Update SJC gold price

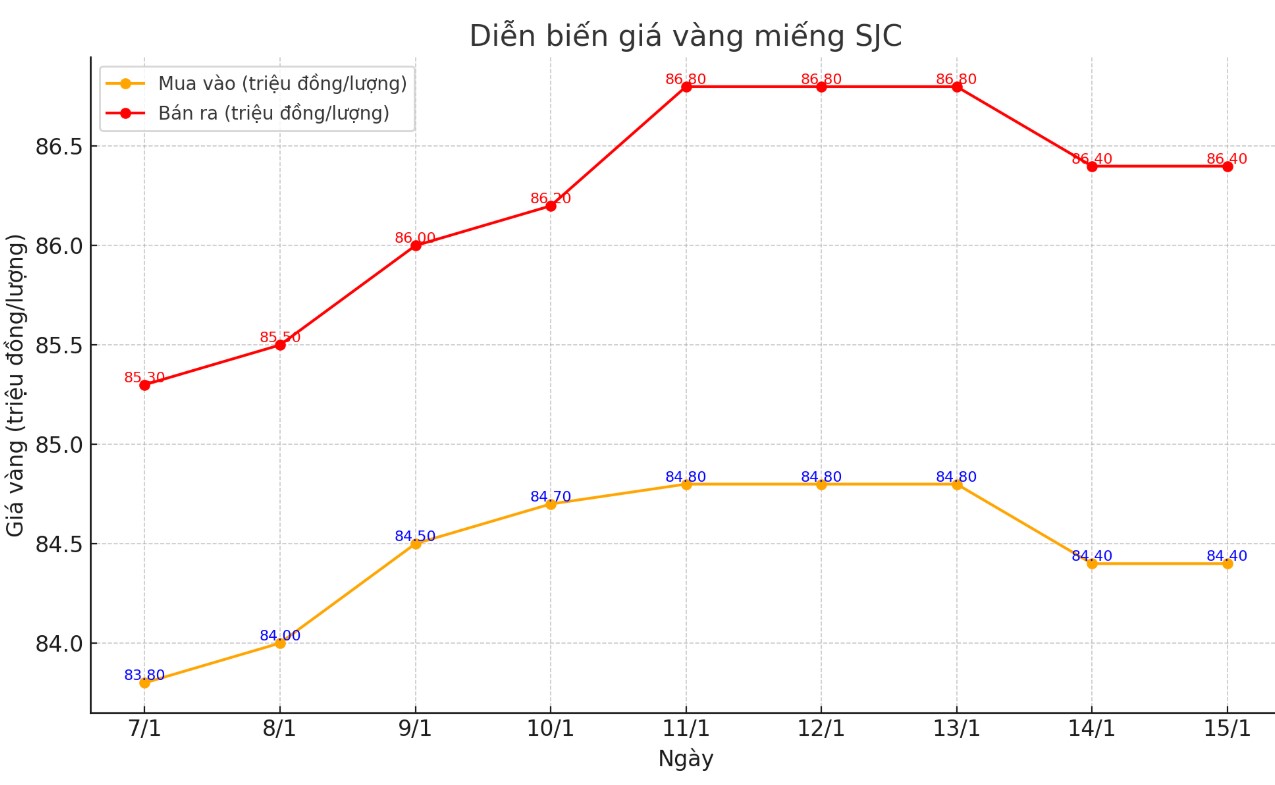

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 84.4-86.4 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Update SJC gold price.

Meanwhile, DOJI Group listed the price of SJC gold at 84.4-86.4 million VND/tael (buy - sell); down 400,000 VND/tael for both selling and buying.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.4-86.4 million VND/tael (buy - sell); down 400,000 VND/tael for both selling and buying.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

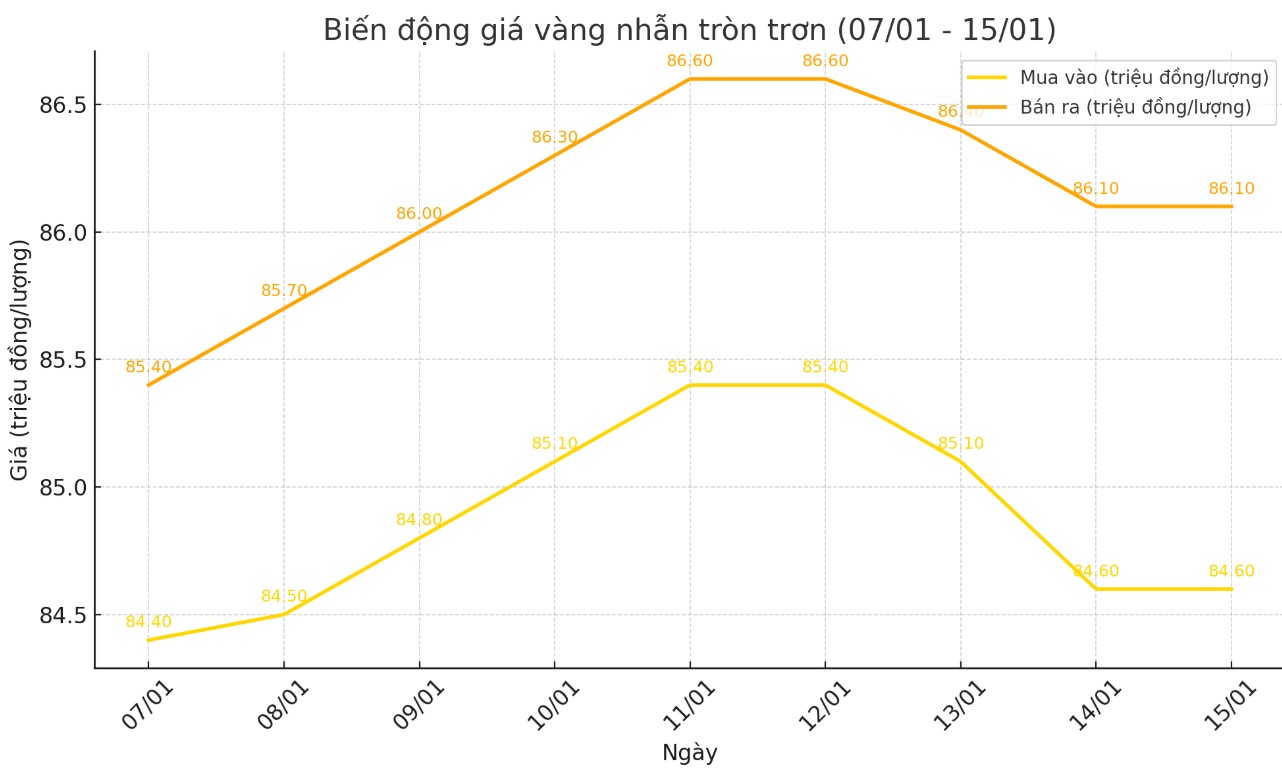

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.6-86.1 million VND/tael (buy - sell); down 500,000 VND/tael for buying and down 300,000 VND/tael for selling compared to the beginning of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 84.8-86.3 million VND/tael (buy - sell), down 400,000 VND/tael for buying and down 300,000 VND/tael for selling compared to the beginning of yesterday's trading session.

World gold price

As of 0:00, the world gold price listed on Kitco was at 2,671.4 USD/ounce, up 4 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices fell despite the decline in the USD index. Recorded at 0:00 on January 15, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 109,200 points (down 0.56%).

According to Kitco - gold prices received support from a lower-than-expected US inflation report. The US producer price index (PPI) report for December showed a lower-than-expected increase of just 0.2% month-on-month, while the forecast was for a 0.4% increase. The core PPI (excluding food and energy) was also lower than expected, remaining unchanged from the previous month, while the forecast was for a 0.3% increase.

The highlight of U.S. economic data this week is the December consumer price index (CPI) report, due Wednesday. The CPI is expected to rise 2.9% year-on-year, up from the 2.7% increase in the November report.

Core CPI is expected to rise 0.2% after four straight monthly increases of 0.3%, according to a Bloomberg survey. Core CPI is expected to rise 3.3% on an annual basis, unchanged from the previous three months. “The bond market turmoil and inflation concerns have kept Wednesday’s CPI report in the spotlight. Any surprise to the upside would reinforce the view that the Fed will not cut rates anytime soon,” Deutsche Bank strategist Jim Reid wrote in an email to Bloomberg.

Asian and European markets were mixed overnight, with some indexes rising while others fell slightly. Meanwhile, US stock indexes are expected to open higher when the New York session begins, helped by weaker-than-expected PPI data. However, the US stock market’s rally has been waning over the past few weeks, with bearish signs appearing on the daily chart.

In other news, the yield on Japan's 40-year government bond hit its highest level since it was issued in 2007, driven by a global bond sell-off and expectations the Bank of Japan will raise interest rates in the coming months.

The administration of US President-elect Donald Trump is reportedly discussing gradually increasing trade tariffs to increase its negotiating leverage while trying to avoid creating inflationary pressures.

Major outside markets today saw Nymex crude oil futures fall after hitting a six-month high on Monday, trading around $76.75 a barrel. The yield on the 10-year US Treasury note is currently at 4.774%. Investors are increasingly concerned that Mr. Trump’s tax and trade policies could fuel price inflation.

See more news related to gold prices HERE...