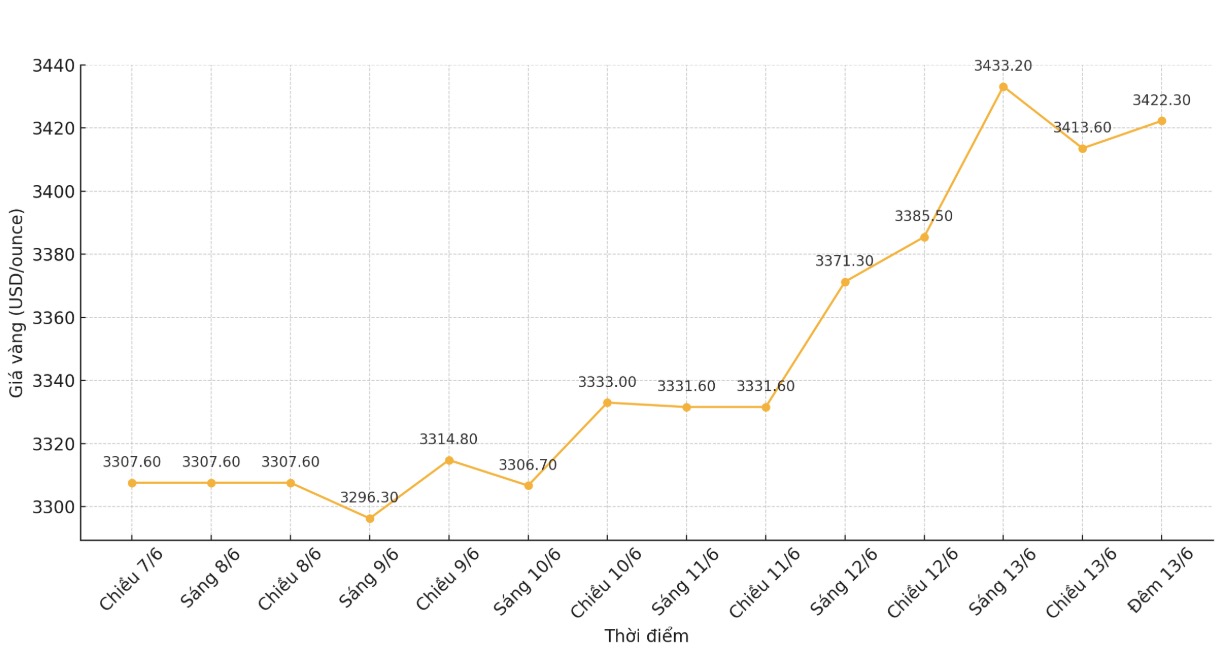

Gold prices have broken through the resistance level of $3,400/ounce but remained steady below their all-time high of $3,500/ounce in April. Looking at the long term, strategists predict that gold will continue to benefit from cyclical factors and price structure in the second half of 2025.

Roukaya Ibrahim - commodity strategist at BCA Research (an international financial research and analysis company), said that their model portfolio still maintains an outstanding position in precious metals, including silver and platinum. However, gold is still a major asset, as all three are strong.

While silver and platinum have quickly caught up with gold, Ibrahim noted that gold still holds a significant advantage in the precious metals space, as it has reaffirmed itself as an important monetary asset in the context of global efforts to diversify away from the US dollar and Treasury bonds.

Ibrahim explained that persistent inflation risks, due to unsustainable public debt, are helping to reduce the opportunity cost of gold as a non-yielding asset.

At the same time, she also pointed out that new geopolitical instability - due to US President Donald Trump's tariff policies and the global trade war has created an additional driver for gold, in addition to continuous demand.

We are seeing a high correlation between stocks and bonds, and this is putting upward pressure on gold as investors seek new diversification tools. In this environment, gold is positioned to benefit from many different scenarios," she said.

Ibrahim explained that as countries lose confidence in the US as a reliable trading partner, gold will continue to be an attractive safe haven asset. However, she also noted that if the trade fades and concerns about tariffs are eased, the Federal Reserve will have room to cut interest rates, which will reduce the opportunity cost of gold.

Its hard for me to see any scenario where gold prices fall sharply, she said.

Although gold was overbought in April, as the rally pushed prices to $3,500 an ounce, Ibrahim said the current stability period has helped partly eliminate market inflation and bring prices closer to reasonable value.

She added that with the current uncertainty, she sees a solid foundation forming at $3,000 an ounce.

Despite some concerns that a rate cut could boost investment in stocks and attract interest away from gold, Ibrahim sees it as a limited risk.

The Montreal-based research firm sees a high risk of a recession, which Ibrahim said would mean that if the Fed cut interest rates, it would be for the right reasons.

The Fed will cut interest rates, but that will be a reaction to weak growth conditions. That environment is of course negative for stocks. We are really optimistic about the stock outlook because of the growth outlook," she said.

Ibrahim also expressed optimism about gold as the market is going through an important turning point. Since the end of 2022, the gold rally has been driven largely by unprecedented demand from central banks. Official gold reserves have increased by 1,000 tons per year over the past three years, with expectations of an increase of 1,000 tons by 2025, marking the fourth consecutive year of strong growth in reserves.

Ibrahim said this demand has created real market value, which investors are only just starting to see.

Not only do we see an increase in investment demand, but this is happening as prices continue to trade near their record highs. Even as gold prices surpassed $3,000 an ounce, investors still saw value in the market. With everything happening in the global economy, whether you are a central bank or a personal investor, people are starting to recognize the role of gold as an important diversifier," she said.