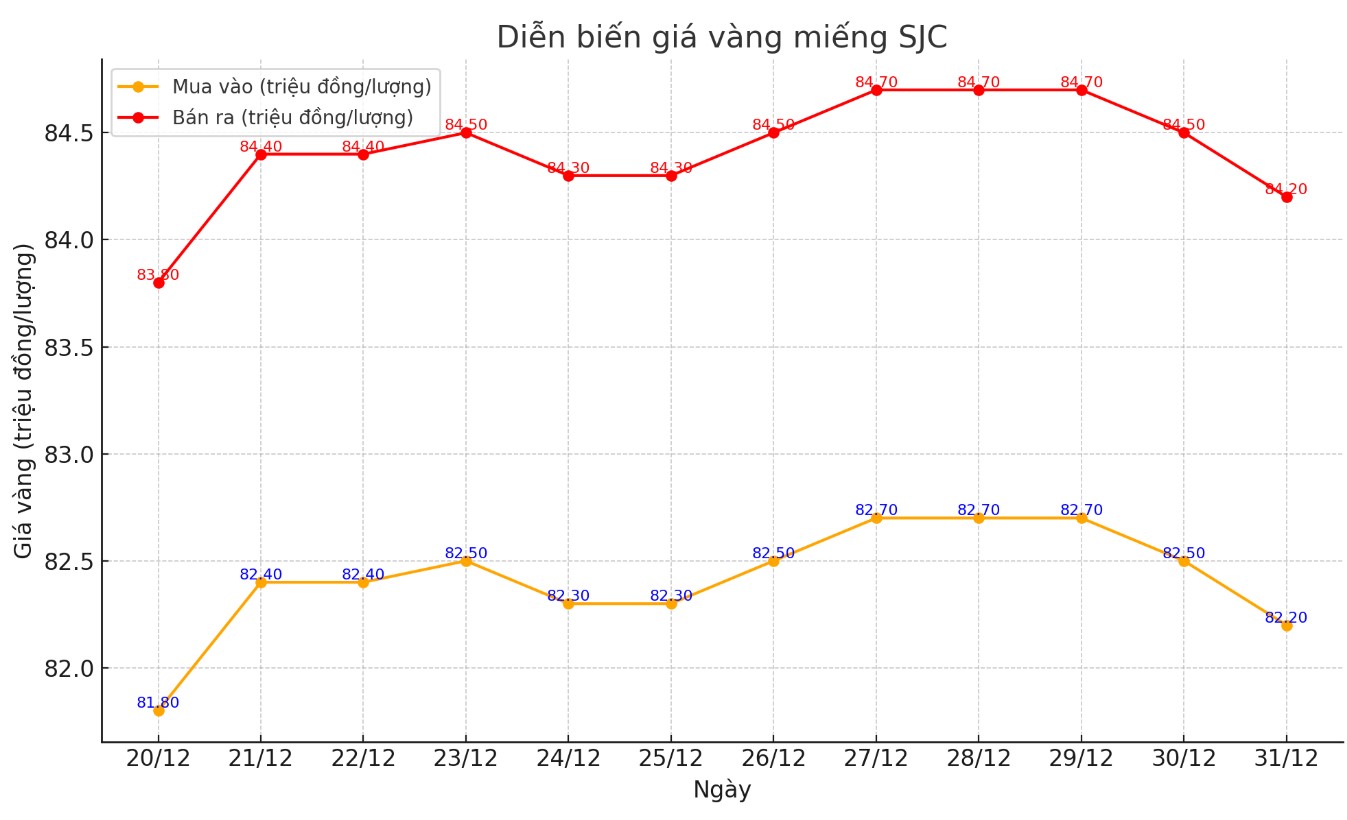

Update SJC gold price

As of 10:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND82.2-84.2 million/tael (buy - sell); down VND300,000/tael.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 82.2-84.2 million VND/tael (buy - sell); down 300,000 VND/tael.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.2-84.2 million VND/tael (buy - sell); down 300,000 VND/tael.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

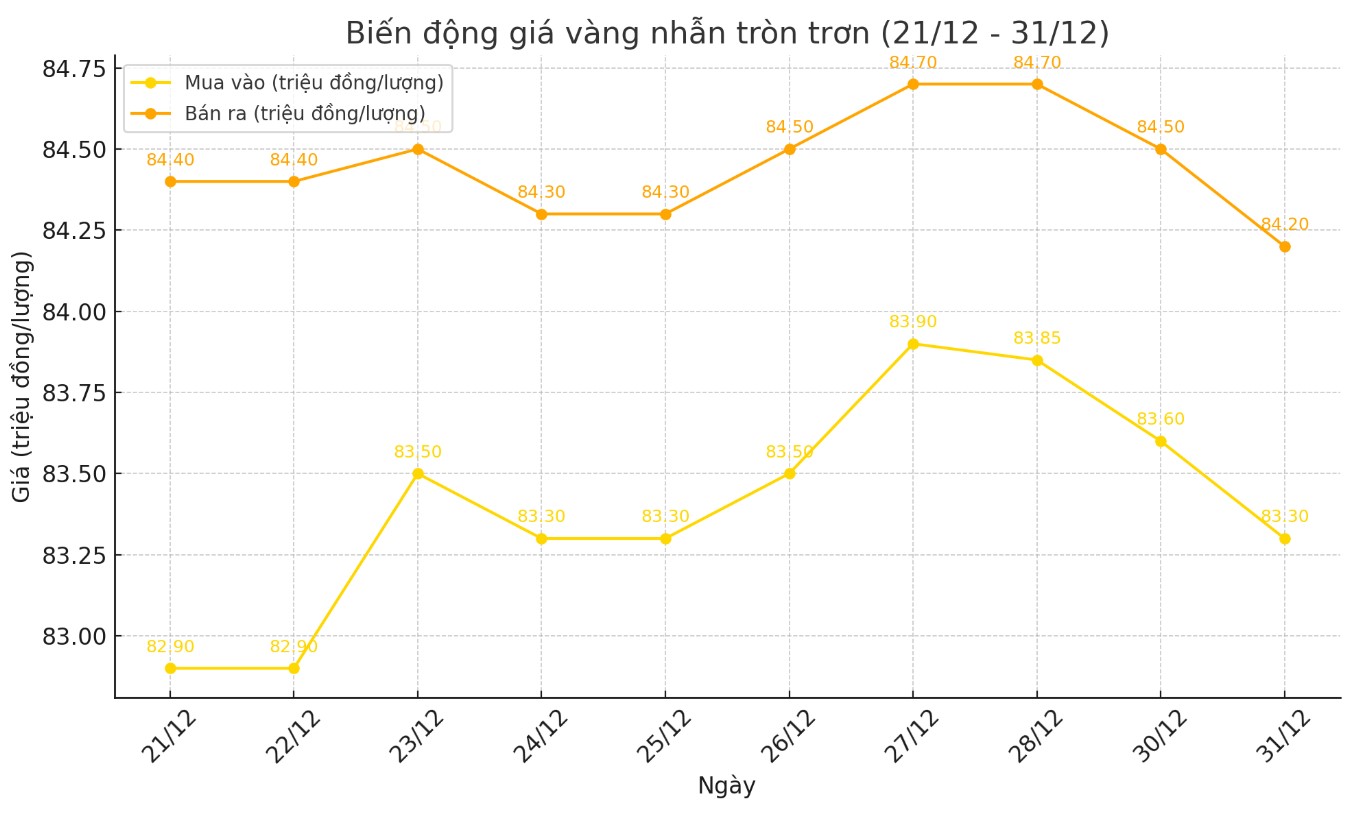

Price of round gold ring 9999

As of 10:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.3-84.2 million VND/tael (buy - sell); down 400,000 VND/tael for buying and down 300,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 82.6-84.2 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling compared to early this morning.

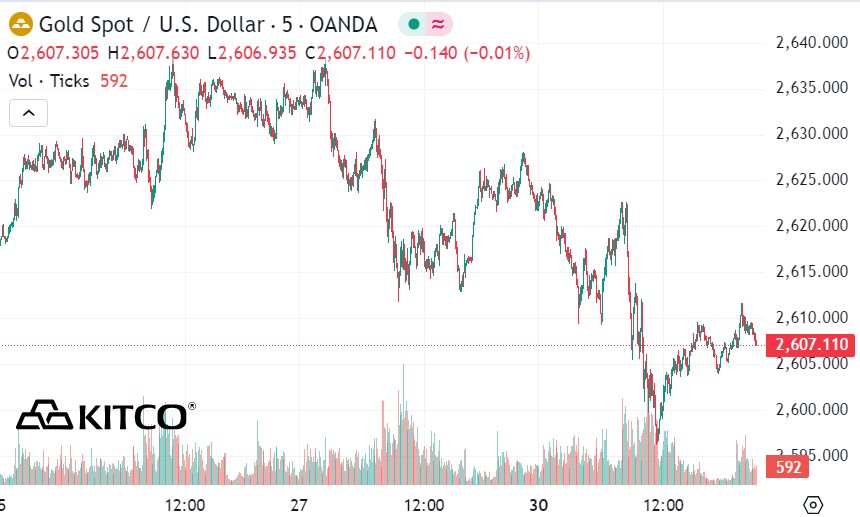

World gold price

As of 10:00 a.m., the world gold price listed on Kitco was at 2,607.1 USD/ounce, down 19.8 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell despite the downward trend of the USD. Recorded at 10:00 a.m. on December 31, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.725 points (down 0.11%).

According to Bloomberg, "the dollar is heading for its best year in nearly a decade, as US economic strength curbs expectations of a rate-cutting cycle by the Federal Reserve (FED) and President-elect Donald Trump's aggressive tariff threats boost positive expectations for the currency."

The gold market is struggling to hold the important support level of $2,600/ounce and may face selling pressure as the US real estate market continues to show signs of stability.

More consumers are starting the process of buying a new home, according to the latest data from the National Association of Realtors (NAR).

Pending home sales in the U.S. rose 2.2% in November, the NAR said Monday, after recording a 1.8% increase in October.

That beat economists' forecasts, which had expected a 0.9% increase. The report showed that contracts signed rose in all four regions of the country over the past 12 months, with the West posting the biggest gain. For the year, pending home sales rose 6.9%.

The gold market has not yet seen a significant reaction to this economic data. However, some analysts believe that positive news from the housing market could create additional selling pressure as gold prices remain hovering near key support levels.

Analysts said trading volume at the beginning of the week was thin, as investors waited for new catalysts, such as US economic data next week and President-elect Donald Trump's policies.

"I think the main reason is the reduced trading volume during the holiday season. Maybe some people want to take profits before the end of the year," said Peter Grant, vice president of Zaner Metals.

The expert predicts that political tensions will remain high next year, which will encourage central banks to continue buying gold. US debt is likely to worsen and deficits will increase during Donald Trump's term, which will increase demand for safe-haven gold.

See more news related to gold prices HERE...