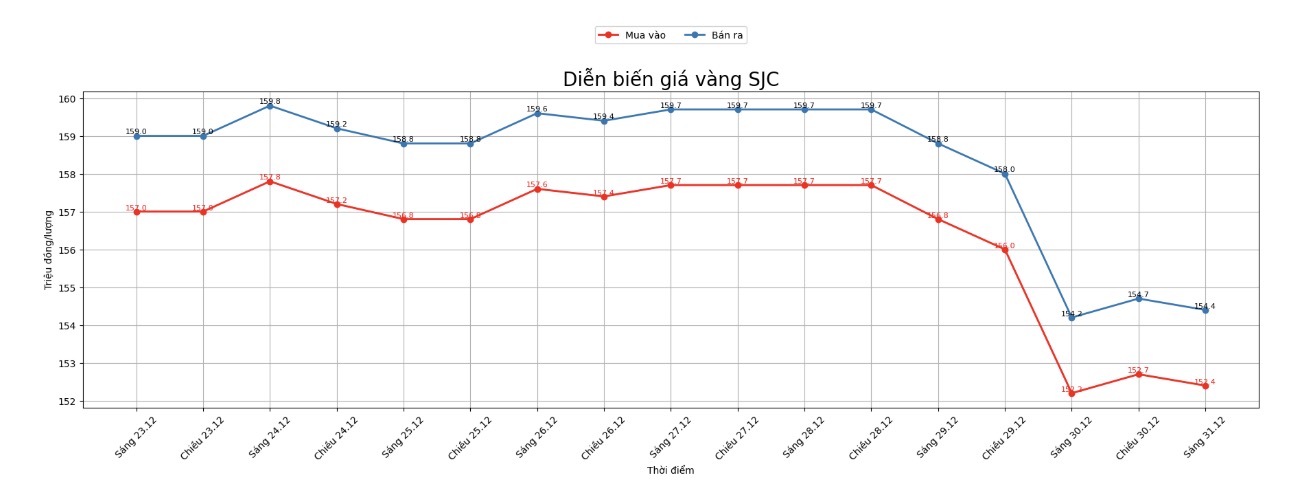

SJC gold price update

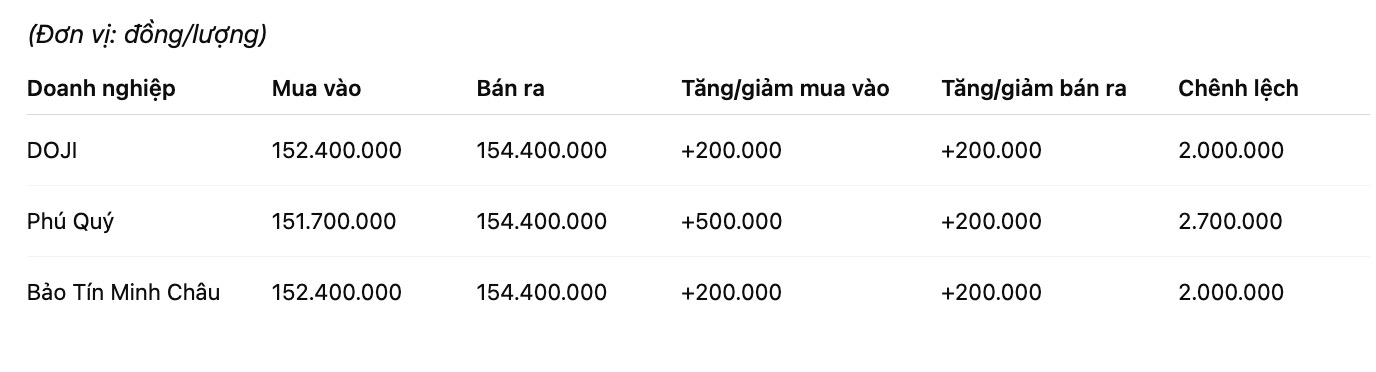

As of 9:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 152.4-154.4 million VND/tael (buying - selling), an increase of 200,000 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gems Group listed SJC gold bar prices at 151.7-154.4 million VND/tael (buying - selling), an increase of 500,000 VND/tael on the buying side and an increase of 200,000 VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.7 million VND/tael.

Bao Tin Minh Chau listed SJC gold bar prices at the threshold of 152.4-154.4 million VND/tael (buying - selling), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

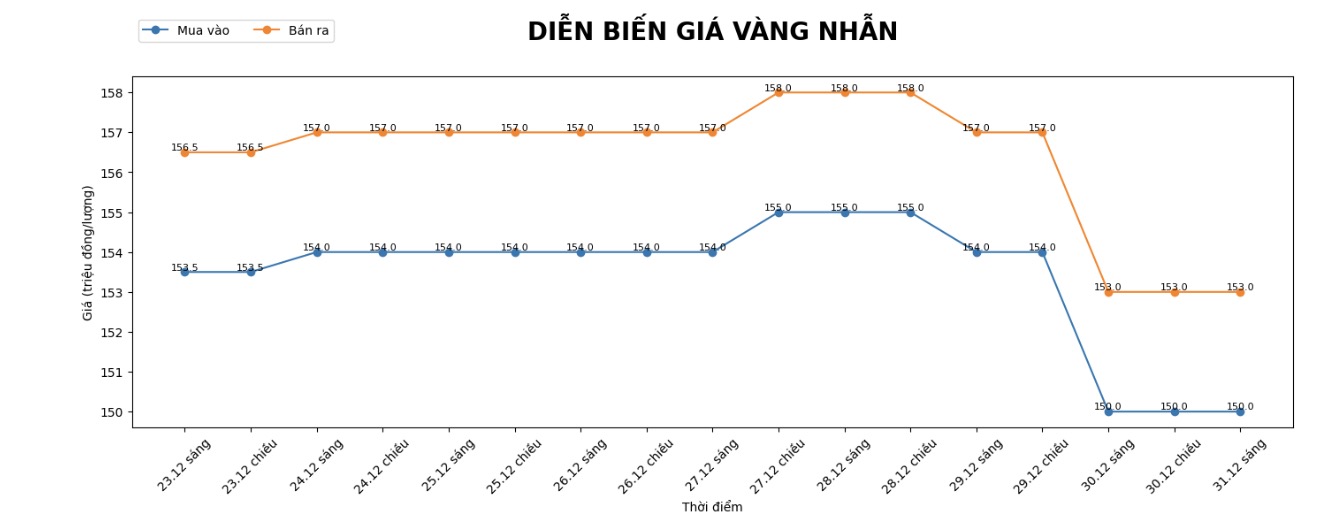

Price of 9999 round gold ring

As of 9:00 AM, DOJI Group listed the price of gold rings at the threshold of 150-153 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 151-154 million VND/tael (buying - selling), an increase of 300,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.5-155.5 million VND/tael (buying - selling), an increase of 800,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The buying-selling gap is high, causing risks for individual investors to increase. Individual investors, especially those with "surfing" psychology, need to consider carefully before spending money.

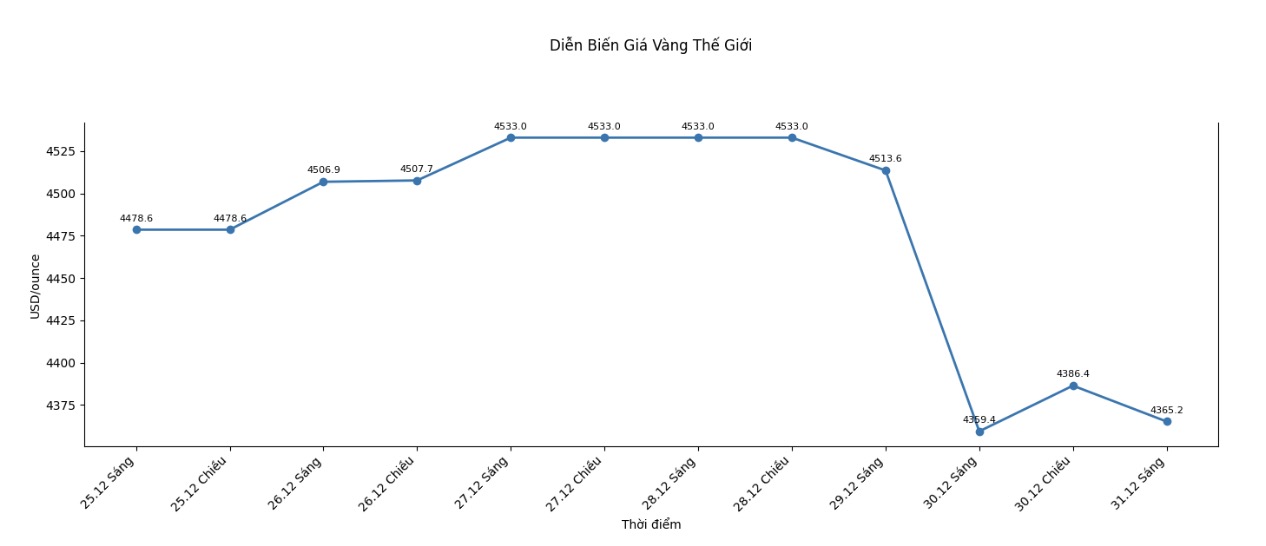

World gold price

At 9:00 AM, world gold prices were listed around the threshold of 4,365.2 USD/ounce, up 5.8 USD compared to the previous day.

Gold price forecast

Gold market struggles before the minutes of the December monetary policy meeting of the US Federal Reserve (Fed). The content of the minutes shows that the US central bank is not in a hurry to cut interest rates in 2026.

In early December, the Fed cut interest rates by 0.25%, marking the third consecutive quarter of loosening monetary policy. This move is generally in line with market expectations. However, the Fed still maintains its view of only implementing two interest rate cuts next year.

Minutes of the meeting show that US monetary policymakers are still concerned about inflation, in the context of uncertain economic prospects.

In a recent interview, Mr. Juan Carlos Artigas - Head of Global Research at the World Gold Council (WGC) analyzed the factors that brought gold to unprecedentedly high prices in 2025, and explained why this precious metal could continue to maintain its upward momentum next year.

Since May 2024, gold ETF funds have bought about 800 tons of gold" - he said - "This number sounds large, but in reality it is still less than half compared to previous high-risk periods. If economic conditions worsen significantly, demand may increase sharply not only from gold ETFs but also from OTC markets, derivatives markets and central banks. In that scenario, gold prices may even exceed the 5,000 USD/ounce mark".

Answering questions about the possibility of gold price adjustment when investment demand decreases, Mr. Artigas did not rule out this scenario.

To some extent, the current gold price has reflected the risk compensation from current conditions" - he said - "If US economic policies bring positive effects, boosting growth – such as by resolving trade disputes or a more friendly fiscal policy – then part of this compensation will disappear, and gold prices may fall from 5% to 20%, depending on the specific developments".

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...