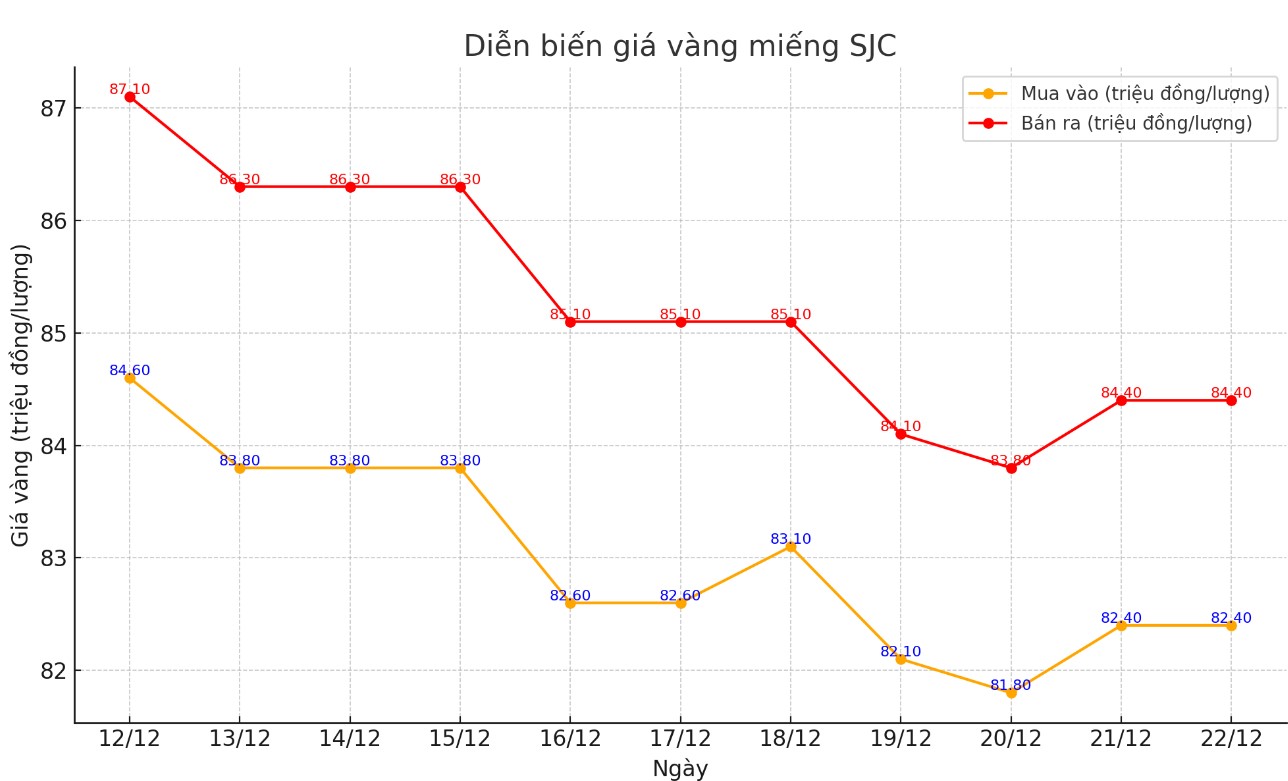

SJC gold bar price

At the end of the week's trading session, DOJI Group listed the price of SJC gold at 82.4-84.4 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at DOJI decreased by VND 1.4 million/tael for buying and VND 1.9 million/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 81.8-83.8 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at Saigon Jewelry Company decreased by VND 2 million/tael for buying and VND 2.5 million/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

If you buy SJC gold at DOJI Group on December 15 and sell it today (December 22), you will lose 3.9 million VND/tael. Meanwhile, those who buy gold at Saigon Jewelry Company SJC will lose 4.5 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 2 million VND/tael. Experts say this difference is very high, causing investors to face the risk of losing money when investing in the short term.

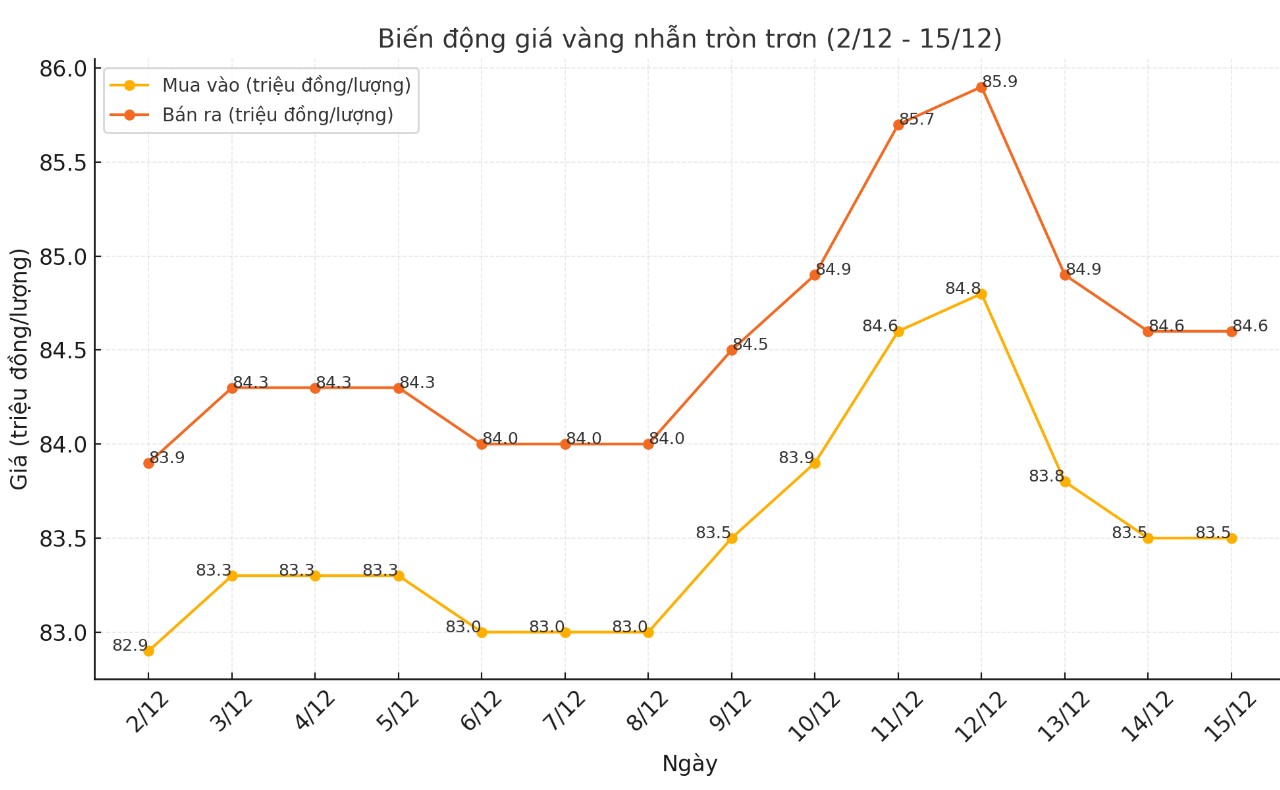

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold ring at DOJI was listed at 82.9-84.4 million VND/tael (buy - sell); down 600,000 VND/tael for buying and down 200,000 VND/tael for selling compared to the closing price of last week's trading session.

Bao Tin Minh Chau listed the price of gold rings at 82.7-84.4 million VND/tael (buy - sell); down 930,000 VND/tael for buying and down 980,000 VND/tael for selling compared to the closing price of last week's trading session.

After a week of decline, if you buy gold rings on December 15 and sell them today (December 22), the loss investors will have to accept when buying at DOJI and Bao Tin Minh Chau is VND1.7 million/tael and VND2.68 million/tael, respectively.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

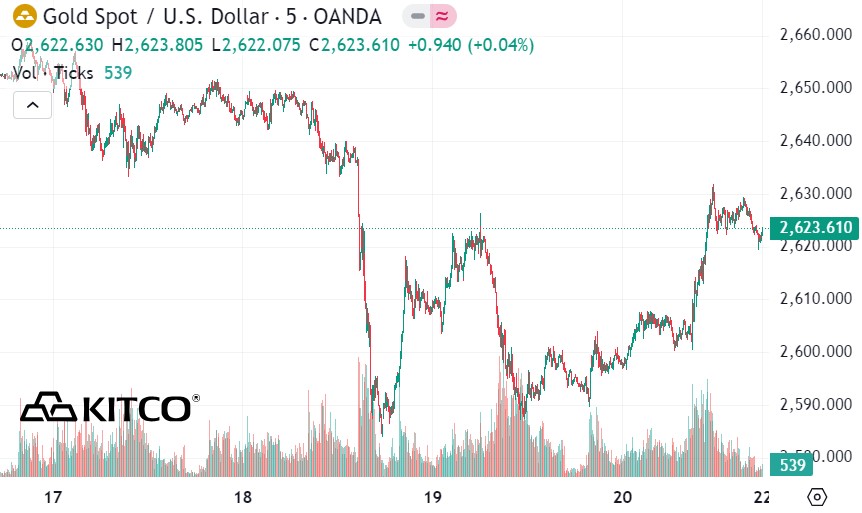

World gold price

At the close of the weekly trading session, the world gold price listed on Kitco was at 2,623.6 USD/ounce, down 25 USD/ounce compared to the close of the previous week's trading session.

Gold Price Forecast

World gold prices received support at the end of the week when the USD index decreased. Recorded at 9:00 a.m. on December 22, the US Dollar Index, which measures the greenback's fluctuations against 6 major currencies, was at 107.350 points (down 0.74%).

In its new report on the gold price outlook for 2025, the World Gold Council assessed that gold prices are experiencing their most impressive year in more than a decade. Since the beginning of the year, the precious metal has reached a record high 40 times, including a time when it nearly reached the $2,800/ounce mark in late October. Despite selling pressure after the US presidential election, gold prices still recorded a 30% increase this year.

The World Gold Council predicts that gold prices will still have the potential to increase in 2025 if demand from central banks exceeds expectations or the global economic situation worsens, increasing the need for safe havens. However, the rate of increase may be slower than this year. On the contrary, if the global interest rate reduction policy is interrupted, gold prices will face difficulties. Gold demand from central banks is still expected to be the main factor driving gold prices next year.

UBS is also optimistic about gold demand from central banks. The bank's report said that data from the International Monetary Fund (IMF) showed that net gold purchases by global central banks in October reached a 2024 high. UBS expects this trend to continue in 2025, as some countries try to reduce their dependence on the US dollar. In addition, UBS forecasts that gold demand from retail investors will also increase next year.

Although US President-elect Donald Trump’s policies have been widely publicized, many uncertainties still surround their practical implementation, especially in the fiscal, trade and geopolitical areas, due to his flexible approach. At the same time, the prolonged Russia-Ukraine tensions and the complicated situation in the Middle East are expected to continue to boost demand for risk-off investments. UBS predicts that capital flows will continue to be strong in gold ETFs, maintaining its optimistic view on gold prices. According to the bank, gold prices could reach $2,900/ounce by the end of 2025.

See more news related to gold prices HERE...