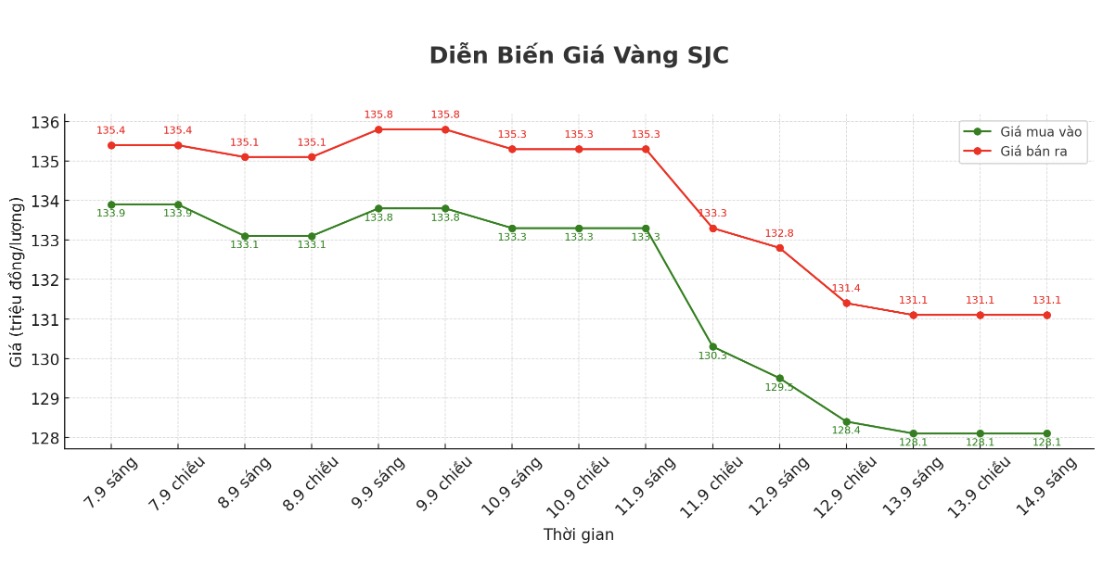

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 128.1-131.1 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (September 7, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC decreased by 5.8 million VND/tael for buying and decreased by 4.3 million VND/tael for selling. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 128.1-131.1 million VND/tael (buy in - sell out).

Compared to a week ago, the price of SJC gold bars was reduced by 5.8 million VND/tael for buying by Bao Tin Minh Chau and 4.3 million VND/tael for selling. The difference between the buying and selling prices of SJC gold at Bao Tin Minh Chau is at 3 million VND/tael.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau in the session of September 7 and selling it in today's session (September 14), buyers will lose the same amount of 7.3 million VND/tael.

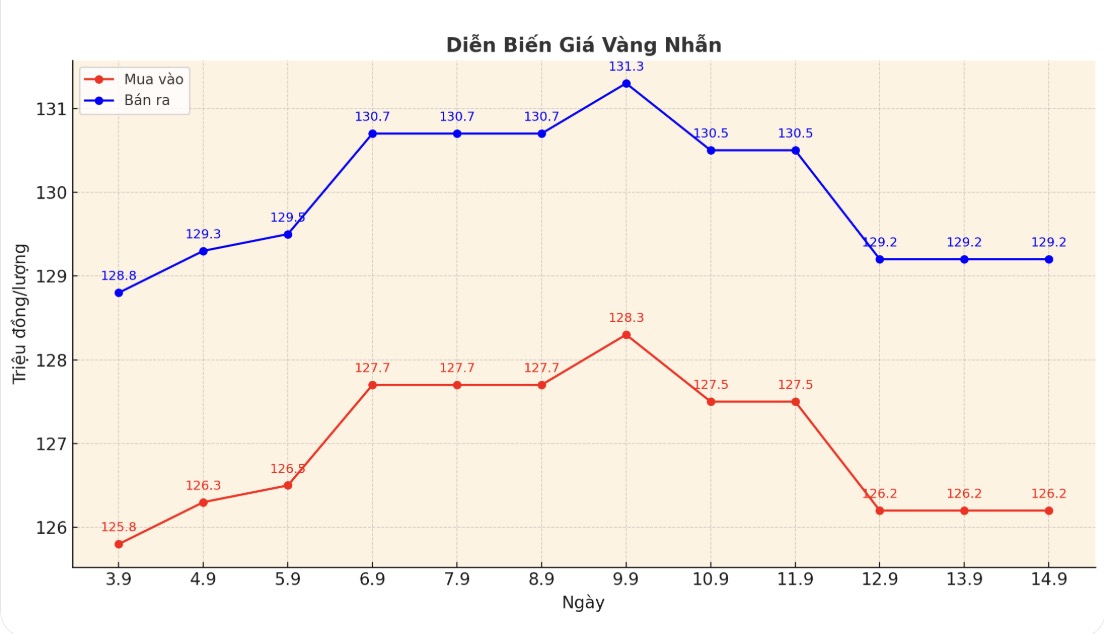

9999 gold ring price

Bao Tin Minh Chau listed the price of gold rings at 127-130 million VND/tael (buy in - sell out); down 800,000 VND/tael in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 125.5-128.5 million VND/tael (buy - sell), down 2 million VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of September 7 and selling in today's session (September 14), buyers at Bao Tin Minh Chau will lose 3.8 million VND/tael. Meanwhile, the loss when buying in Phu Quy is 5 million VND/tael.

Currently, the difference between buying and selling prices is remaining high, posing great risks to short-term investors. Buyers should be cautious and avoid the crowd mentality when chasing price fluctuations, because just a slight decrease in price can lead to significant losses.

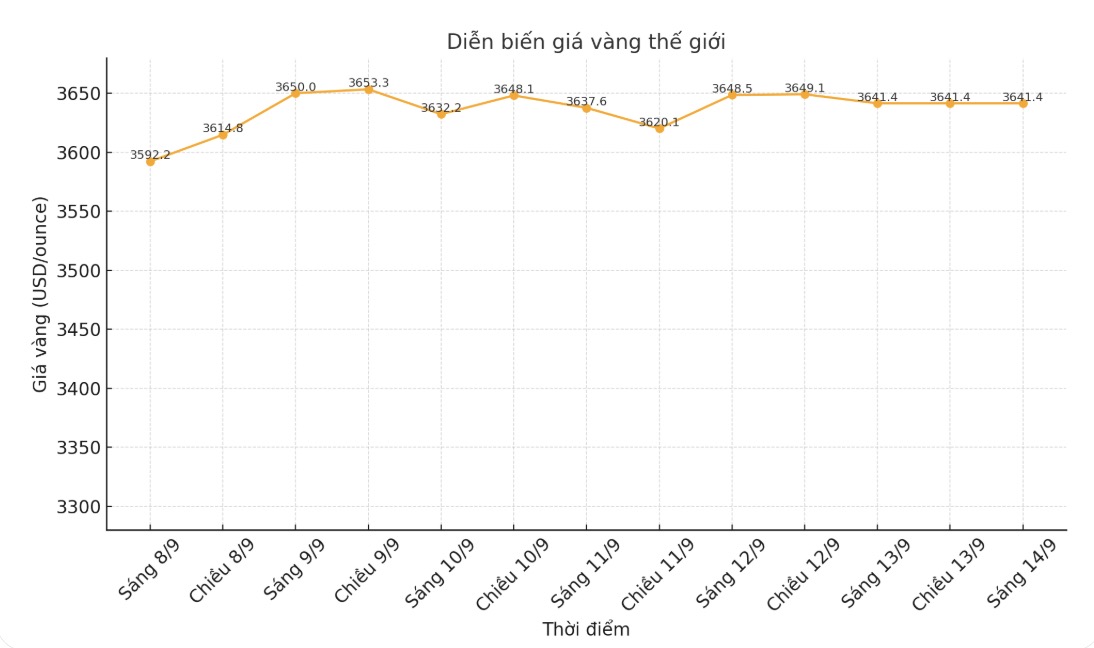

World gold price

At the end of the trading session of the week, the world gold price was listed at 3,641.4 USD/ounce, a sharp increase of 194.6 USD/ounce compared to the closing price of the previous trading session.

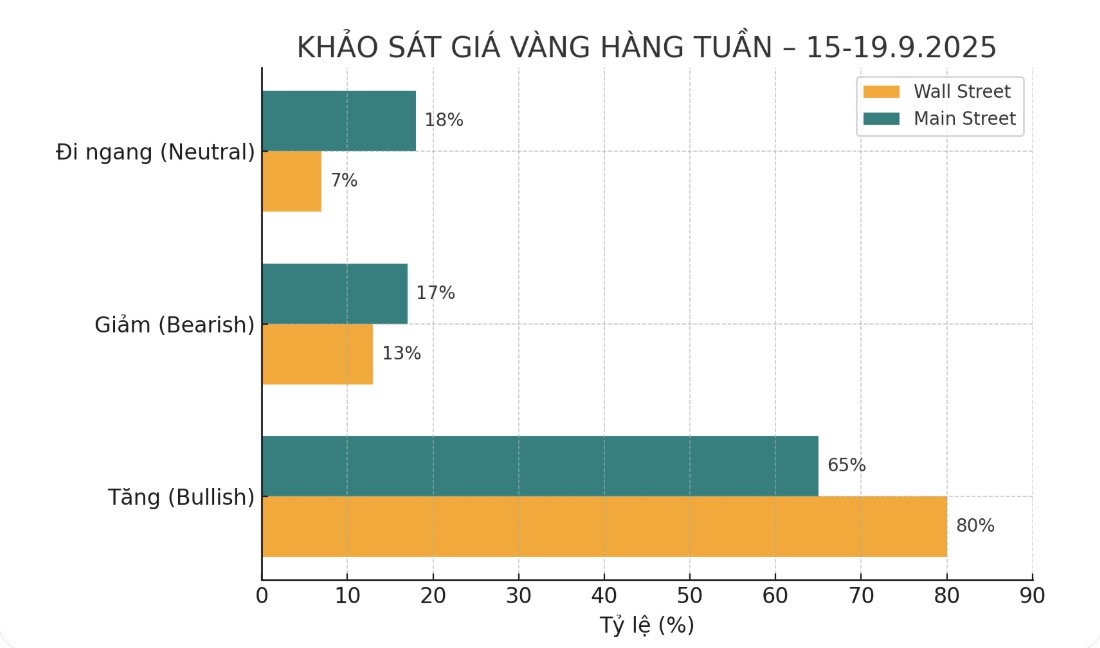

Gold price forecast

The latest weekly gold survey with Wall Street experts shows that the majority are still overwhelmingly optimistic despite gold prices anchored around their all-time highs.

Of the 15 analysts, 12 experts (equivalent to 80%) predict gold prices will increase next week. Only 2 people (accounting for 13%) predict prices will decrease. The remaining expert (accounting for 7%), said that gold prices will move sideways.

Rich Checkan - Chairman and COO of Asset Strategies International, commented: "It is likely that gold prices will increase. Assuming the majority of investors are correct when predicting that the US Federal Reserve (FED) will cut interest rates next week, I think gold will benefit from this information and prices will be higher. However, if the Federal Open Market Committee (FOMC) surprises by keeping interest rates unchanged, we could see a profit-taking sale.

Adrian Day - Chairman of Adrian Day Asset Management, said: " Prices will increase because there are new buyers participating in the gold market".

In contrast, Michael Brown - senior research strategist at Pepperstone, is optimistic about gold prices next week. He said the gold market is expecting too much from the Fed's dovish stance.

Next week will be an important week with a series of major economic information, including many interest rate decisions by central banks - including the FED - and many data that can strongly impact the market.

Empire State manufacturing survey will be released on Monday, followed by the US Retail Sales report for August on Tuesday morning.

By Wednesday, the market will receive data on Construction Starting Houses and Construction Permits for August. Then there is the monetary policy decision of the Bank of Canada (BoC), before all eyes were on Washington for the FED's interest rate announcement and Chairman Jerome Powell's press conference in the afternoon.

There will be a monetary policy decision by the Bank of England (BoE) on Thursday morning, followed by a US weekly jobless claims report and a Philly Fed manufacturing survey.

The economic week ended with the monetary policy decision of the Bank of Japan (BoJ) on Thursday evening.

See more news related to gold prices HERE...