Updated SJC gold price

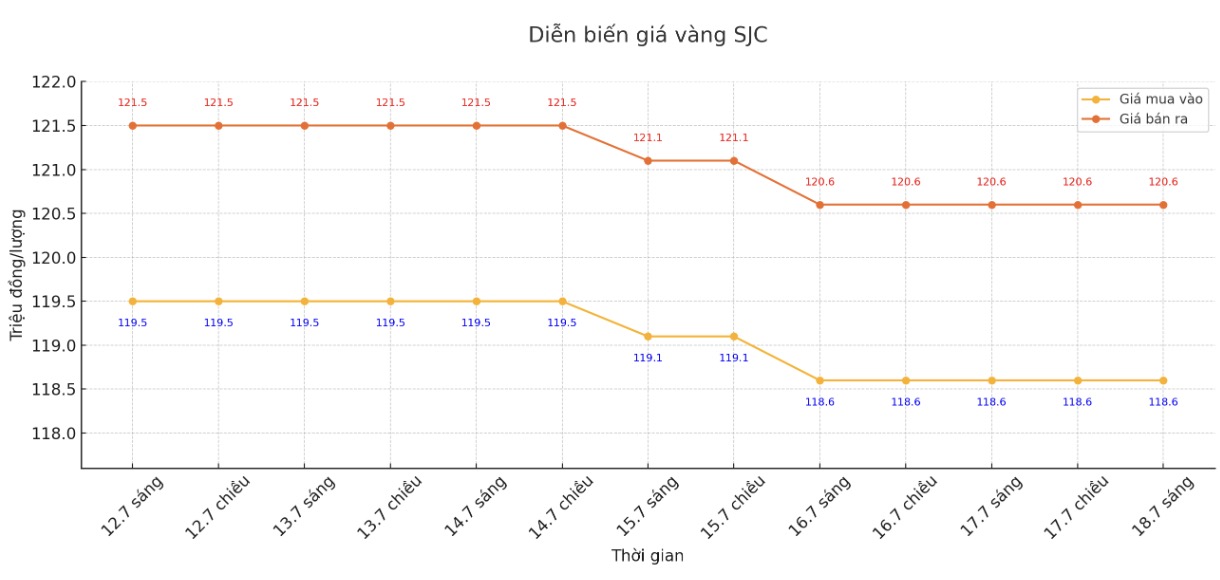

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118.6-120.6 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed SJC gold bar price at 118.6-120.6 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.6-120.6 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117.9-120.6 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.7 million VND/tael.

9999 round gold ring price

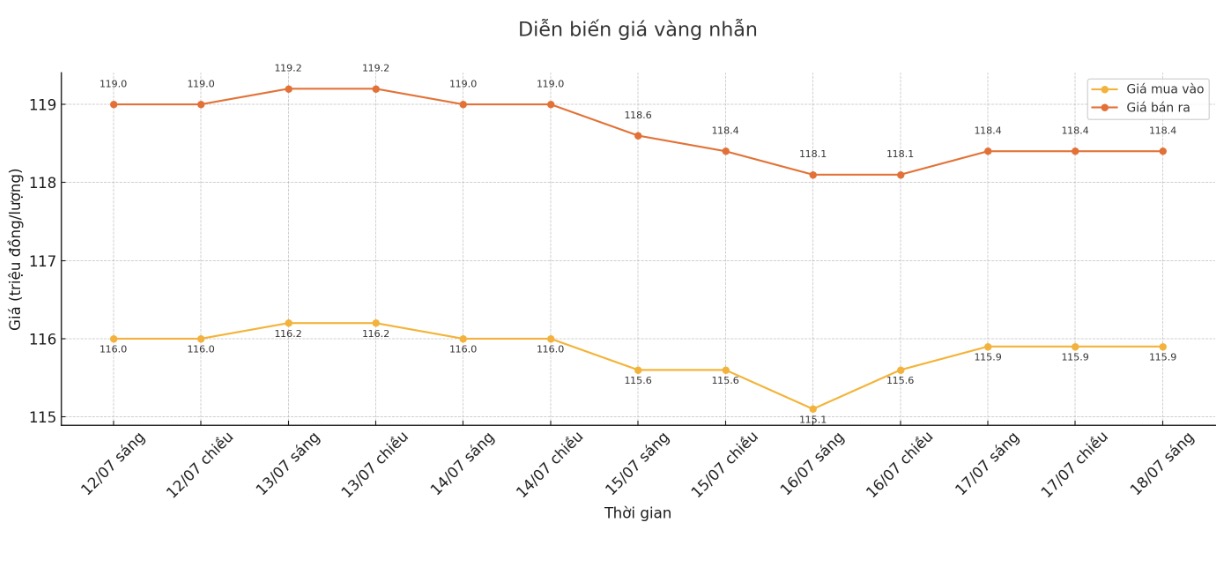

As of 9:00 a.m., DOJI Group listed the price of gold rings at 115.9-118.4 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.6-117.6 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

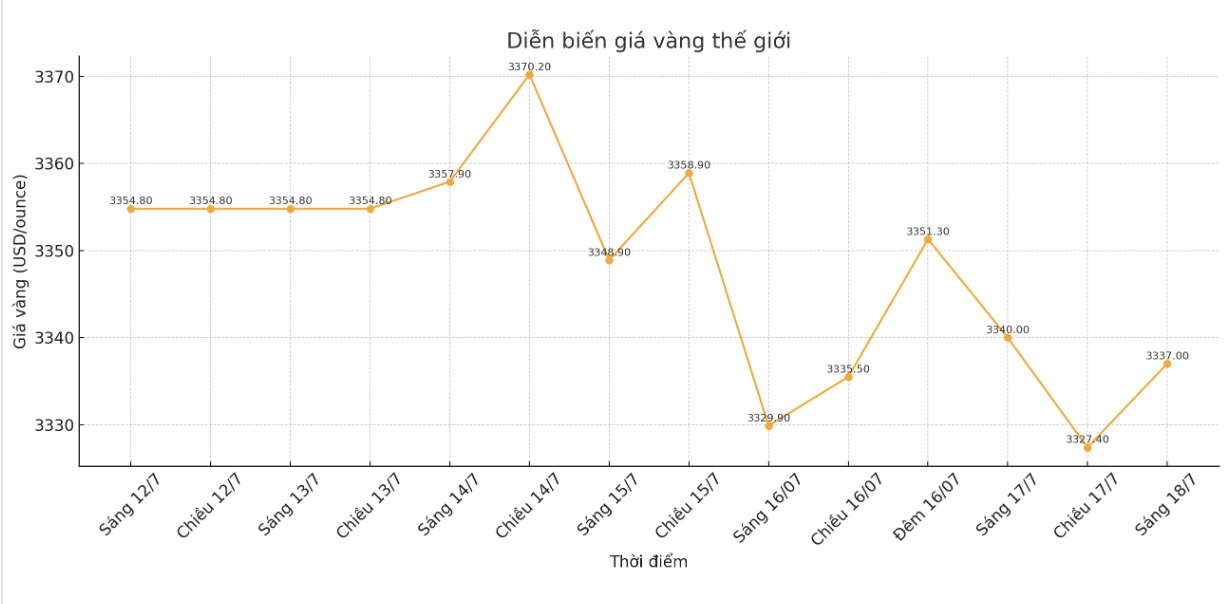

At 9:00 a.m., the world gold price was listed around 3,337 USD/ounce, down 3 USD/ounce.

Gold price forecast

World gold prices are under pressure after a series of US economic data were released showing that the world's largest economy is still growing strongly.

Selling pressure comes after the US Department of Labor announced that the number of initial jobless claims in the week ended July 12 was only 221,000, much lower than the forecast of 235,000 and down from 228,000 in the previous week.

The four-week average - a less volatile measure - also fell to 229,500 applications, showing a stable labor market.

On the same day, the US Commerce Department announced that retail sales in June increased by 0.6% compared to the previous month, far exceeding the forecast of only 0.1%. This increase completely reversed compared to the 0.9% decrease in May. For the year, retail sales increased by 4.1%.

core retail sales (excluding cars) also rose 0.5%, exceeding expectations and marking a significant recovery in consumer spending.

This development shows that US consumers continue to spend strongly, contributing to maintaining economic growth momentum despite high interest rates. Some experts believe that this will strengthen the view of maintaining a neutral monetary policy of the US Federal Reserve (FED).

Fawad Razaqzada - an expert at City Index commented that the delay in interest rate cuts is strengthening the USD, putting pressure on gold prices. He warned that a stronger US dollar could hinder gold's gains, while trade deals could reduce demand for the precious metal.

However, global geopolitical uncertainties continue to support gold as a safe haven asset. Razaqzada recommends that investors watch key support levels at $3,320 and $3,300/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...