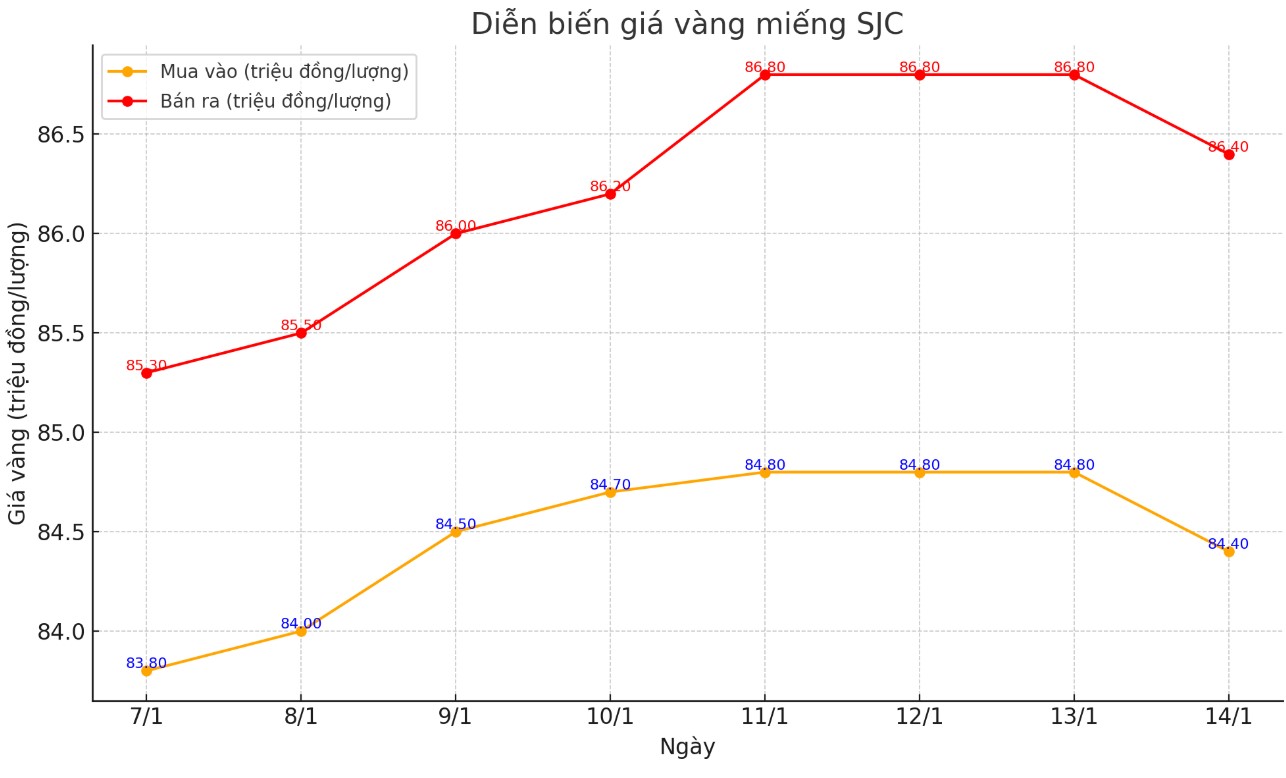

Update SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.4-86.4 million/tael (buy - sell); down VND400,000/tael for both selling and buying.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 84.4-86.4 million VND/tael (buy - sell); down 400,000 VND/tael for both selling and buying.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.4-86.4 million VND/tael (buy - sell); down 400,000 VND/tael for both selling and buying.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

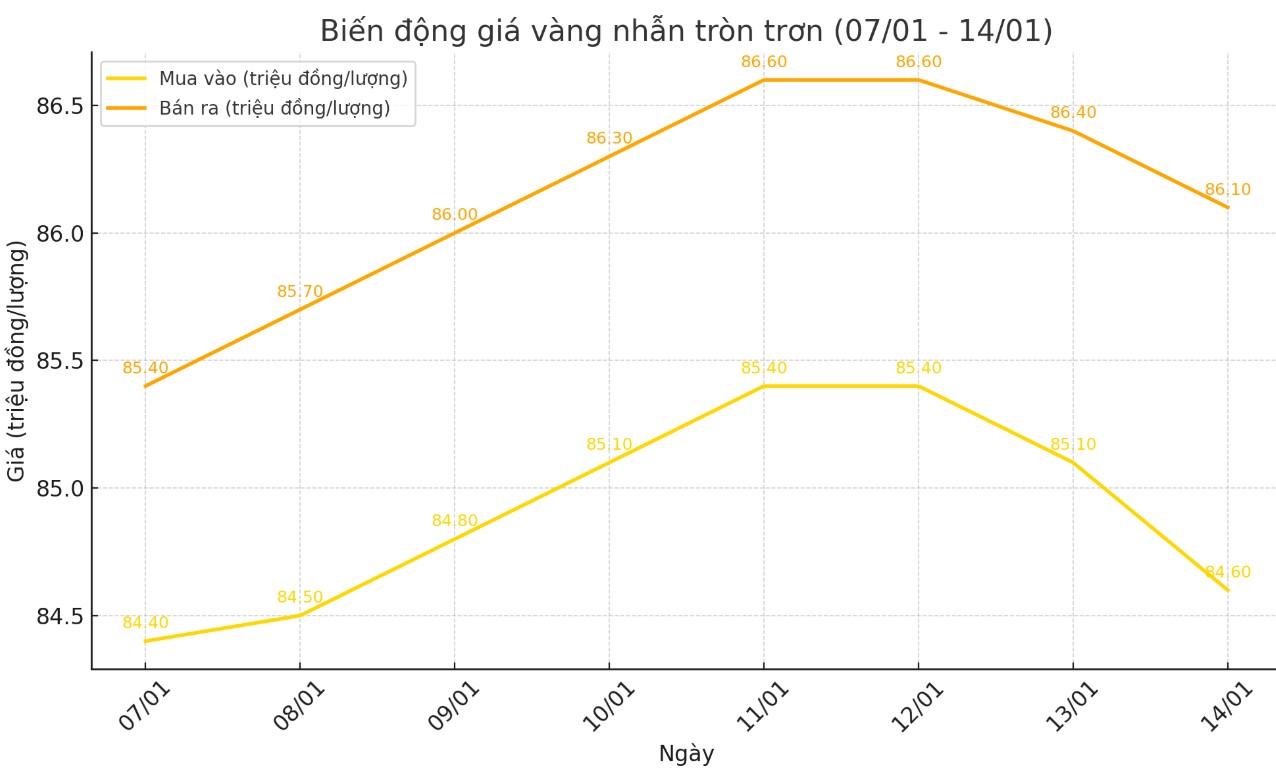

Price of round gold ring 9999

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.6-86.1 million VND/tael (buy - sell); down 500,000 VND/tael for buying and down 300,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 84.8-86.3 million VND/tael (buy - sell), down 400,000 VND/tael for buying and down 300,000 VND/tael for selling compared to early this morning.

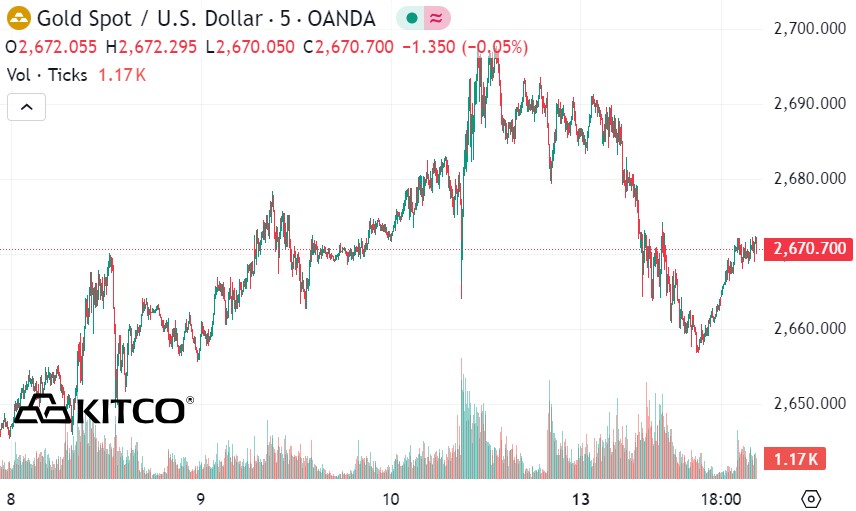

World gold price

As of 10:20 a.m., the world gold price listed on Kitco was at 2,670.7 USD/ounce, down 15.7 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell sharply despite the decline of the USD. Recorded at 10:20 a.m. on January 14, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 109,420 points (down 0.36).

Gold prices are under pressure as traders reassess economic data. Jim Wyckoff, senior analyst at Kitco, said that the decline in gold prices was mainly due to short-term corrections and profit-taking by futures traders after recent good gains.

Besides, the recovery of the USD index to its highest level in more than two years and the increase in US Treasury bond yields were also external factors that negatively affected the market in the new trading week.

Gold prices are holding up relatively well despite high bond yields and a lower likelihood of a rate cut by the US Federal Reserve (FED), according to precious metals analysts at Heraeus.

In their latest update, analysts said that while China's resumption of gold purchases at the end of the year has received much attention, Poland will be the country leading central banks in 2024.

“The People’s Bank of China bought 5 tonnes of gold in November, adding to 9.3 tonnes in December, marking a return to steady gold purchases to end 2024 after a six-month hiatus.

However, in 2024, Poland led central banks in gold purchases, with a total of 89.5 tonnes from the beginning of the year to November, much higher than China's 33.9 tonnes over the same period.

The top four countries for central bank gold demand in 2024 are Poland, Türkiye, India and China (in that order) – accounting for 72% of total demand, reaching 270.8 tonnes as of November. Of these, Turkey and India have been net buyers every month in 2024, while Poland has been a consistent buyer since April,” they wrote.

See more news related to gold prices HERE...