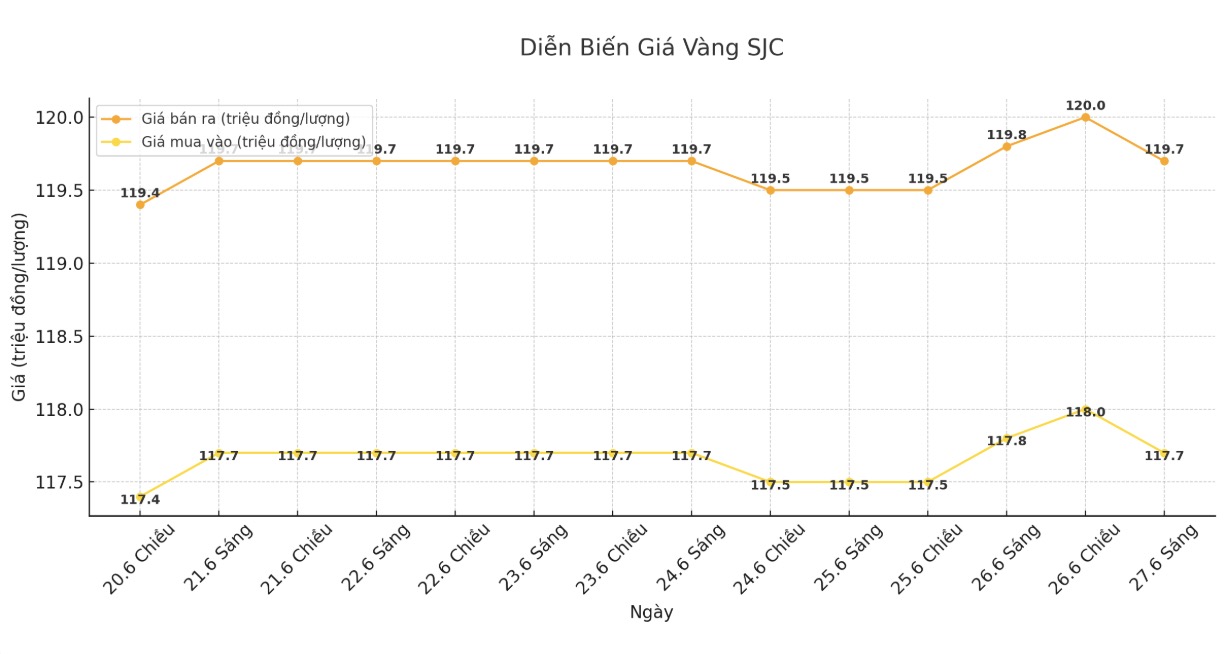

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.7 crore VND11.7 million/tael (buy in - sell out), down VND100,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed the price of SJC gold bars at 117.7 crore VND11.7 million/tael (buy in - sell out), down VND100,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118-120 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.2-120 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2.8 million VND/tael.

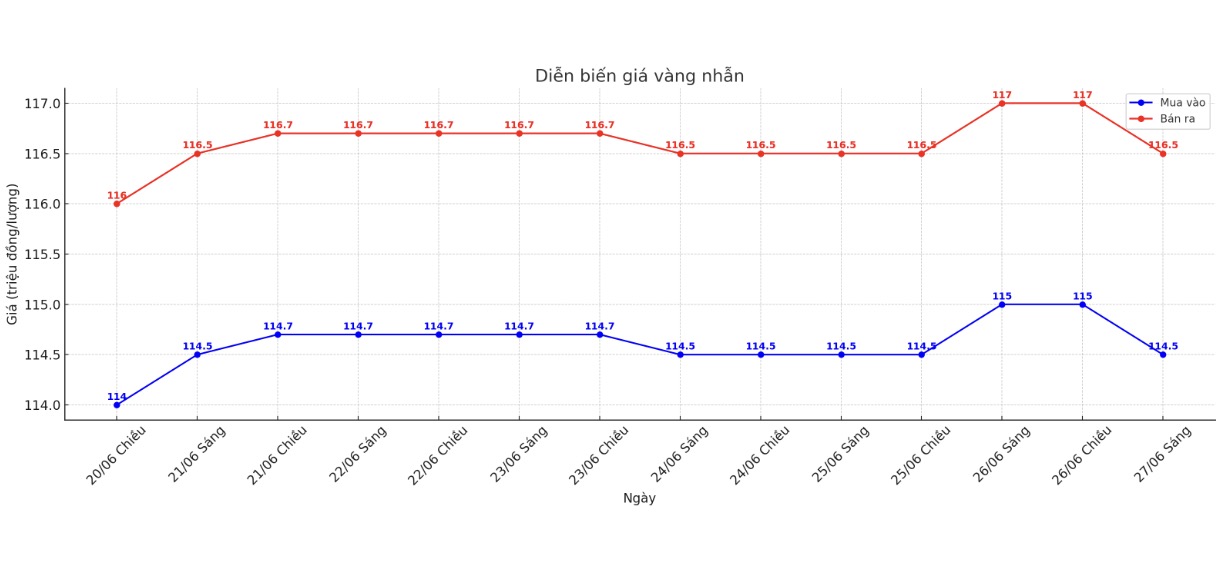

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 114.5-116.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.6-116.6 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

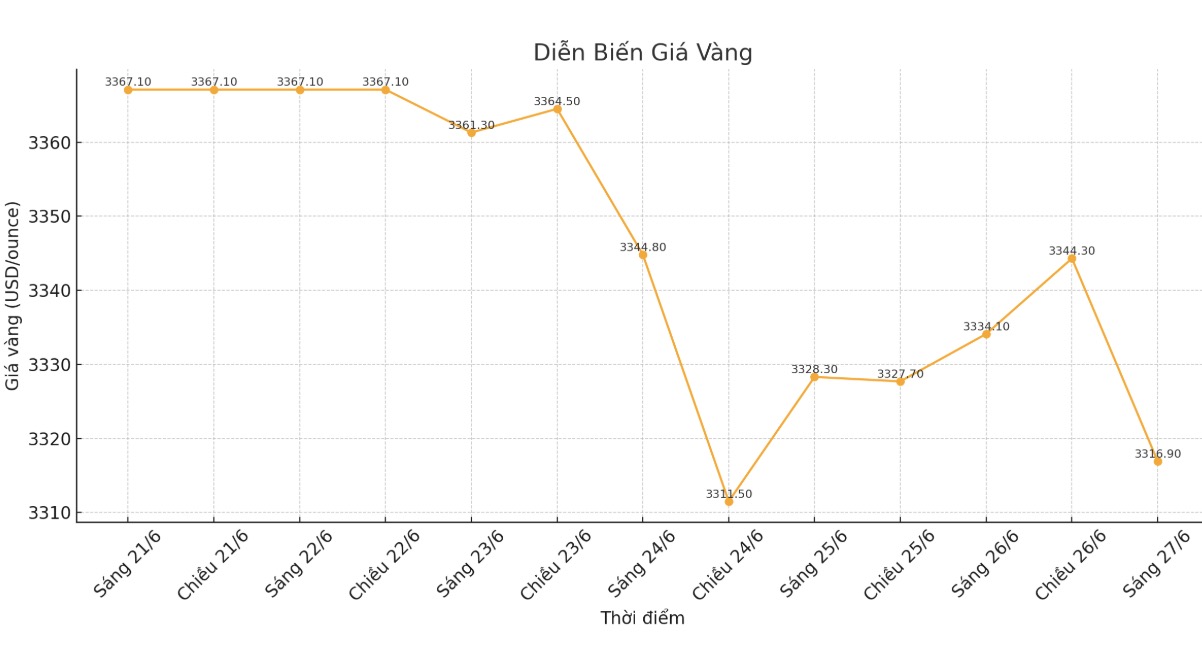

World gold price

At 8:45 a.m., the world gold price was listed around 3,316.9 USD/ounce, down 17.2 USD compared to 1 day ago.

Gold price forecast

FX Empire expert James Hyerczyk said that the ceasefire between Iran and Israel has contributed to easing geopolitical tensions, thereby reducing demand for gold as a safe asset.

Based on technical signals, Hyerczyk said that gold's recent rally has slowed before a record high of $3,500.000/ounce. The inability to maintain increased momentum has caused many traders to temporarily take profits, shifting to a more cautious stance in the short term.

From a market perspective, Mr. Stuart OReilly - Director of Analysis at Royal mint - said that gold sales in the second quarter showed signs of slowing down, reflecting a tense mentality: buyers were afraid of high prices, while sellers were looking for opportunities to realize profits.

The latest report from the Official Federation of Financial and Monetary Organizations (OMFIF) also shows that about a third of central banks, which are managing assets worth $5,000 billion, plan to increase the share of gold in their reserve portfolios in the next 1 to 2 years - the highest figure recorded in the past 5 years.

The Dollar Index (DXY) is recording an unprecedented weakness this week, hitting its lowest bottom compared to major trading partners since February 2022.

This four-session streak of declines is the USD's most sustained weakening period since March, showing complex resettlement strategies from investment institutions in the context of expectations of policy changes by the US Federal Reserve (FED).

The long-term weakness of the US dollar reflects a combination of monetary policy uncertainty and political momentum that goes beyond traditional currency valuation models.

The index's decline to February 2022 shows a fundamental reshaping of assumptions about the strength of the USD, affected by multidimensional pressures beyond the scope of conventional economic indicators.

The US dollar weakened strongly but the decline in gold prices showed that currency support is a key factor in holding prices. Without this support, gold prices could have fallen sharply.

Investors are shifting their attention to the US PCE core inflation index, due today (Friday), as the Federal Reserve's preferred inflation measure.

The development of this index could have a direct impact on monetary policy expectations. If core inflation rises higher than expected, the Fed could maintain higher interest rates for longer, strengthening the USD and putting downward pressure on gold.

Conversely, if the data shows that inflation cools down, expectations of a Fed cutting interest rates soon will increase, creating momentum for gold prices to increase. The market is currently in a state of waiting, with many investors expecting a decrease in core PCE to be a factor that will push gold above the resistance level in the coming time.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...