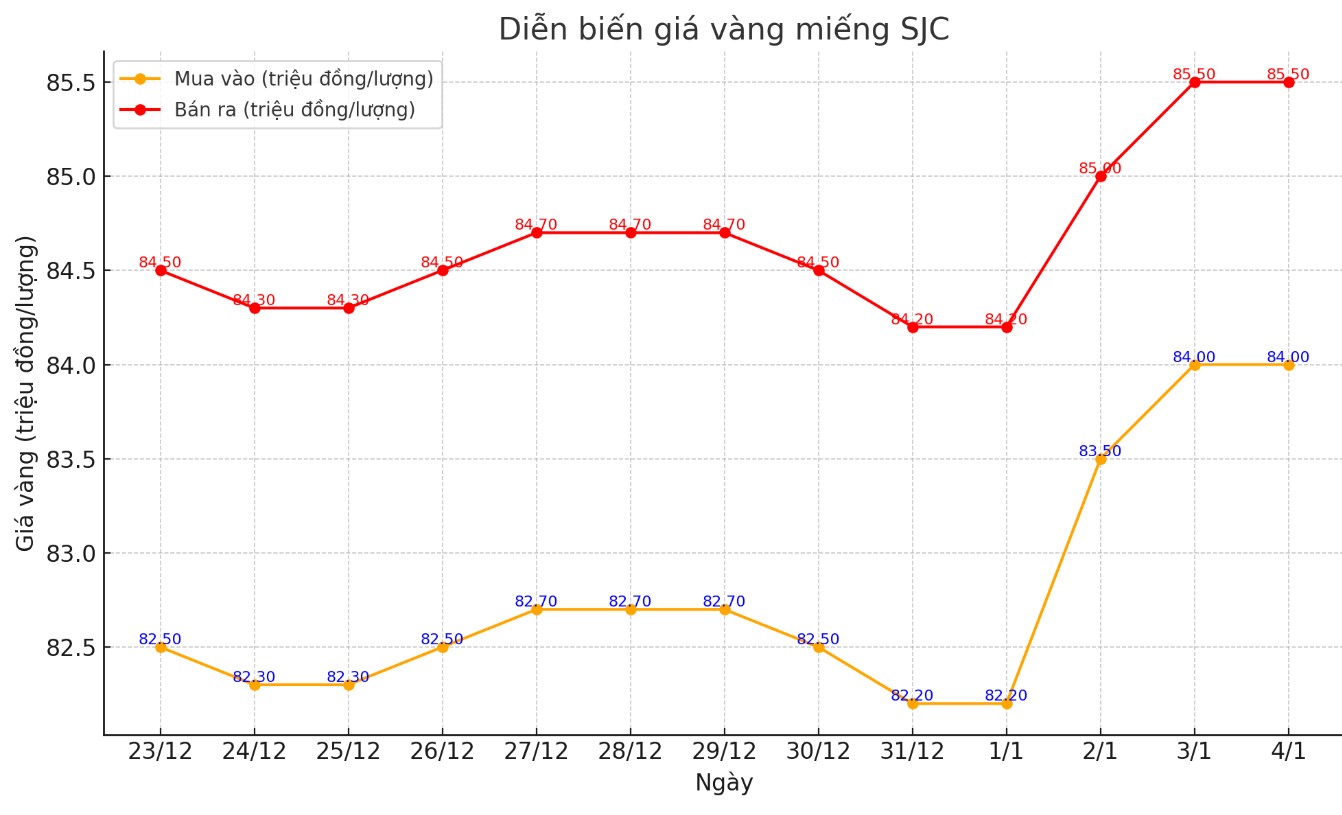

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84-85.5 million/tael (buy - sell); an increase of VND500,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84-85.5 million VND/tael (buy - sell); an increase of 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84-85.5 million VND/tael (buy - sell); increased 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

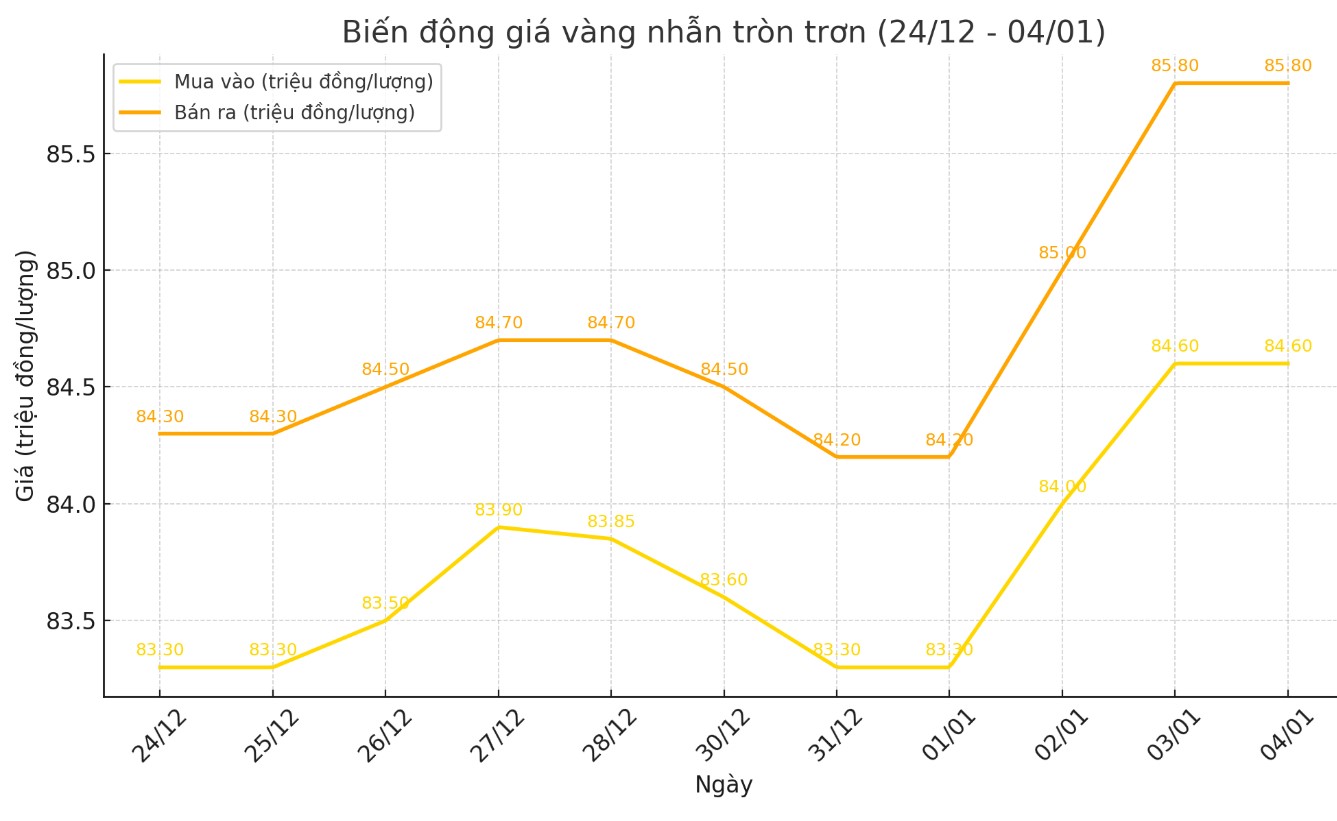

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.55-85.55 million VND/tael (buy - sell); an increase of 550,000 VND/tael for both buying and selling compared to the opening of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 84.6-85.8 million VND/tael (buy - sell), an increase of 2 million VND/tael for buying and 1.6 million VND/tael for selling compared to the opening of the trading session this morning.

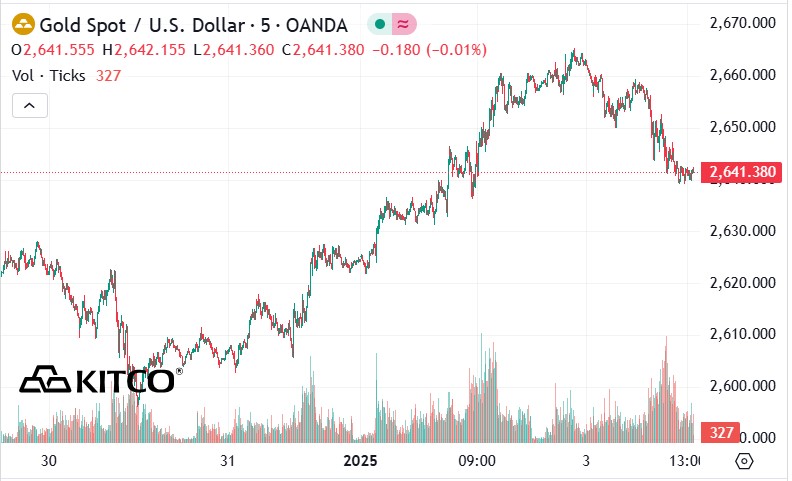

World gold price

Gold prices rose sharply last night, but are showing signs of cooling down this morning. As of 1:45 a.m. on January 4 (Vietnam time), the world gold price listed on Kitco was at $2,641.3/ounce, down $14.7/ounce compared to early this morning.

Gold Price Forecast

World gold prices fell amid the USD anchoring at a high level. Recorded at 1:45 a.m. on January 4, the US Dollar Index measuring the greenback's fluctuations against 6 major currencies was at 108.835 points.

According to Kitco - World gold prices retreated from a three-week high on Friday under pressure from a strong US dollar. The US dollar strengthened as the market braced for economic and trade changes under US President-elect Donald Trump.

"The new president's policy of increasing import tariffs has pushed the US dollar higher and put a lot of pressure on the metal market," said Nitesh Shah, commodity strategist at WisdomTree.

The gold market is also struggling to find momentum and could face more challenges as the US manufacturing sector recorded an improvement, moving closer to neutral, according to the latest data from the US Institute for Supply Management (ISM).

ISM announced Friday that its manufacturing Purchasing Managers' Index (PMI) rose to 49.3 in December, up from 48.4 in November. While the manufacturing sector remained in contraction territory, the figure was better than expected, with consensus forecasts calling for a flat reading of around 48.2.

See more news related to gold prices HERE...