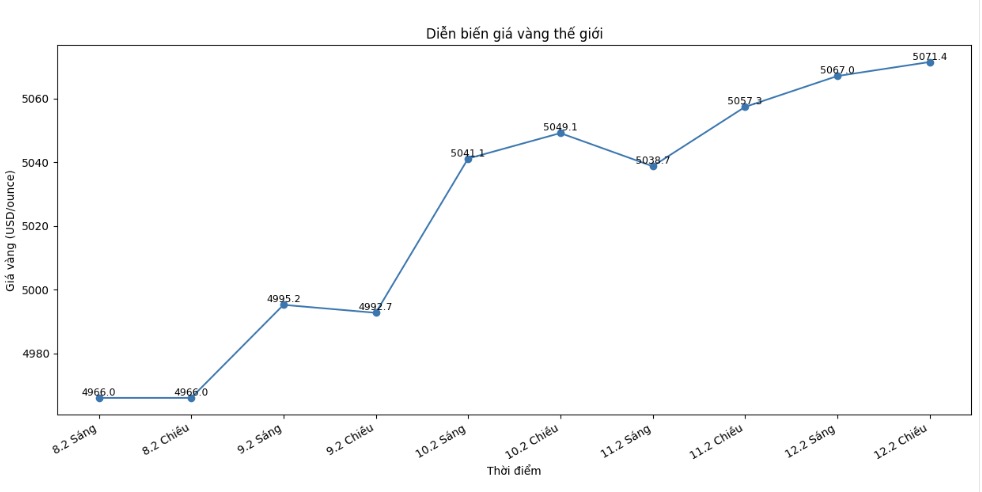

Gold futures continued their impressive rally. Comex gold for February delivery jumped 67.8 USD per ounce in Tuesday's trading session, closing the session at 5,071.6 USD/ounce, equivalent to an increase of 1.35%.

This precious metal shows strong momentum in recent sessions, increasing in price in 5/7 recent trading sessions. However, the price has narrowed down the previous increase after the January jobs report was released.

A report from the US Department of Labor shows that the number of new jobs increased far beyond expectations, with 130,000 jobs created, significantly higher than the forecast of 66,000-70,000. The unemployment rate also slightly decreased to 4.3% from 4.4%, reflecting that the labor market continues to maintain stability.

These more positive than expected figures have almost eliminated the possibility that the US Federal Reserve (Fed) will cut interest rates in March. The market is no longer completely expecting a wave of interest rate cuts in June.

However, traders are still betting on the possibility that the Fed will cut interest rates in July and December - factors that continue to support the attractiveness of gold as a hedging channel against uncertainties in monetary policy.

Market attention is currently focused on inflation data to be released on Friday, which is considered a key factor shaping the Fed's policy roadmap. Recent statements from Fed officials show that the central bank still maintains a cautious stance.

San Francisco Fed Chairman Mary Daly said that current policies are in a suitable position to both support the labor market and curb inflation. Dallas Fed Chairman Lorie Logan also expressed a similar view, saying that the Fed is not in a hurry to adjust policies.

Although it has retreated from the peak, the current closing price of gold is still the fifth highest closing price in history and the strongest level since January 29, 2026 - the time gold hit an all-time peak of 5,318.4 USD/ounce.

Currently, the price is about 4.64% lower than this record, but still significantly higher than the closing level of the first session of the year 4. 314.4 USD/ounce on January 2, showing a positive development of gold in 2026.

Technically, gold is in a neutral to positive state. The precious metal has successfully converted the important psychological milestone of 5,000 USD/ounce from the resistance zone to the support zone - a noteworthy development when gold just surpassed this milestone three weeks ago.

If the price maintains firmly above this key threshold, the long-term outlook still leans towards a strong upward trend. In case of weakening, the next noteworthy support zone is around 4,800 USD/ounce.

The general context continues to strengthen the strength of gold. Since the beginning of 2026, gold prices have increased by 746 USD, equivalent to an increase of 17.25%. February alone contributed 188 USD to this increase.

With less than half a month left, this is considered a favorable period for buyers. This upward momentum becomes even more noteworthy when compared to the increase of about 575 USD in January, showing persistent demand from many groups of investors.