Last week, the domestic gold market recorded a slight decrease, but many investors still suffered losses of up to more than 3 million VND per tael.

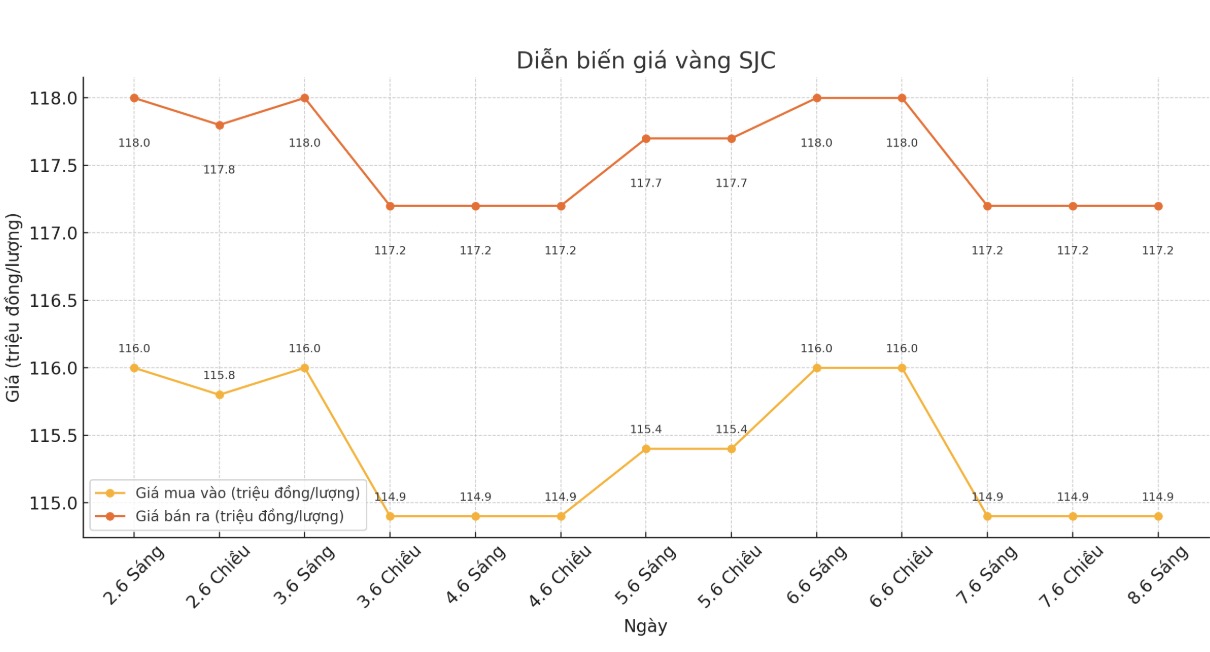

Recorded at some business units such as DOJI Group, Saigon Jewelry Company SJC or Bao Tin Minh Chau, as of the trading session on June 8, the price of SJC gold bars was listed at 114.9 million VND/tael for buying and 117.2 million VND/tael for selling.

Compared to last weekend, the buying price has decreased by 800,000 VND/tael, while the selling price has decreased by 1 million VND/tael. The difference between the two directions is 2.3 million VND/tael. With this volatility, if an investor buys gold last weekend and sells it this weekend, they could lose up to 3.3 million VND per tael.

Experts say that the main reason why buyers suffered heavy losses despite slight price reductions is because the difference between buying and selling prices is too high. Each time buying gold, investors immediately had to pay a difference of 2 to 3 million VND/tael. When the gold price decreased by 800,000 to 1 million VND/tael like last week, the total loss will be very high.

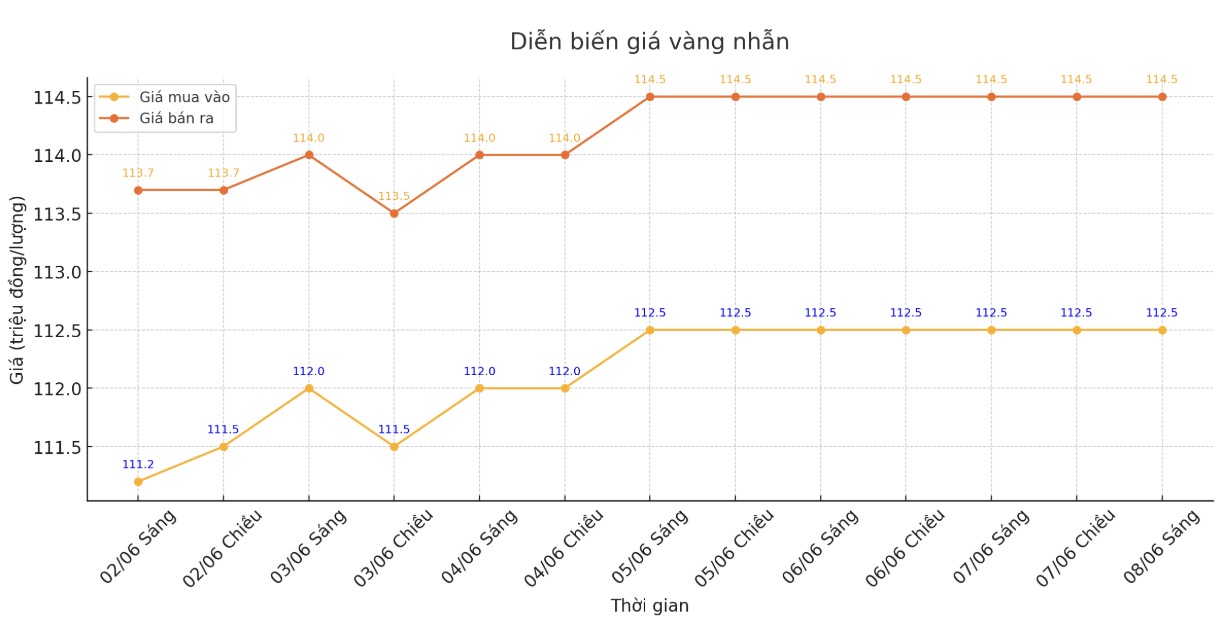

This reality does not only happen to gold bars but also to 9999 gold rings, which have been chosen by many people recently. In some enterprises, the price of gold rings has a difference between buying and selling ranging from 2 to 2.5 million VND/tael. This shows that price range is still a major barrier for investors who want to "surf" gold in the short term.

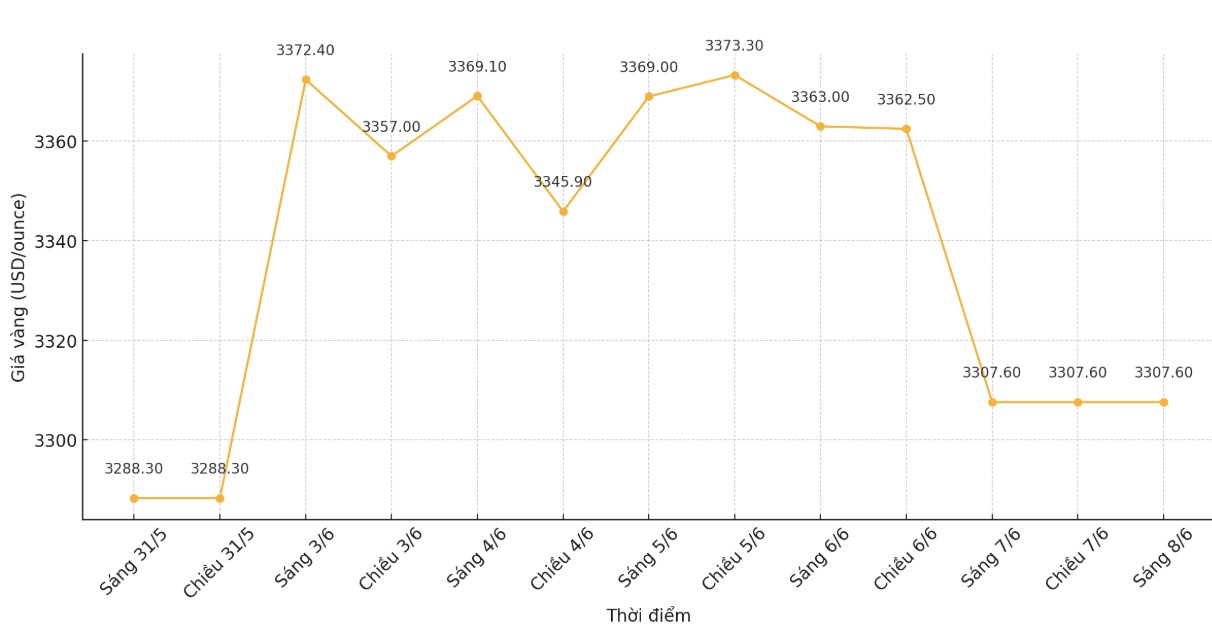

Domestic gold prices fell last week, despite the increase in world gold prices. After a week, the world gold market recorded an increase of 19.3 USD/ounce, up to 3,307.6 USD/ounce.

This mixed development partly shows that a series of measures to regulate the gold market implemented by authorities in the past have had an impact.

Following the direction of the Prime Minister and the inspection conclusion of the State Bank, the domestic gold market witnessed a strong adjustment. The promotion of gold bar auctions, tightening speculative activities, and requiring transparency in distribution are expected to narrow the gap between domestic and world gold prices. This is also the reason for the decline in domestic gold prices, even though international prices are rising.

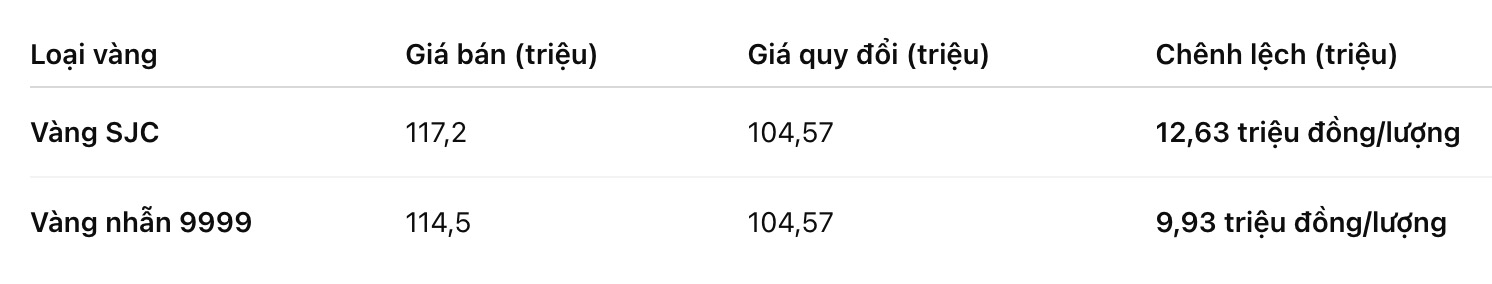

As of 2:00 p.m. on June 8, the difference between SJC gold bar prices and world gold prices decreased to around VND9.9-12.6 million/tael. Although still high, it has decreased a lot compared to the previous 15-18 million VND/tael.

Domestic gold prices last week decreased partly due to the influence of the world market. World gold prices last week did not create enough strong enough momentum to support domestic prices. On the contrary, the pressure from the stronger US dollar and the shift of cash flow to risky investment channels such as stocks makes it difficult for domestic gold to maintain its upward momentum.

Another factor affecting domestic gold prices is the reservations of people and small investors. After the price fever in April and early May, the market gradually stabilized again, liquidity decreased, and investment sentiment became more cautious. The fact that prices continuously fluctuate within a narrow range but the buy-sell gap does not decrease limits profitability, while risks still exist.

With the current developments, experts warn investors to be cautious when participating in gold surfing. Price fluctuations are not large enough to compensate for high transaction costs, especially in the context of a lack of supporting information in the market. Without careful calculation and a clear risk management strategy, investors can easily fall into the situation of "peak buying, bottom selling" as seen in the past week.

In the short term, the gold market will still be affected by external factors, especially US economic data such as the consumer price index (CPI) and the Fed's decision. These will be key factors shaping the global gold price trend and affecting the domestic market. When there are no clear signals from the international market, participating in domestic gold surfing is no different from a gamble, with a much higher probability of risk than a profit opportunity.