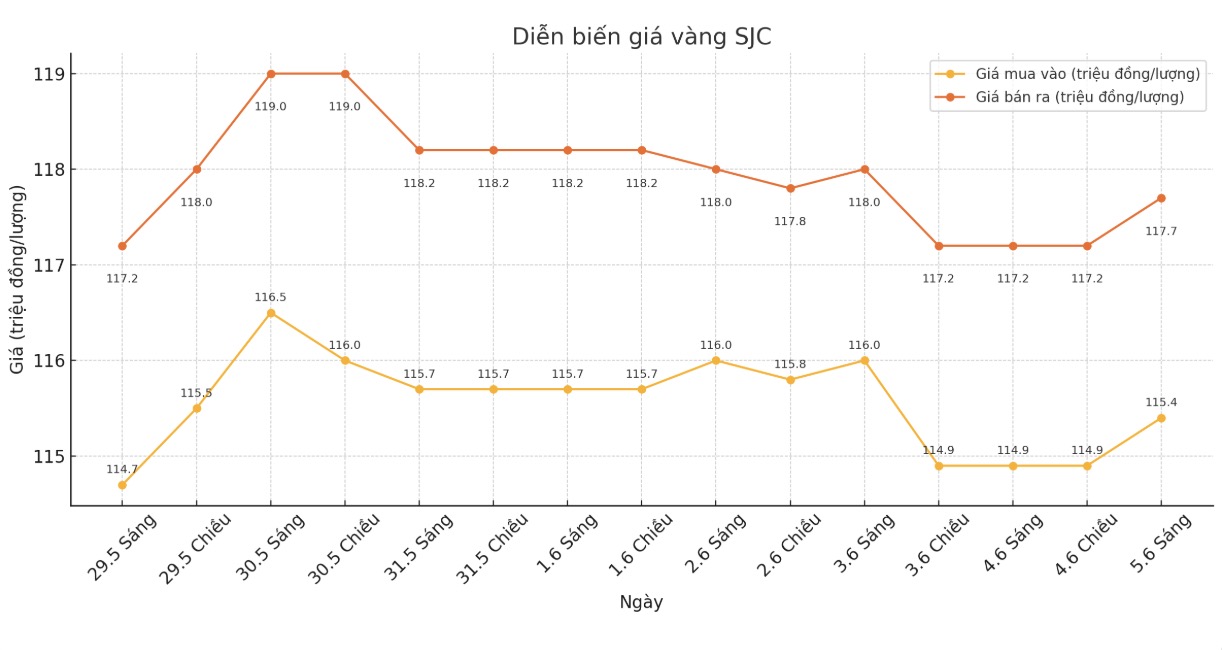

Updated SJC gold price

As of 9:20 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 115.4-117.7 million/tael (buy in - sell out), an increase of VND 500,000/tael in both directions. The difference between buying and selling prices is at 2.3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.4-117.7 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 115.4-117.7 million/tael (buy - sell), an increase of VND 500,000/tael in both directions. The difference between buying and selling prices is at 2.3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 114.9-117.7 million/tael (buy in - sell out), an increase of VND 500,000/tael in both directions. The difference between buying and selling prices is at 2.8 million VND/tael.

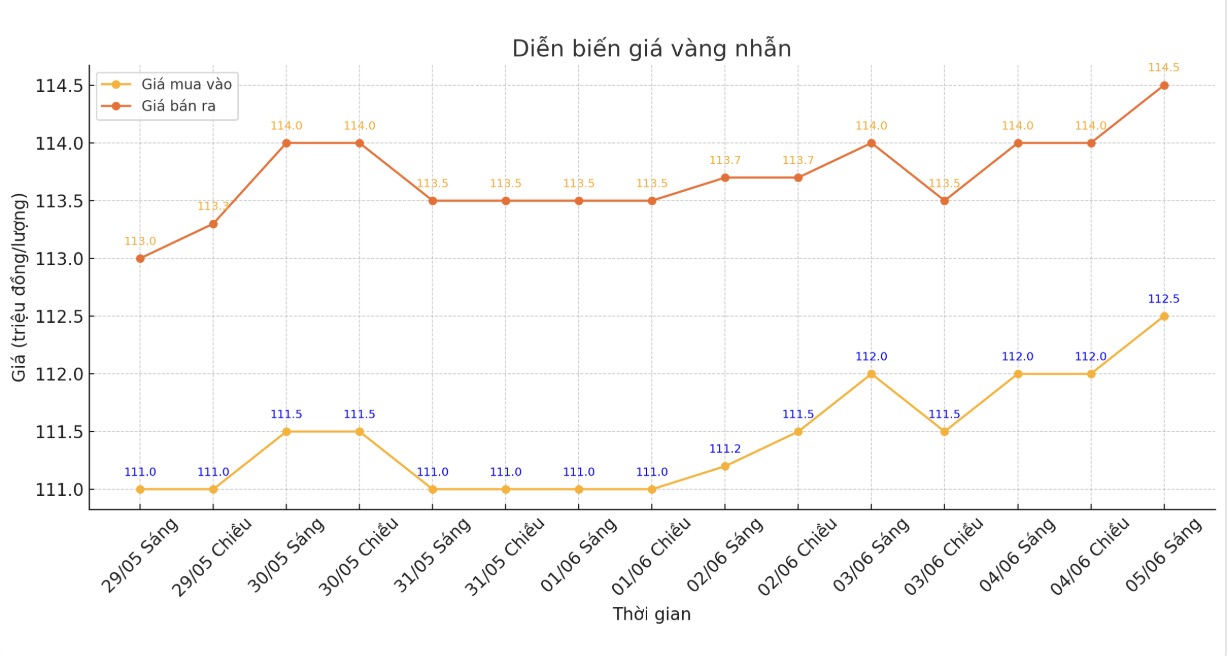

9999 round gold ring price

As of 9:25, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-124.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.5-116.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.5-114.5 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

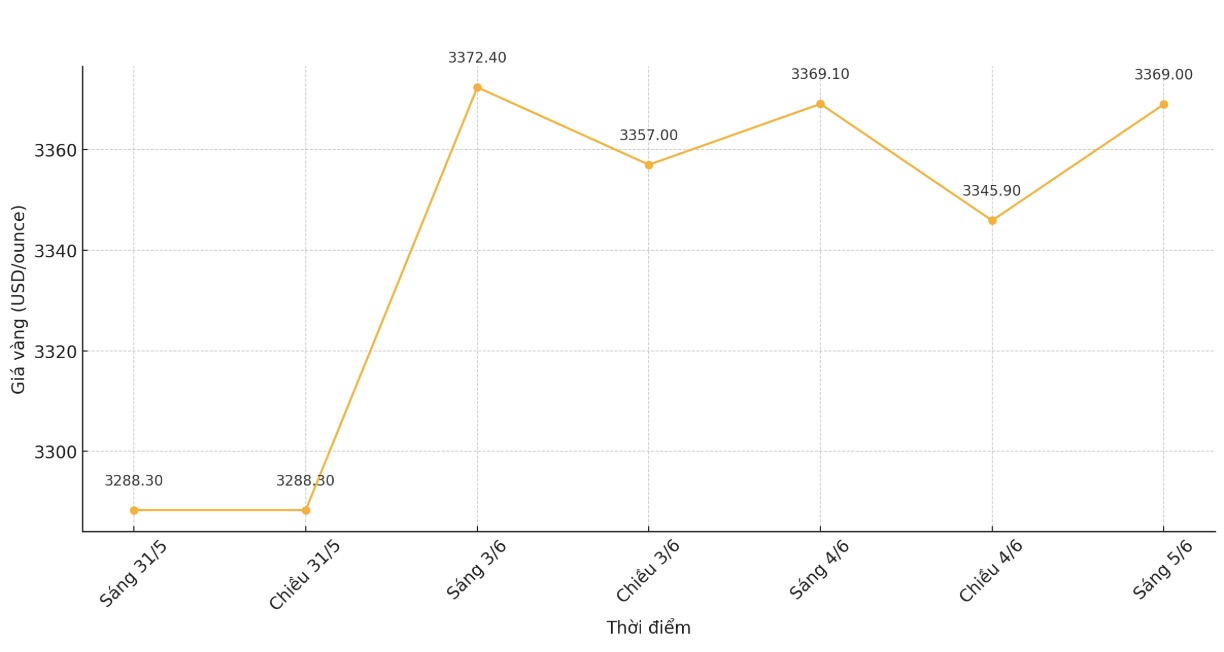

World gold price

At 9:27, the world gold price listed on Kitco was around 3,369 USD/ounce, almost unchanged from 1 day ago.

Gold price forecast

In the context of gold prices remaining above the threshold of 3,350 USD/ounce, famous asset manager Adrian Day warned that the market is underestimating mining stocks and ignoring the risk of liquidity crisis - a factor that could force the US Federal Reserve (FED) to return to the monetary easing policy (QE) as early as September.

Its unlikely to have any negative scenarios for gold, said Adrian Day. He said that central banks continuing to buy gold, Chinese investors seeking to hedge against the risk of depreciation of the yuan, along with growing concerns about the global financial situation, will be the main drivers of gold prices in the coming time.

Meanwhile, a market strategist said that the historical peak of 3,500 USD/ounce in April could be the limit for gold prices, at least for now.

Carley Garner - co-founder of brokerage firm DeCarley Trading - said that although she is currently neutral on gold, she is waiting to sell when the price is higher.

Carley Garner's assessment was made in the context of gold attracting strong buying power thanks to safe-haven demand, stemming from economic and geopolitical instability. Although she believes gold is still an attractive asset in the long term, this precious metal has increased too quickly and too far.

Ive been through many cycles of gold, and this time its got me thinking something is not right. I know there are many reasons to explain why gold prices will continue to increase, but I have witnessed this scenario many times and I know what the outcome will be. I don't believe that bigger macro factors are still reflected in prices," she said.

The Bank of Canada (BoC) has just issued a decision to keep interest rates unchanged at 2.75%/year, while warning about the growing impact of trade tariffs from the US.

According to the BoC, the US and China have temporarily suspended high tariffs, but the outcome of negotiations between the two superpowers is still uncertain. The current tariffs are much higher than in early 2025 between the US and other countries, showing that instability is still high.

Currently, investors are closely following the developments of the negotiations. The US-China trade war has shown no signs of cooling down. US President Donald Trump posted on social media late Tuesday that Chinese President Xi Jinping had a hard time reaching an agreement.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...