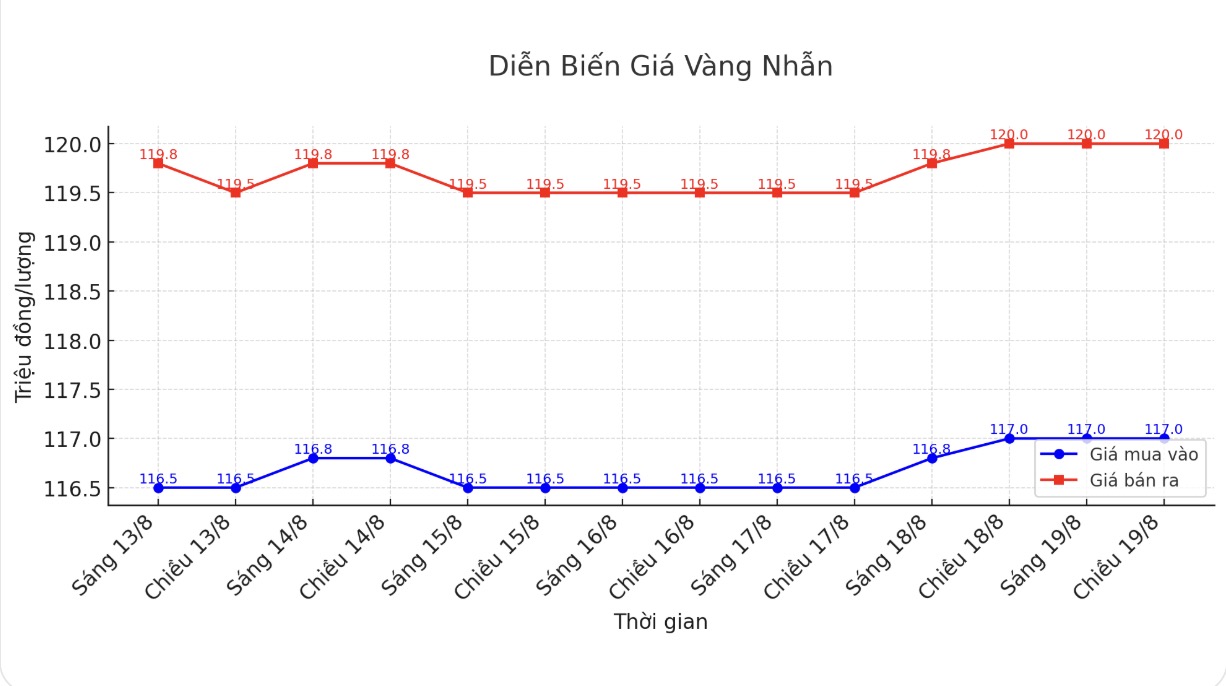

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 117-120 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-119 7.7 million VND/tael (buy - sell), down 100,000 VND/tael in both directions compared to a day ago. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

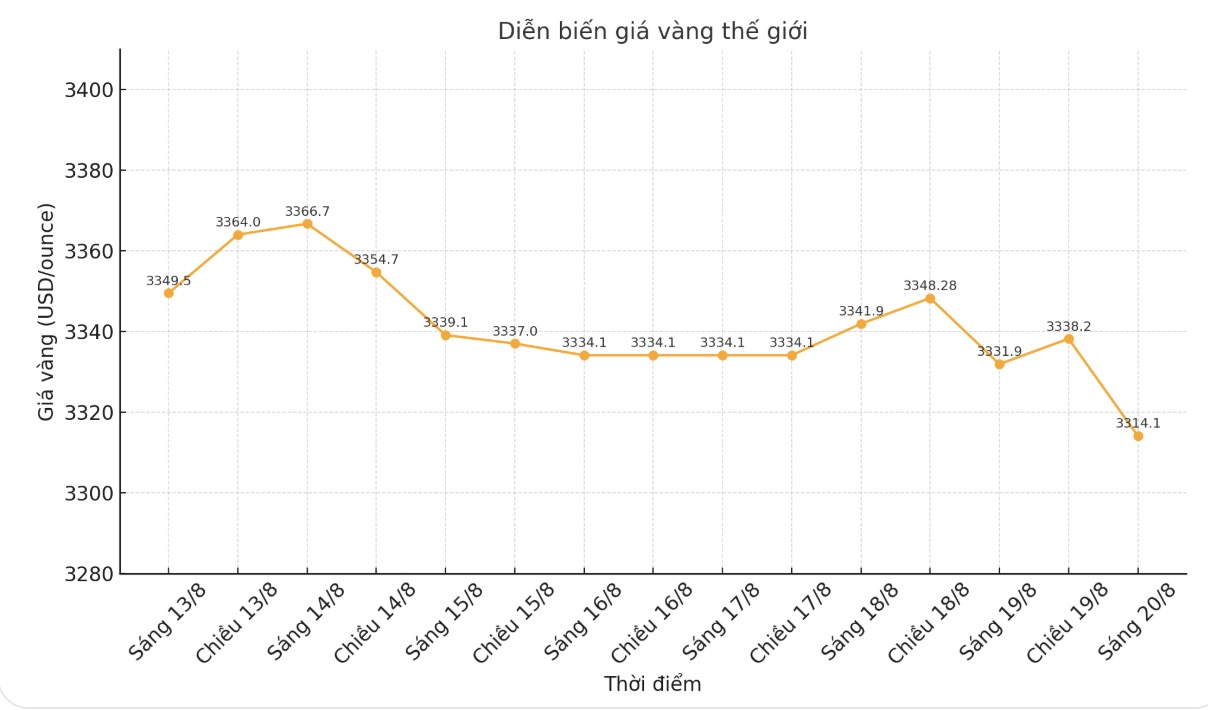

World gold price

The world gold price was listed at 6:45 at 3,314.1 USD/ounce, down 17.9 USD.

Gold price forecast

World gold prices have fallen to a two-week low. Selling pressure according to technical analysis from short-term futures traders appeared on both gold and silver.

Investors are also taking the opportunity to adjust their portfolios ahead of the Fed's big meeting in the western United States this weekend. At the end of the session, December gold contract decreased by 8.6 USD to 3,369.6 USD/ounce, while September silver lost 0.604 USD, down to 37.42 USD/ounce.

Traders and investors are awaiting the annual economic policy conference of the Federal Reserve, Kansas branch, starting on Thursday evening in Jackson Hole, Wyoming.

Federal Reserve Chairman Jerome Powell is expected to announce the new Fed policy framework on Friday. This speech could provide new information for the market on the level of support for rate cuts at the September session.

The global stock market had mixed movements last night. US stock indexes are expected to open slightly as the trading session in New York begins.

Technically, December gold futures still have a short-term advantage. The next target for buyers is to get the closing price above the solid resistance level of $3,500/ounce. On the contrary, the target for the sellers is to push prices below the important technical support level, which is the July bottom at 3,319.2 USD/ounce.

The first resistance level was at this week's highest level of 3,403.6 USD, followed by 3,423.8 USD/ounce. The first support was $3,350/ounce and then $3,319.2/ounce.

In outside markets, the USD index is almost flat, crude oil prices have decreased to around 62.75 USD/barrel. The yield on the 10-year US Treasury note is currently around 4.3%.

Notable US economic data this week

Wednesday: Minutes of the July FOMC meeting, Waller and Bostic speech, opening of the Jackson Hole Conference.

Thursday: Philadelphia Fed manufacturing index, weekly jobless claims, S&P Global comprehensive PMI in August, existing home sales in July.

Friday: FED Chairman Jerome Powell speaks at Jackson Hole an event closely watched by global investors.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...