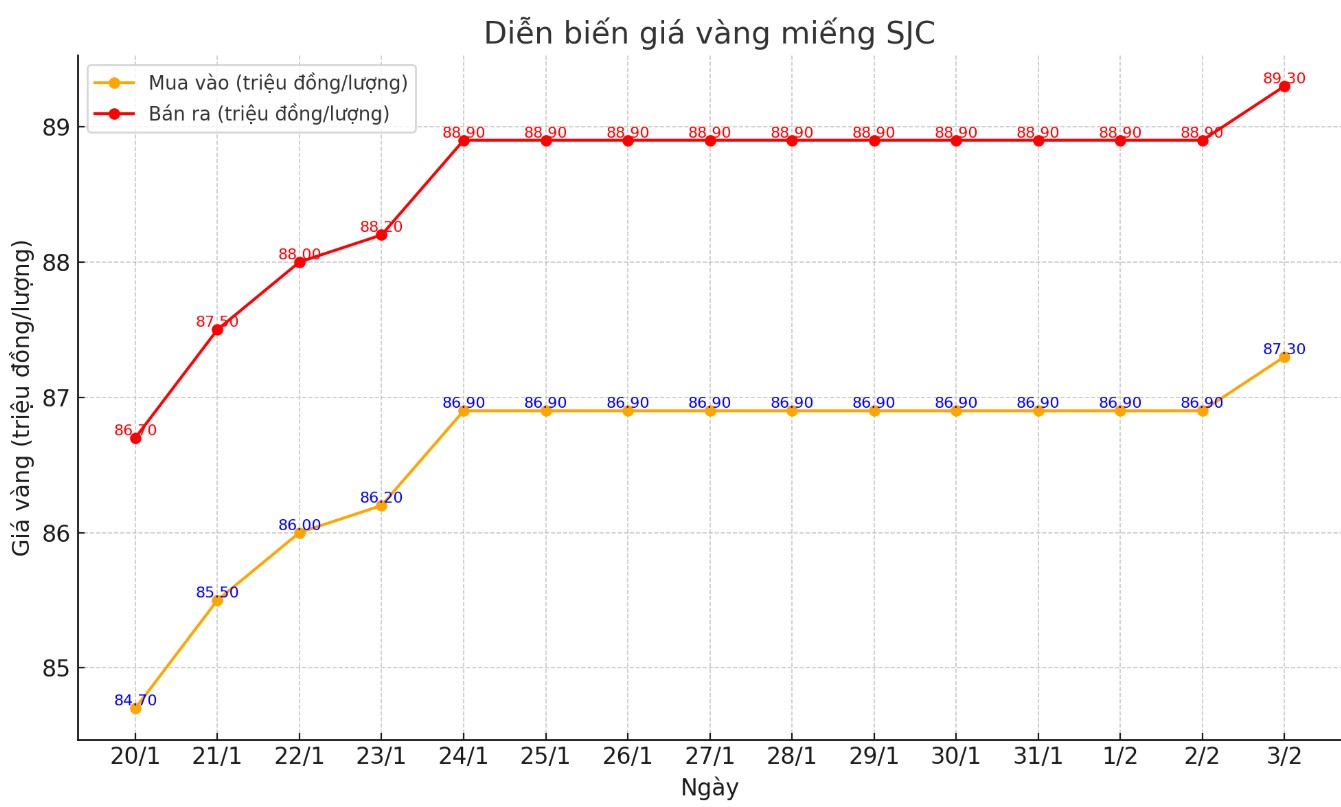

Update SJC gold price

As of 10:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND87.3-89.3 million/tael (buy - sell); an increase of VND500,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 87.3-89.3 million VND/tael (buy - sell); an increase of 400,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

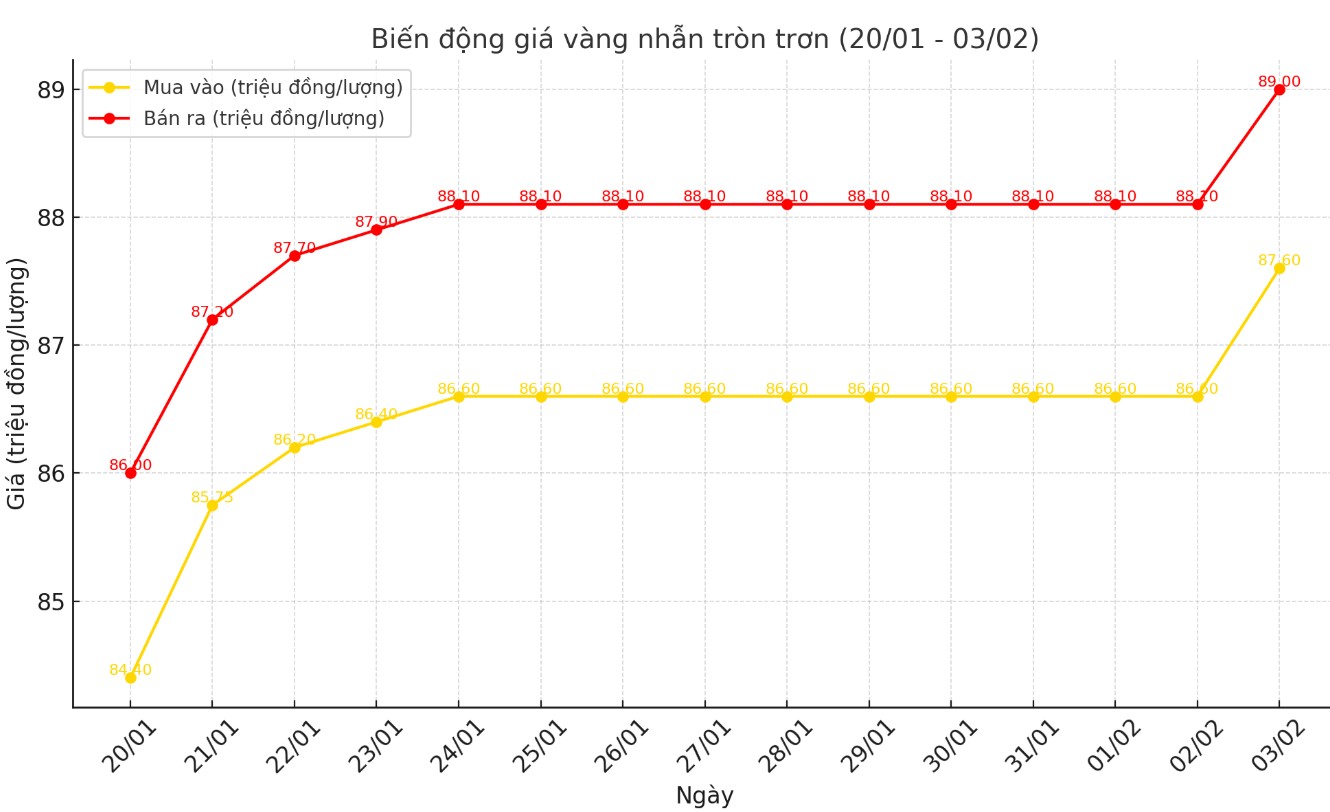

Price of round gold ring 9999

As of 10:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 87.6-89 million VND/tael (buy - sell); an increase of 1 million VND/tael for buying and an increase of 900,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 87.1-89.25 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and 350,000 VND/tael for selling compared to early this morning.

World gold price

As of 10:30 a.m., the world gold price listed on Kitco was at 2,776.1 USD/ounce, down 21.8 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices are under pressure amid the rising USD. At 10:30 a.m. on February 3, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 109.695 points (up 1.35%).

Despite the decline, gold prices are receiving very positive forecasts from experts. The latest weekly Kitco News gold survey shows that industry experts remain positive on the precious metal, while retail investors also forecast higher prices in the near future.

Nine experts, or 69%, expect gold prices to break record highs this week. Four experts, or 31%, predict gold prices will fall. None expect gold to trade sideways or consolidate this week.

Meanwhile, 147 investors participated in Kitco's online poll, with retail investors as bullish as the professionals.

101 traders, or 69%, forecast gold prices to rise next week, while 27, or 18%, expect gold to fall. The remaining 19 investors, or 13% of the total, believe gold will move sideways in the short term.

Naeem Aslam - Chief Investment Officer at Zaye Capital Markets - maintains a bullish view on gold.

“If the tariff concerns materialize, the US dollar could strengthen, which would typically put downward pressure on gold. However, if the situation is resolved quickly or without significant impact, gold could continue to rally.

Regardless, it will be important to watch how global investors react to these developments. A correction is possible, but it will be short-term, with broader market factors, including inflation concerns and central bank policy, playing a key role in maintaining gold’s value in the medium to long term,” he explained.

Meanwhile, some experts say a gold price correction is not a bad thing, as many people see this as a buying opportunity.

Joy Yang, global head of index product management at MarketVector, predicts that gold prices may fluctuate due to speculative positioning. However, this does not change the long-term outlook for the precious metal.

“It’s not just about tariffs or whether they will be implemented. Sooner or later, there will be another surprise that the market didn’t see coming,” she said. “The market doesn’t know how to navigate this environment, so it makes sense for gold to stay above $2,800 an ounce.”

See more news related to gold prices HERE...