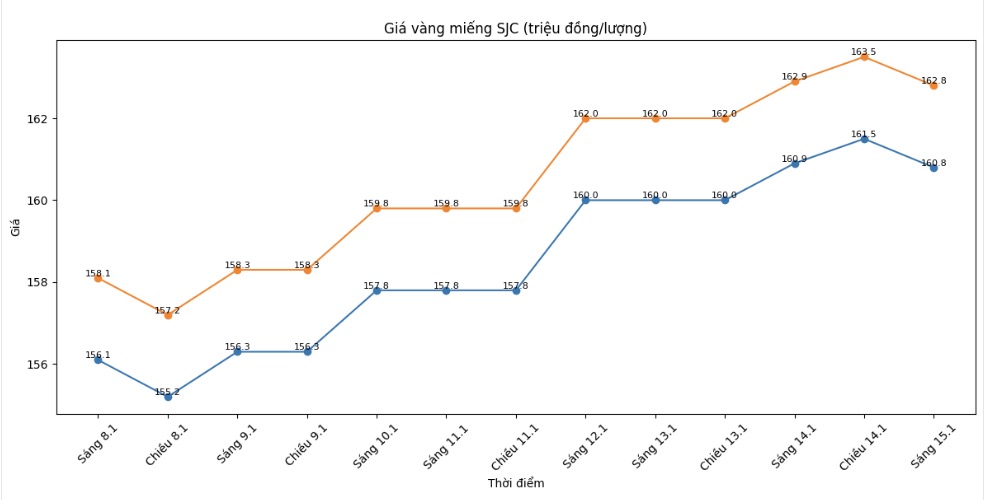

SJC gold bar price

As of 9:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 160.8-162.8 million VND/tael (buying - selling), down 100,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 160.8-162.8 million VND/tael (buying - selling), down 100,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 160-162.8 million VND/tael (buying - selling), down 400,000 VND/tael on the buying side and down 100,000 VND/tael on the selling side. The difference between buying and selling prices is at 2.8 million VND/tael.

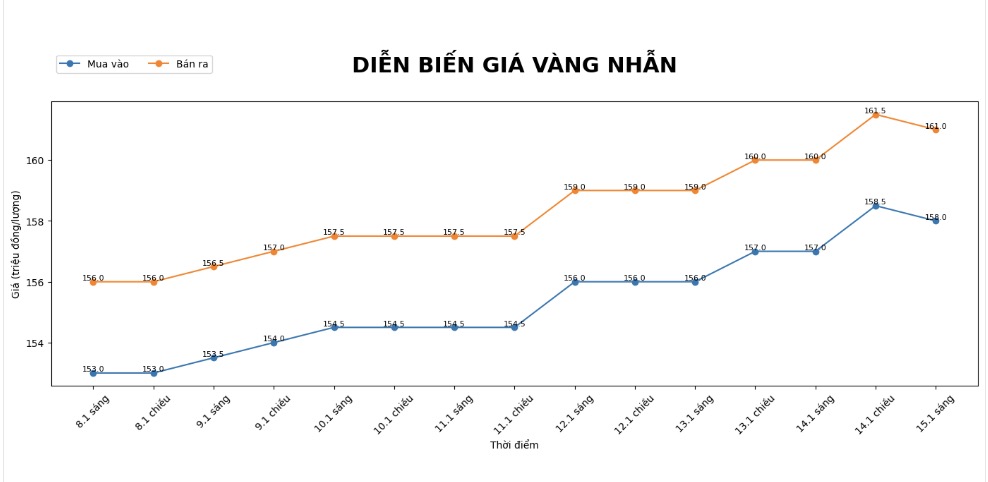

9999 gold ring price

As of 9:00 AM, DOJI Group listed the price of gold rings at 158-161 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 1598.8-162.8 million VND/tael (buying - selling), down 100,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 158-161 million VND/tael (buying - selling), down 200,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

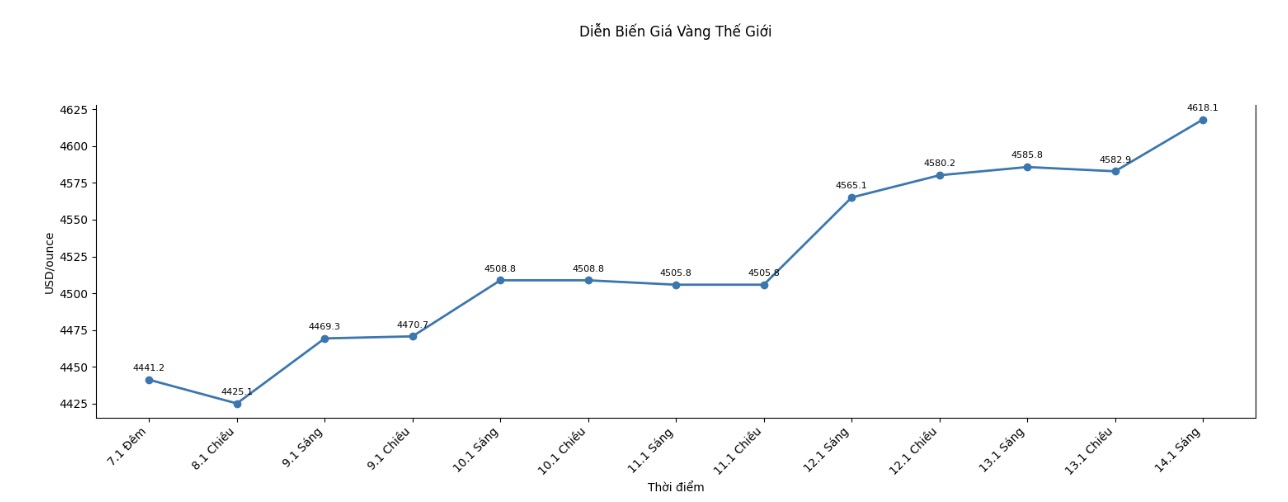

World gold price

At 9:00 AM, world gold prices were listed around the threshold of 4,600.9 USD/ounce, up 15.1 USD compared to the previous day.

Gold price forecast

Developments in the international market show that the precious metal is still in a rare upward cycle. After setting new record highs, gold and silver continue to maintain a "high" position despite many positive US economic data. As of this morning, spot gold prices fluctuated above the 4,600 USD/ounce range, showing that the defensive buying force of investors has not weakened at all.

According to analysts, the global economic context still contains many risks, from geopolitical tensions to concerns about inflation, which are causing cash flow to continue to turn to shelter assets.

Inflation in the US, especially production price inflation, is still maintained at a higher than forecast level, showing that the input costs of the economy have not been completely controlled. This is an important factor helping gold prices maintain high prices, even though US consumption and housing markets are recovering.

Technically, the upward trend of gold is still considered dominant. Experts believe that the 4,400 USD/ounce zone is playing an important support threshold, while the near target of the market is to challenge the strong resistance level around 4,750 USD/ounce. When the price still stands firmly above this support zone, the upward trend has not been broken.

From a medium-term perspective, many major financial institutions are optimistic. In the latest report, Citigroup's strategist group led by Kenny Hu forecasts that gold prices could reach $5,000/ounce in Q1/2026, as geopolitical risks, material supply shortages and instability surrounding US monetary policy continue to fuel shelter demand. However, Citigroup also warned that if global tensions subside, gold prices may face strong correction pressure by the end of 2026.

Meanwhile, Mr. Daniel Ghali - Commodity Strategy Director at TD Securities - said that gold is benefiting greatly from the trend of declining confidence in the USD.

Gold, a precious metal, is currently the clearest reflection of concerns about the storage value of the US dollar" - Mr. Ghali said. However, this expert also noted that the upward momentum of gold is changing and the market may enter a more volatile phase in the near future.

With the above factors, the gold price outlook is forecast to remain positive in the short and medium term, but investors need to be cautious before correction phases when the market advances deep into the record price range.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...