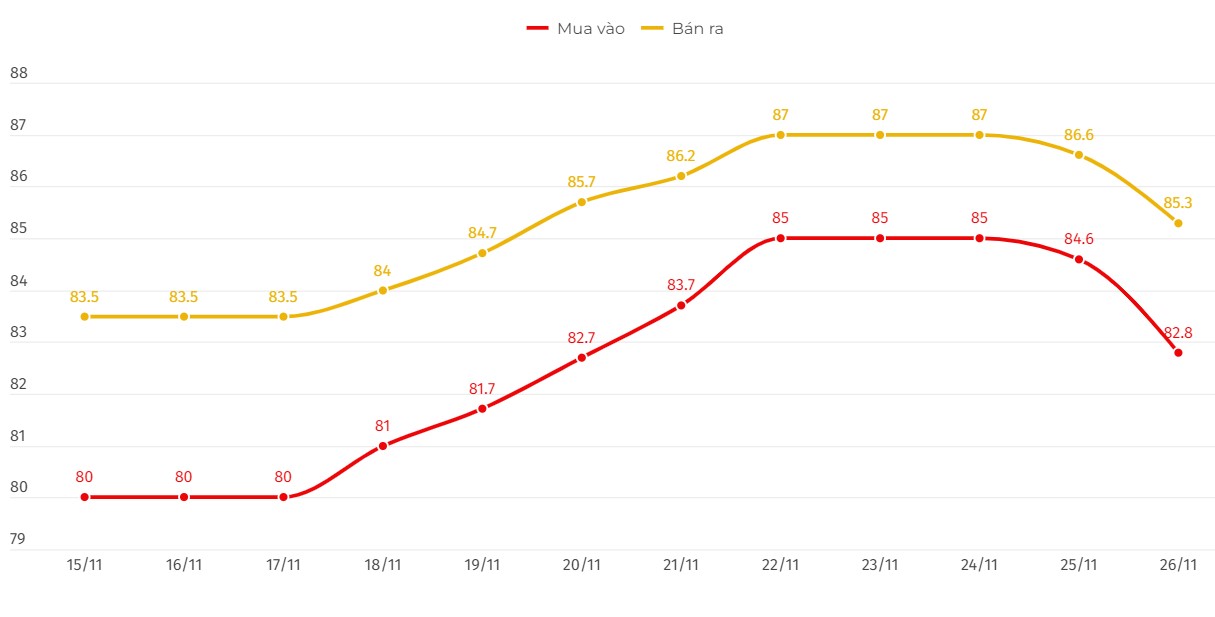

Update SJC gold price

As of 9:45 a.m., DOJI Group listed the price of SJC gold bars at VND82.8-85.3 million/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at DOJI decreased by 1.8 million VND/tael for buying and decreased by 1.3 million VND/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 82.8-85.3 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC decreased by 1.8 million VND/tael for buying and decreased by 1.3 million VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.8-85.3 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at Bao Tin Minh Chau decreased by 1.8 million VND/tael for buying and decreased by 1.3 million VND/tael for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Although it has decreased compared to the previous trading session, this difference is still very high.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

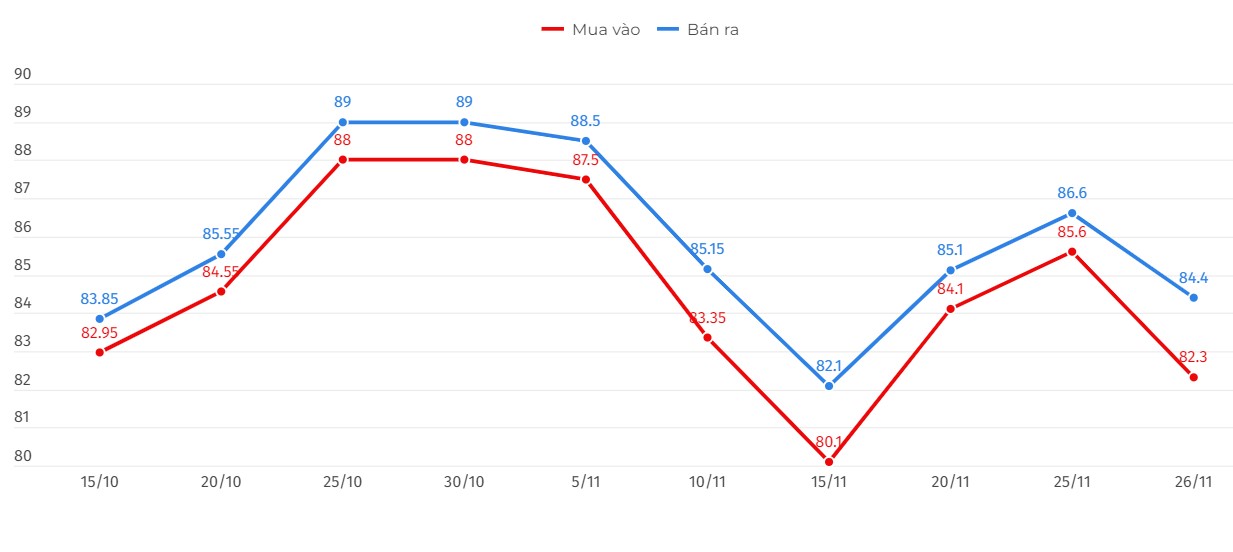

Price of round gold ring 9999

As of 9:50 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 82.3-84.4 million VND/tael (buy - sell); down 3.3 million VND/tael for buying and down 2.2 million VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 82.73-84.68 million VND/tael (buy - sell), down 2.75 million VND/tael for buying and down 1.75 million VND/tael for selling compared to early this morning.

World gold price

As of 9:50 a.m., the world gold price listed on Kitco was at 2,626.2 USD/ounce, down 65.6 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell amid the rising USD. Recorded at 9:50 a.m. on November 26, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.212 points (up 0.34%).

According to Kitco, the sharp decline in gold and silver prices on Monday was due to increased investor risk sentiment, large profit-taking pressure, and a sell-off from short-term futures traders.

US financial markets started the Thanksgiving-shortened trading week on a more upbeat note, weighing on safe-haven metals amid reports that Israel and Hamas may be close to a ceasefire.

Israel could be just days away from reaching a ceasefire agreement with Hezbollah in Lebanon, according to the Israeli ambassador to the US, Bloomberg reported.

Gold prices continued to fall after Axios reported that Israel and Lebanon have accepted the terms of a ceasefire agreement. However, the parties have not yet officially announced the agreement.

Traders are also analyzing President-elect Donald Trump's pick for Treasury Secretary Scott Bessent, seen as a choice that would bring more stability to the U.S. economy and financial markets. The nomination has eased concerns about the upcoming inflation agenda, reducing the appeal of gold as a hedge against inflation.

The Bessent news is a factor that could lead to a drop in gold prices on Monday, along with profit-taking pressure after last week's rally, according to UBS Group AG commodities analyst Giovanni Staunovo.

Investors are now focused on the outlook for monetary policy, after a report showed U.S. business activity grew at its fastest pace since April 2022. Traders are pricing in a less than 50% chance of the Fed cutting interest rates next month.

A slew of data this week could provide clues about the Fed’s interest rate path. These include minutes from the central bank’s November meeting, consumer confidence and data on personal expenditures (PCE), the Fed’s preferred inflation gauge.

See more news related to gold prices HERE...