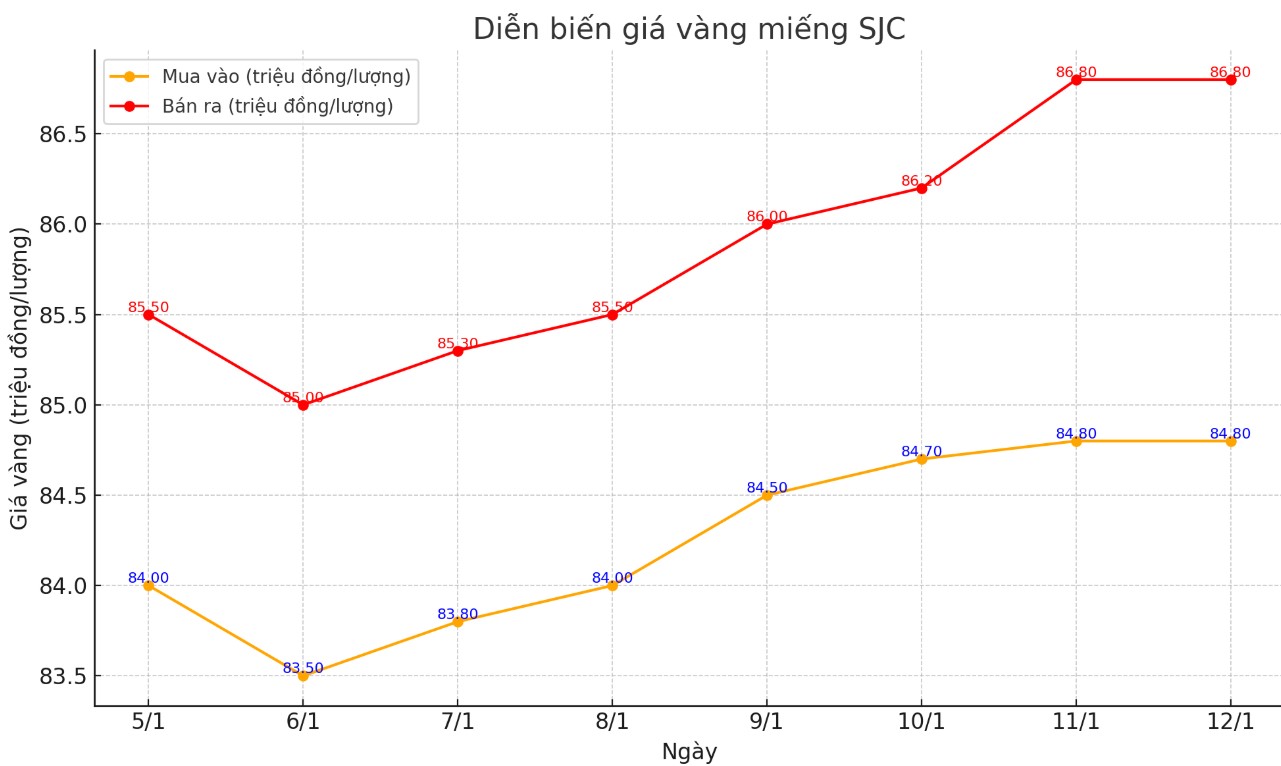

SJC gold bar price

At the end of the week's trading session, DOJI Group listed the price of SJC gold at 84.8-86.8 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at DOJI increased by VND800,000/tael for buying and VND1.3 million/tael for selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 1.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 84.8-86.8 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at Saigon Jewelry Company increased by VND800,000/tael for buying and increased by VND1.3 million/tael for selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 1.5 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in session 5.1 and selling in today's session (January 12), investors will lose 700,000 VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 2 million VND/tael. Experts say this difference is very high, causing investors to face the risk of losing money when investing in the short term.

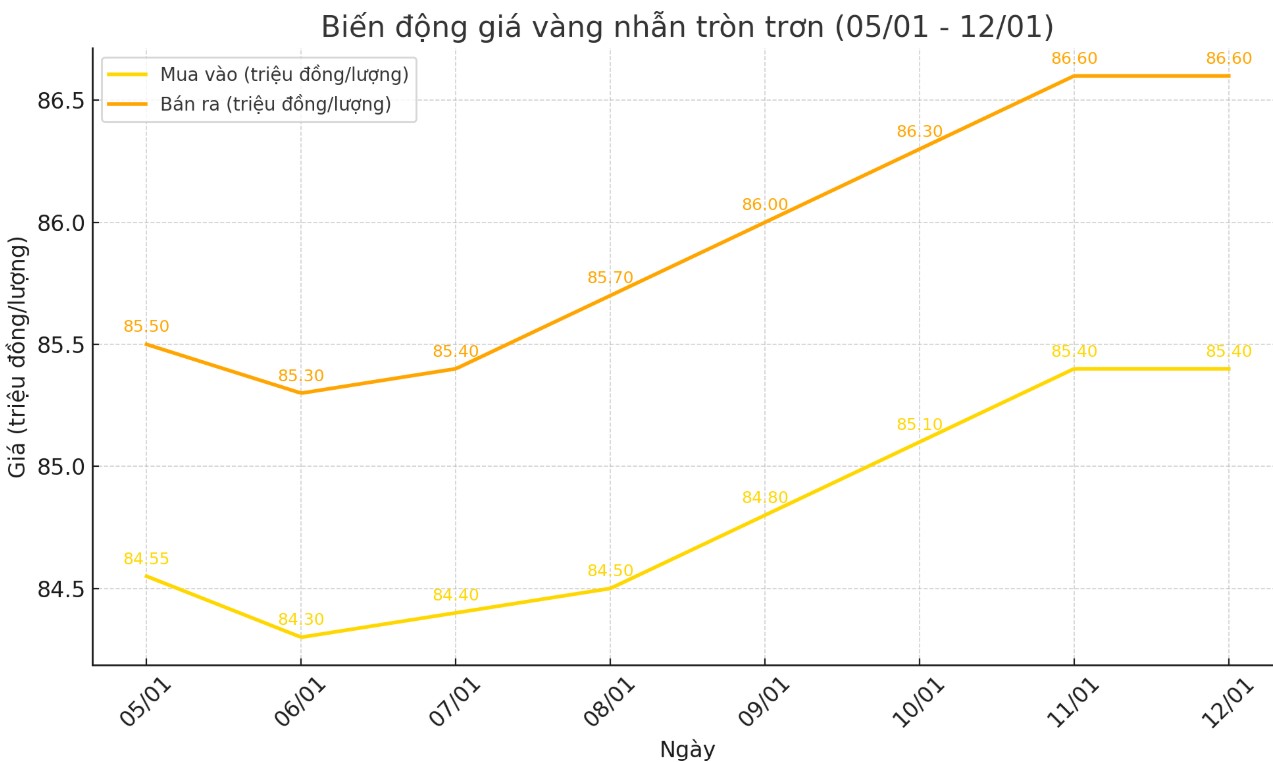

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold ring at DOJI was listed at 85.4-86.6 million VND/tael (buy - sell); an increase of 850,000 VND/tael for buying and an increase of 1.05 million VND/tael for selling compared to the closing price of last week's trading session.

Bao Tin Minh Chau listed the price of gold rings at 85.5-86.9 million VND/tael (buy - sell); an increase of 900,000 VND/tael for buying and 1.2 million VND/tael for selling compared to the closing price of last week's trading session.

If buying gold rings in session 5.1 and selling in today's session (12.1), the loss investors will have to accept when buying at DOJI and Bao Tin Minh Chau is 150,000 VND/tael and 200,000 VND/tael, respectively.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

At the close of the weekly trading session, the world gold price listed on Kitco was at 2,689.3 USD/ounce, up 49.6 USD/ounce compared to the close of the previous week's trading session.

Gold Price Forecast

World gold prices increased at the end of the week despite the increase in the USD index. Recorded at 7:00 a.m. on January 12, 2025, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 109,490 points (up 0.45%).

This past week, Kitco News collected opinions from 208 investors for the Kitco News Top Metals 2025 survey. The results showed that more than half of the participants predicted that gold would continue to outperform all other metals in 2025.

106 traders, or 51 percent, believe gold will lead the way this year. Meanwhile, 74 investors, or 36 percent, predict silver will be the best performing metal in 2025. 17, or 8 percent, say copper will be the best performer. The remaining 11, or 5 percent, believe platinum and palladium will outperform other metals this year.

Like investors, most Wall Street experts also have a bias towards gold. However, a large number of major banks and industry experts predict that silver could surpass gold by the end of the year.

Ole Hansen, head of commodity strategy at Saxo Bank, believes that silver could surpass gold in 2025.

“This year’s silver rally is fundamentally no different from previous rallies. Silver still mirrors gold’s moves, but with greater intensity. Often referred to as “power gold,” silver tends to move up and down more aggressively than its stable sibling,” Hansen said.

Hansen said silver will only reach a 12-year high in 2024, while gold continues to hit record highs. “With its dual role of balancing investment and industrial demand, silver could outperform gold next year,” he said.

See more news related to gold prices HERE...