Big profit when buying SJC gold bars

At the beginning of the trading session of the year (January 1, 2024), the buying price of SJC gold bars was listed by DOJI Group at VND68 million/tael; the selling price was VND74 million/tael. The difference between the buying and selling price of gold at DOJI was at a record level of VND6 million/tael.

Meanwhile, Saigon Jewelry Company SJC listed the buying price of SJC gold bars at 71 million VND/tael; the selling price was 74 million VND/tael. The difference between the buying and selling price of gold at Saigon Jewelry Company SJC was 3 million VND/tael.

As of early this morning (December 31, 2024), the price of SJC gold bars was listed by DOJI Group at VND 82.5-84.5 million/tael. The difference between the buying and selling price of SJC gold at DOJI Group was VND 2 million/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold bars at 82.5-84.5 million VND/tael (buy - sell). The difference between the buying and selling price of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Thus, after one year, buyers of SJC gold bars at DOJI Group and Saigon SJC Jewelry Company together earned a profit of up to VND8.5 million/tael.

It can be seen that the above interest rate is quite high. For example, with the same amount of money to buy a quantity of SJC gold bars (74 million VND) and deposit it in Agribank on January 1, 2024 for a term of one year, receiving 5% interest, the amount you will receive will be 3.7 million VND. With the same amount and term, if you deposit it in Vietcombank and receive 4.8% interest, the amount you will receive will be 3.553 million VND.

World gold also increased

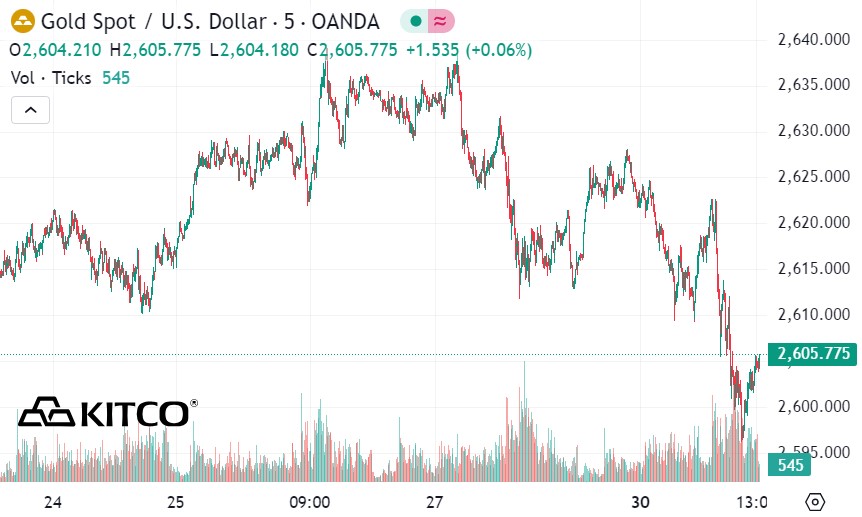

For the world market, on January 1, 2024, the precious metal was listed on Kitco at $2,062.9/ounce. At 1:25 a.m. on December 31, 2024, world gold was listed on Kitco at $2,605.7/ounce.

Thus, after one year, the world gold price increased by more than 542 USD/ounce. In reality, this increase could be much higher. However, at the end of the year, the market was relatively quiet, at times even falling sharply.

With the gold market holding firm support above $2,600 an ounce, gold prices have risen more than 25% for the year. At its peak in late November, gold prices were up more than 30%, marking their best performance since 1979.

Commenting on the gold price in 2025, some experts still have a relatively positive opinion. In an interview with Kitco, George Milling-Stanley - chief gold strategist at State Street Global Advisors - said that he expects 2025 to be an interesting year and could set a new record for gold.

Ahead of the new year, Tom Bruce, macro investment strategist at Tanglewood Total Wealth Management, said he has a "fairly positive" view on gold, despite some tough headwinds facing the precious metal.

While gold may see modest growth in 2025 compared to 2024's nearly 30% gain, Bruce said it is still an important asset for investors to own.

In fact, the price of domestic gold bars has not followed the world price trend in recent times, but in the long term, the two markets will still have the same direction. Therefore, investors can monitor the world gold market before making the choice to invest in this precious metal.