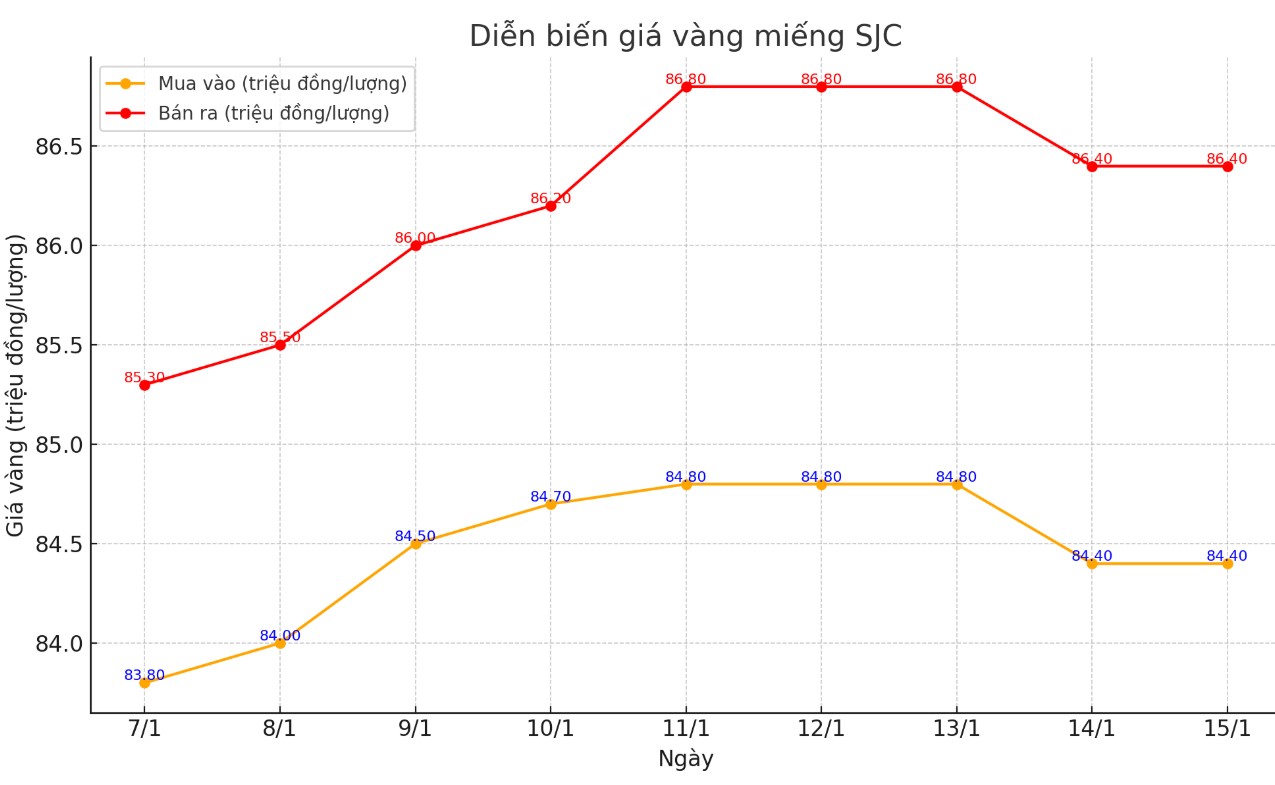

Update SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.4-86.4 million/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 84.4-86.4 million VND/tael (buy - sell); the selling price remains the same.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.4-86.4 million VND/tael (buy - sell); kept the selling price unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

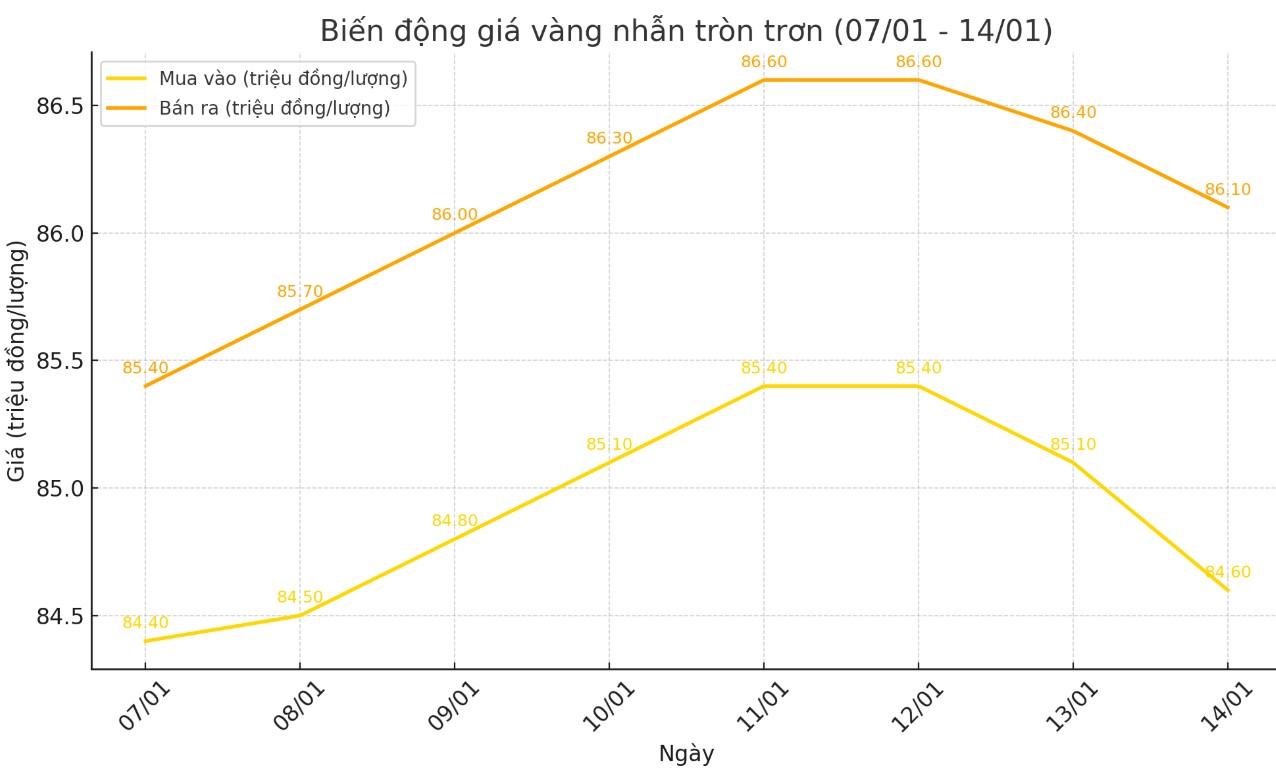

Price of round gold ring 9999

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.6-86.1 million VND/tael (buy - sell); both selling prices remain the same compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 84.5-86.35 million VND/tael (buy - sell), down 300,000 VND/tael for buying and up 50,000 VND/tael for selling compared to early this morning.

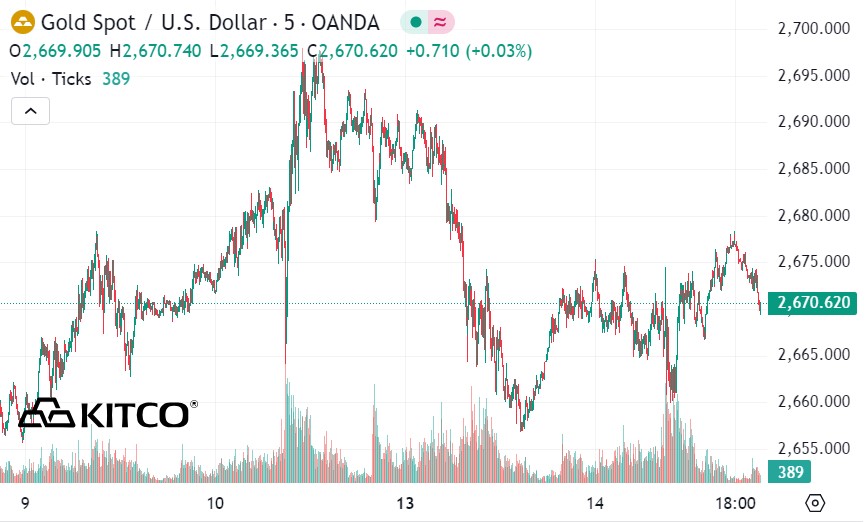

World gold price

As of 9:00 a.m., the world gold price listed on Kitco was at 2,670.7 USD/ounce, almost unchanged from the beginning of the previous trading session.

Gold Price Forecast

World gold prices remained unchanged as the USD did not change much. Recorded at 9:00 a.m. on January 15, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 109.090 points (up 0.08).

Neils Christensen, an analyst at Kitco News, said the gold market is having trouble determining a clear trend ahead of US inflation data.

The headline producer price index (PPI) rose 0.2% in December, following a 0.4% increase in November, the U.S. Labor Department said on Tuesday. The latest inflation data was slightly below expectations, with economists forecasting a 0.4% increase.

Over the past 12 months, headline wholesale inflation rose 3.3%, below the forecast of 3.4%. However, the report also pointed out that this increase was much more significant than the 1.1% increase in 2023.

"Some economists believe that the weaker PPI data in December was not enough to reinforce expectations for additional monetary easing from the US Federal Reserve (FED). Therefore, this data could put pressure on gold prices in the short term, especially as the market adjusts to the Fed's changing monetary policy stance," said Neils Christensen.

Markets are awaiting the Bureau of Labor Statistics' consumer price index (CPI) report later today. Economists expect both headline and core inflation to rise 0.3% month-over-month, for annual rates of 2.9% and 3.3%, respectively. While the Fed favors the personal expenditures price index (PCE) as its primary inflation measure, both PPI and CPI data factor into the calculation.

The possibility of a ceasefire in the Israel-Hamas conflict has added further downward pressure on gold and silver prices, which have been weakened by the strength of the US dollar and high bond yields, according to David Scutt, a market analyst at City Index.

“Gold prices have been falling since the start of the week. A strong US dollar, rising bond yields, and renewed hopes for a Middle East peace deal may have contributed to the sharp decline. Short-term positioning imbalances after a strong start to the year may have amplified the reversal,” he said.

See more news related to gold prices HERE...