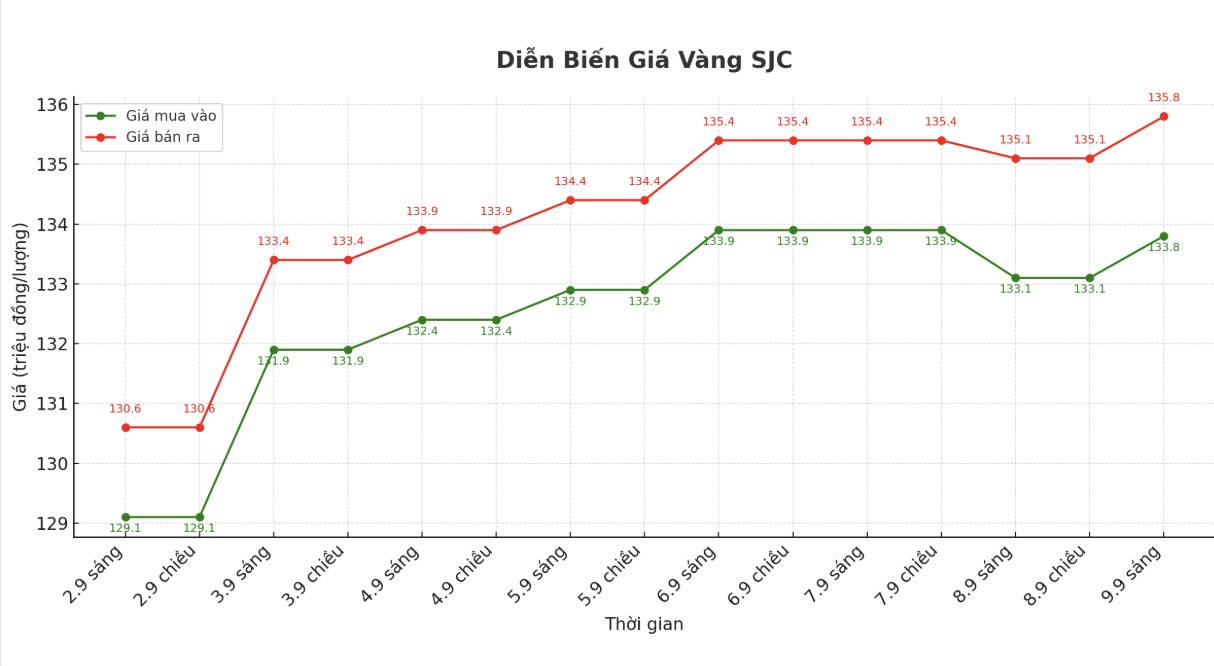

Updated SJC gold price

As of 9:30 a.m., DOJI Group listed the price of SJC gold bars at 133.8-135.8 million VND/tael (buy - sell), an increase of 700,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 133.8-135.8 million VND/tael (buy - sell), an increase of 700,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 133-135.8 million VND/tael (buy - sell), an increase of 100,000 VND/tael for buying and an increase of 400,000 VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

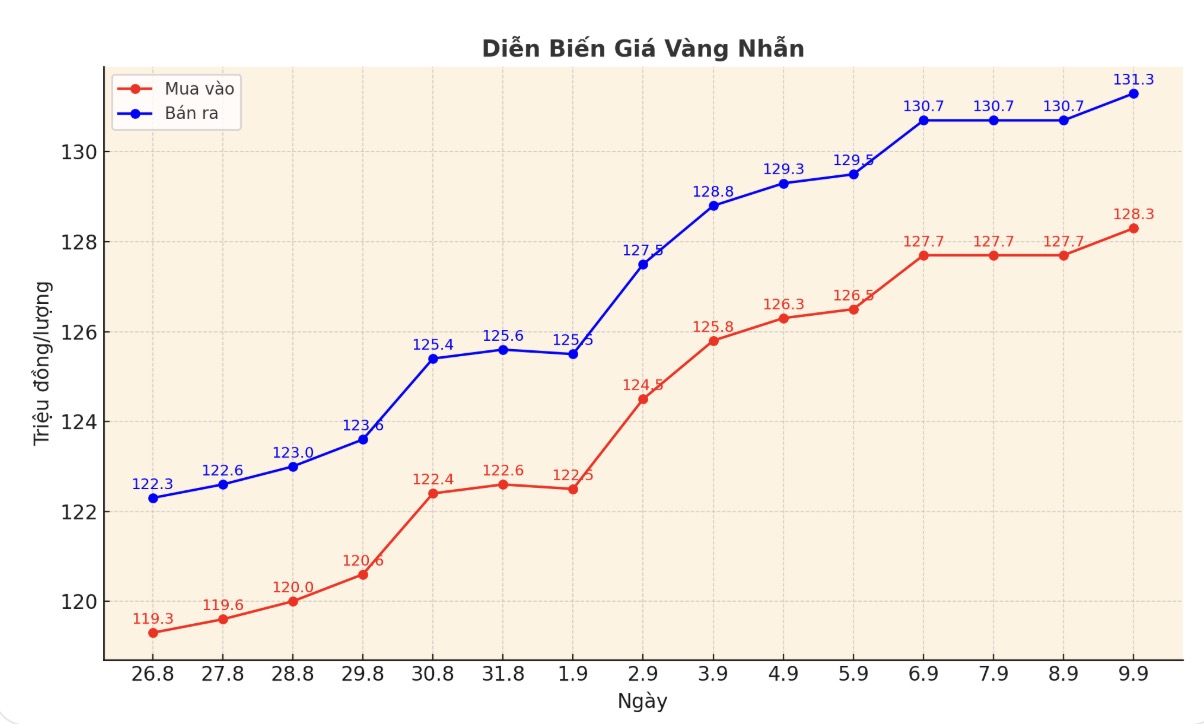

9999 round gold ring price

As of 9:30 a.m., DOJI Group listed the price of gold rings at 128.3-131.3 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 128.5-131.5 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128-131 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

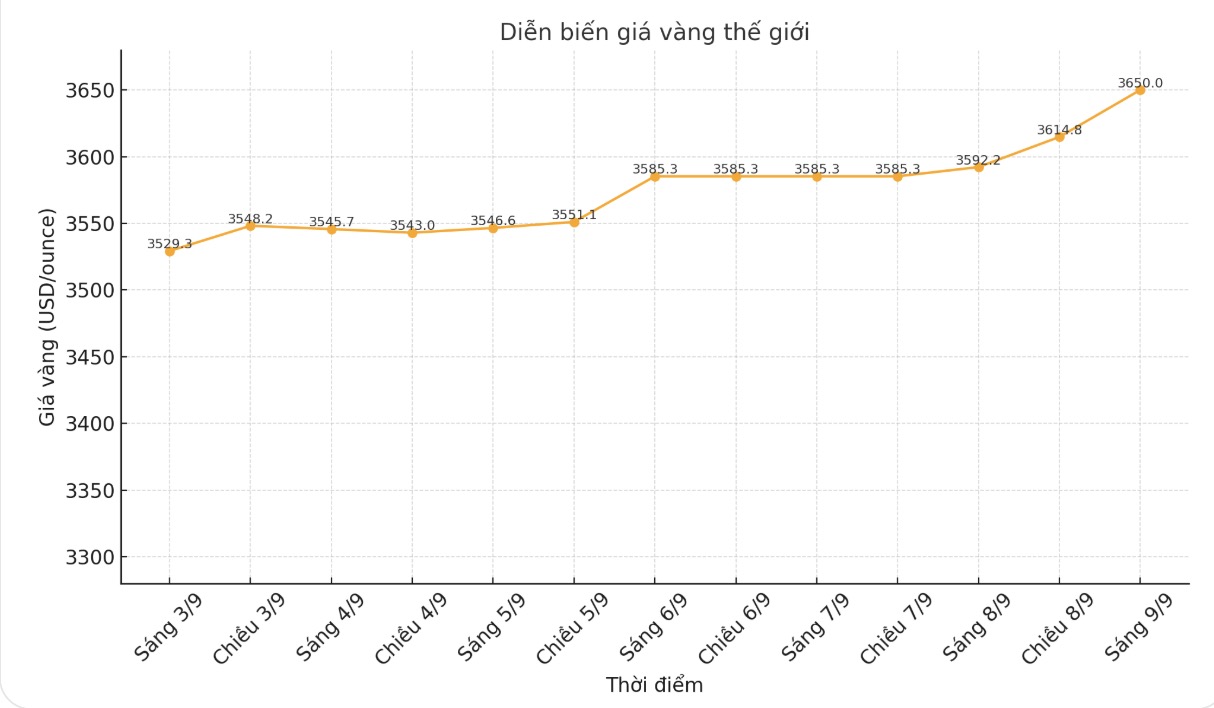

World gold price

At 9:30 a.m., the world gold price was listed around 3,650 USD/ounce, up 57.8 USD compared to a day ago.

Gold price forecast

World gold prices increased last night thanks to growing expectations that the US Federal Reserve (FED) will cut interest rates three times, each time by 0.25 percentage points before the end of this year. There are currently no clear technical or fundamental signs that the precious metal is about to peak.

Adrian Day - Chairman of Adrian Day Asset Management - commented: "Gold has broken through thanks to the continued central bank purchases as well as thanks to expectations of looser monetary policy in the US and globally.

The Fed's expectation of a rate cut this month has been reflected in prices, but the market can still consider this a turning point."

According to monthly data from the World Gold Council (WGC), after a period of stagnation in the early summer, by August, investors had returned to pouring capital into gold ETFs, with inflows doubling compared to July.

In the latest report, WGC analysts said global gold ETFs recorded 53 tons of capital flow, worth $5.5 billion, up from 22.3 tons in July.

In terms of region, North America continues to dominate the global market. North American gold ETFs increased by 37.1 tons, worth 4.1 billion USD. Analysts said demand in North America remains strong as investors seek to take precautions against economic uncertainty and geopolitical risks.

However, the WGC stressed that the biggest driver last month was growing expectations that the Fed would start easing interest rates, as the labor market showed signs of cooling down faster than expected.

Cital flows before the Jackson Hole conference have quickly reversed, as investors predict the Fed will cut interest rates in September, analysts said.

At the same time, the WGC emphasized that investor demand is not only a short-term speculative driver: It is also noteworthy that low-cost gold ETFs, which are often seen as an indicator of long-term strategic position, are having the best year ever. We consider this a signal that - overcoming the short-term disruption of the market - investors are gradually building safe-haven positions in the context of increased risks" - analysts commented.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...