Update SJC gold price

As of 7:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.1-88.1 million/tael (buy - sell); down VND100,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 86.1-88.1 million VND/tael (buy - sell); down 100,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.1-88.1 million VND/tael (buy - sell); down 100,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

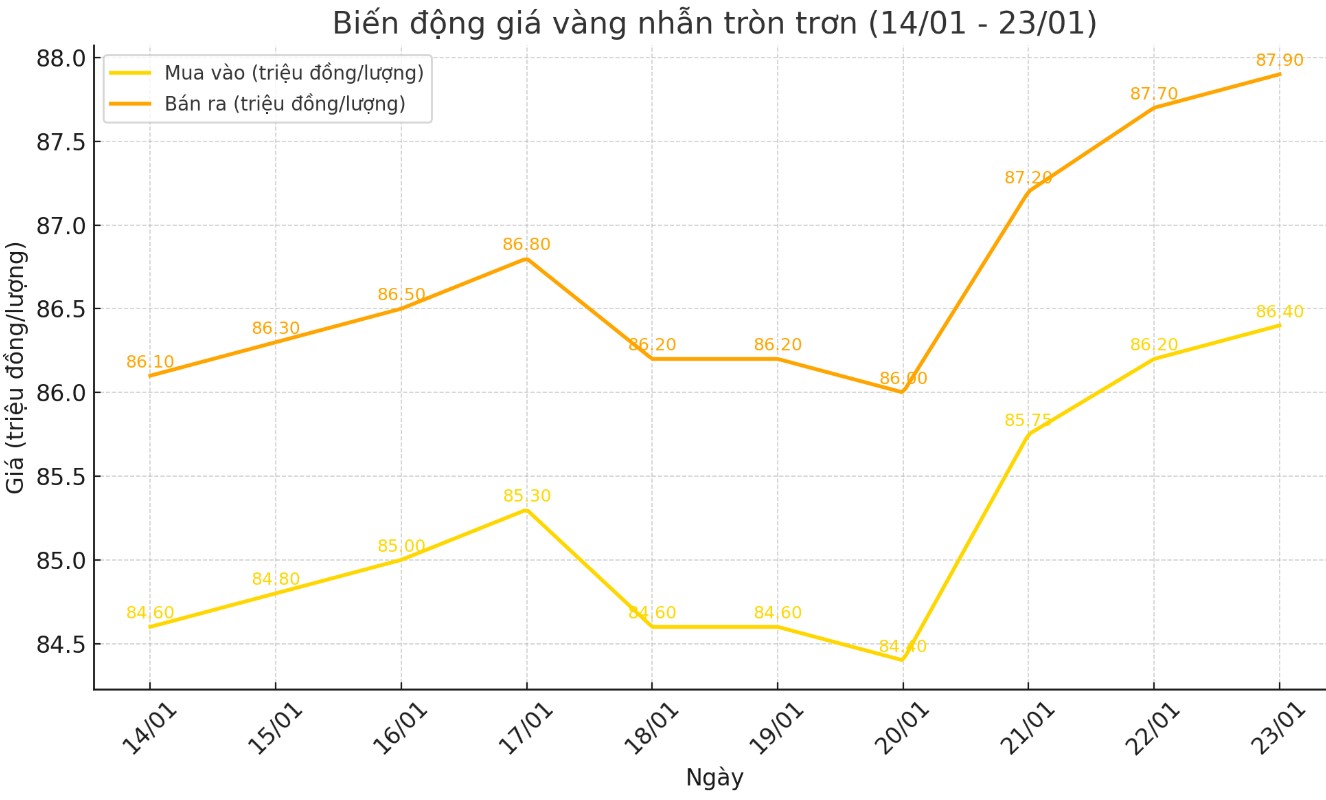

Price of round gold ring 9999

As of 7:30 p.m. today, the listed price of round gold rings was at 86.4-87.9 million VND/tael (buy - sell); an increase of 400,000 VND/tael for both buying and selling compared to the close of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 86.4-88.05 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and a decrease of 100,000 VND/tael for selling compared to the closing price of yesterday's trading session.

World gold price

As of 7:30 p.m., the world gold price listed on Kitco was at 2,747.2 USD/ounce, down 11.1 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices fell amid an increase in the USD index. Recorded at 7:30 p.m. on January 23, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 108.180 points (up 0.2%).

The decline in gold prices today was due to some investors taking profits. However, information surrounding US President Donald Trump's policies still boosted demand for shelter, causing gold prices to rise.

US President Donald Trump has proposed imposing tariffs of about 25% on goods imported from Mexico and Canada, along with a 10% import tax on Chinese goods starting February 1. He has also promised to impose tariffs on imports from Europe, but has not provided specific details.

"Trump's policies will impact gold depending on whether the combination of tax cuts, deregulation, tariffs and deportations leads to strong inflationary pressures. If that happens, the Fed's rate cuts will be limited and gold could struggle," said Ilya Spivak, global macro director at Tastylive.

Mr. Ajay Kedia - Director of Kedia Commodities in Mumbai - commented: "This is just a technical correction due to the USD index rising to 108, triggering profit-taking psychology of investors. However, the overall trend of gold is still expected to be positive."

Gold prices may face resistance at $2,759 an ounce, which could trigger a price correction, according to Reuters technical analyst Wang Tao.

The US Federal Reserve (FED) will meet next week (January 28-29), amid continued US economic growth and falling inflation. However, Mr. Trump's policies are expected to put inflationary pressure on the US economy.

The European Central Bank (ECB) has unanimously supported further interest rate cuts, while the Bank of Japan (BoJ) is expected to raise interest rates at its meeting on January 24.

See more news related to gold prices HERE...